Pair trading involves simultaneously buying and selling two correlated assets to exploit price divergences, minimizing market risk through market-neutral strategies. Range trading focuses on identifying support and resistance levels, capitalizing on predictable price oscillations within a defined range. Explore these trading methodologies further to enhance your strategy selection.

Why it is important

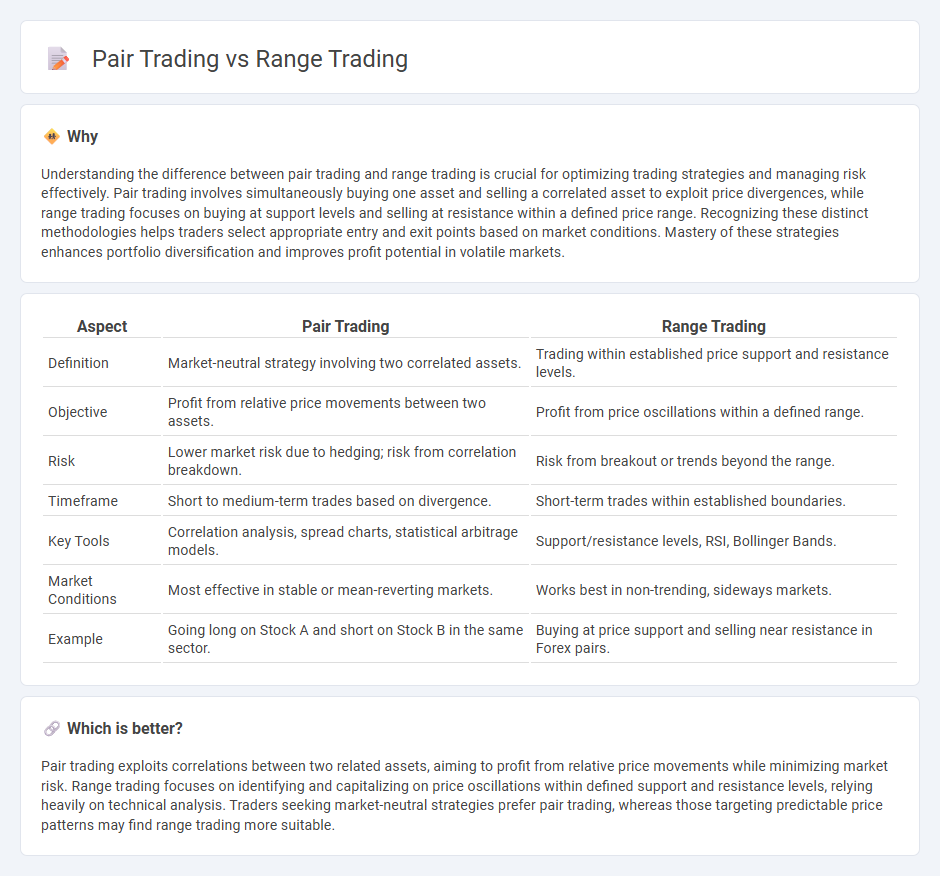

Understanding the difference between pair trading and range trading is crucial for optimizing trading strategies and managing risk effectively. Pair trading involves simultaneously buying one asset and selling a correlated asset to exploit price divergences, while range trading focuses on buying at support levels and selling at resistance within a defined price range. Recognizing these distinct methodologies helps traders select appropriate entry and exit points based on market conditions. Mastery of these strategies enhances portfolio diversification and improves profit potential in volatile markets.

Comparison Table

| Aspect | Pair Trading | Range Trading |

|---|---|---|

| Definition | Market-neutral strategy involving two correlated assets. | Trading within established price support and resistance levels. |

| Objective | Profit from relative price movements between two assets. | Profit from price oscillations within a defined range. |

| Risk | Lower market risk due to hedging; risk from correlation breakdown. | Risk from breakout or trends beyond the range. |

| Timeframe | Short to medium-term trades based on divergence. | Short-term trades within established boundaries. |

| Key Tools | Correlation analysis, spread charts, statistical arbitrage models. | Support/resistance levels, RSI, Bollinger Bands. |

| Market Conditions | Most effective in stable or mean-reverting markets. | Works best in non-trending, sideways markets. |

| Example | Going long on Stock A and short on Stock B in the same sector. | Buying at price support and selling near resistance in Forex pairs. |

Which is better?

Pair trading exploits correlations between two related assets, aiming to profit from relative price movements while minimizing market risk. Range trading focuses on identifying and capitalizing on price oscillations within defined support and resistance levels, relying heavily on technical analysis. Traders seeking market-neutral strategies prefer pair trading, whereas those targeting predictable price patterns may find range trading more suitable.

Connection

Pair trading and range trading both capitalize on price relationships within financial markets, focusing on relative value rather than directional bets. Pair trading exploits the historical correlation and divergence between two related assets, while range trading identifies price oscillations within a defined support and resistance level. Both strategies rely on market inefficiencies and mean reversion principles to generate consistent profits.

Key Terms

**Range Trading:**

Range trading capitalizes on identifying price levels where an asset repeatedly reverses, leveraging support and resistance zones to execute buy low and sell high strategies. This approach thrives in stable markets with well-defined price channels, enabling traders to predict entry and exit points by monitoring oscillators and volume patterns. Discover more about optimizing range trading techniques for diverse asset classes.

Support and Resistance

Range trading capitalizes on defined support and resistance levels by buying near support and selling near resistance within a horizontal price channel. Pair trading involves selecting two correlated assets and taking opposite positions based on divergence from their typical price relationship, often without relying on traditional support and resistance lines. Explore detailed strategies to optimize your trading approach by understanding the nuances of support and resistance in both range and pair trading.

Oscillators

Range trading relies heavily on oscillators like the RSI and Stochastic to identify overbought and oversold conditions within a defined price range, enabling traders to capitalize on predictable price reversals. Pair trading, a market-neutral strategy, uses oscillators to gauge divergence between two correlated assets, helping traders exploit relative price movements without concerning overall market direction. Explore more by understanding how different oscillators can enhance these strategies in various market conditions.

Source and External Links

Range Trading: How It Works, Indicators & Risk Management - Range trading is a short to medium term strategy that exploits price oscillations within a defined range, buying near support and selling near resistance, using technical indicators like Bollinger Bands and RSI, with careful risk management to profit in stable markets.

What is range trading and how can I use it in my strategy? - Range trading capitalizes on prices moving between support and resistance levels, buying near support and selling near resistance, effective in sideways markets with clear entry and exit points and relatively simple risk management.

What Is Range Trading? - Fidelity Investments - Range trading involves identifying overbought and oversold areas to buy at support and sell at resistance, often using volume trends and moving averages to confirm the range-bound market conditions before executing the strategy.

dowidth.com

dowidth.com