Option selling strategies such as the wheel and strangle offer distinct approaches to generating income and managing risk in the trading landscape. The wheel strategy involves selling cash-secured puts followed by covered calls, optimizing returns through option premiums and potential stock acquisition, while the strangle requires selling both out-of-the-money calls and puts to capitalize on expected volatility with limited directional bias. Explore the nuances of these techniques to enhance your options trading framework and risk management skills.

Why it is important

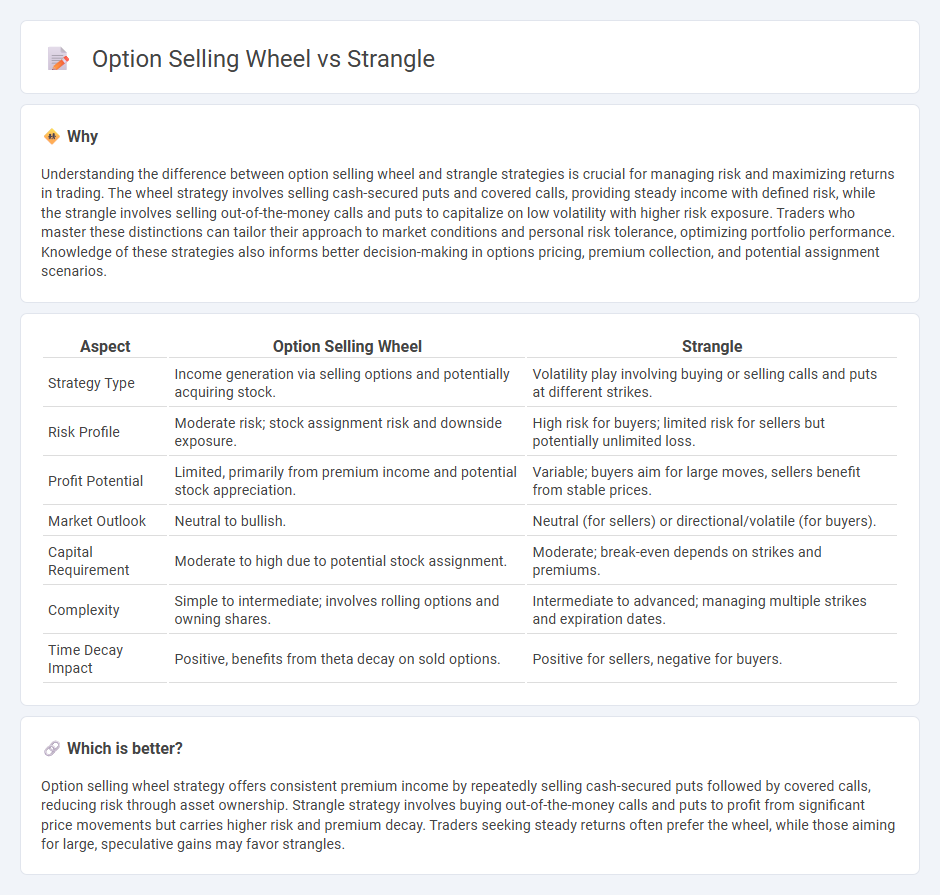

Understanding the difference between option selling wheel and strangle strategies is crucial for managing risk and maximizing returns in trading. The wheel strategy involves selling cash-secured puts and covered calls, providing steady income with defined risk, while the strangle involves selling out-of-the-money calls and puts to capitalize on low volatility with higher risk exposure. Traders who master these distinctions can tailor their approach to market conditions and personal risk tolerance, optimizing portfolio performance. Knowledge of these strategies also informs better decision-making in options pricing, premium collection, and potential assignment scenarios.

Comparison Table

| Aspect | Option Selling Wheel | Strangle |

|---|---|---|

| Strategy Type | Income generation via selling options and potentially acquiring stock. | Volatility play involving buying or selling calls and puts at different strikes. |

| Risk Profile | Moderate risk; stock assignment risk and downside exposure. | High risk for buyers; limited risk for sellers but potentially unlimited loss. |

| Profit Potential | Limited, primarily from premium income and potential stock appreciation. | Variable; buyers aim for large moves, sellers benefit from stable prices. |

| Market Outlook | Neutral to bullish. | Neutral (for sellers) or directional/volatile (for buyers). |

| Capital Requirement | Moderate to high due to potential stock assignment. | Moderate; break-even depends on strikes and premiums. |

| Complexity | Simple to intermediate; involves rolling options and owning shares. | Intermediate to advanced; managing multiple strikes and expiration dates. |

| Time Decay Impact | Positive, benefits from theta decay on sold options. | Positive for sellers, negative for buyers. |

Which is better?

Option selling wheel strategy offers consistent premium income by repeatedly selling cash-secured puts followed by covered calls, reducing risk through asset ownership. Strangle strategy involves buying out-of-the-money calls and puts to profit from significant price movements but carries higher risk and premium decay. Traders seeking steady returns often prefer the wheel, while those aiming for large, speculative gains may favor strangles.

Connection

Option selling strategies like the wheel and strangle both aim to generate income through premium collection by leveraging different market positions. The wheel strategy involves selling cash-secured puts to acquire shares and then selling covered calls on those shares, while the strangle entails simultaneously selling out-of-the-money call and put options to capitalize on low volatility. Both methods rely on careful risk management and understanding options Greeks to optimize returns under varying market conditions.

Key Terms

Premium

The strangle strategy captures premium by simultaneously selling out-of-the-money call and put options, benefiting from time decay and low volatility. The option selling wheel generates premium through a systematic cycle of selling cash-secured puts and covered calls, enhancing income from stock holdings or cash reserves. Explore detailed comparisons to determine which premium-focused strategy aligns best with your market outlook and risk tolerance.

Strike Price

Strangle strategy involves purchasing call and put options with different strike prices to capitalize on volatility, whereas option selling wheel focuses on repeatedly selling put and call options at selected strike prices to generate consistent income. Strike price selection in a strangle targets a broad range, often out-of-the-money, to maximize profit from significant price movement, while the wheel strategy selects strike prices close to or slightly out-of-the-money to balance premium collection and potential assignment. Explore detailed comparisons of strike price impacts in these option strategies for optimized trading outcomes.

Expiry

Strangle and option selling wheel strategies differ significantly in their approach to expiry: strangles involve holding simultaneous call and put options with the same expiry, aiming to profit from volatility before expiration, whereas the option selling wheel consistently sells options in cycles, often focusing on monthly expiries to generate steady income through premiums. The choice of expiry in strangles typically targets quick price movements, while the wheel strategy benefits from time decay as expiration approaches. Explore more to understand how expiry timing impacts risk and reward in these option strategies.

Source and External Links

Strangling - Wikipedia - Strangling or strangulation is the act of compressing the neck to restrict oxygen flow, potentially causing unconsciousness or death, and can occur via hanging, ligature, or manual means.

Strangle - Definition, Meaning & Synonyms - Vocabulary.com - To strangle means to cut off someone's breathing by squeezing their throat, and it can also mean to hinder or choke something metaphorically.

Strangle (options) - Wikipedia - In finance, a strangle is an options strategy involving buying or selling a call and a put option with different strike prices but the same expiry and underlying asset, profiting from price movement regardless of direction.

dowidth.com

dowidth.com