Retail flow chasing involves following the buying and selling activities of individual investors to capitalize on short-term market movements, often leveraging real-time trade data and social media trends. Dark pool trading occurs in private exchanges where large institutional orders are executed anonymously to minimize market impact and price slippage, offering a contrasting strategy focused on discreet, high-volume transactions. Explore how these distinct approaches shape market dynamics and influence trading outcomes for various participants.

Why it is important

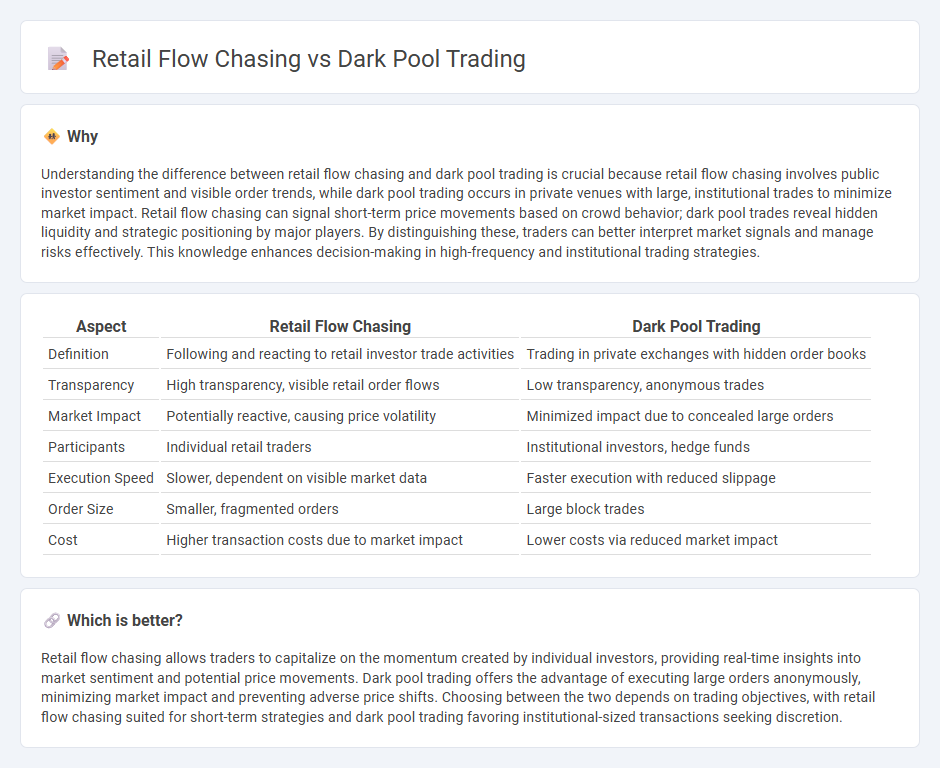

Understanding the difference between retail flow chasing and dark pool trading is crucial because retail flow chasing involves public investor sentiment and visible order trends, while dark pool trading occurs in private venues with large, institutional trades to minimize market impact. Retail flow chasing can signal short-term price movements based on crowd behavior; dark pool trades reveal hidden liquidity and strategic positioning by major players. By distinguishing these, traders can better interpret market signals and manage risks effectively. This knowledge enhances decision-making in high-frequency and institutional trading strategies.

Comparison Table

| Aspect | Retail Flow Chasing | Dark Pool Trading |

|---|---|---|

| Definition | Following and reacting to retail investor trade activities | Trading in private exchanges with hidden order books |

| Transparency | High transparency, visible retail order flows | Low transparency, anonymous trades |

| Market Impact | Potentially reactive, causing price volatility | Minimized impact due to concealed large orders |

| Participants | Individual retail traders | Institutional investors, hedge funds |

| Execution Speed | Slower, dependent on visible market data | Faster execution with reduced slippage |

| Order Size | Smaller, fragmented orders | Large block trades |

| Cost | Higher transaction costs due to market impact | Lower costs via reduced market impact |

Which is better?

Retail flow chasing allows traders to capitalize on the momentum created by individual investors, providing real-time insights into market sentiment and potential price movements. Dark pool trading offers the advantage of executing large orders anonymously, minimizing market impact and preventing adverse price shifts. Choosing between the two depends on trading objectives, with retail flow chasing suited for short-term strategies and dark pool trading favoring institutional-sized transactions seeking discretion.

Connection

Retail flow chasing often leads traders to mimic retail order patterns, which can signal institutional players operating within dark pools. Dark pool trading allows large institutions to execute significant trades anonymously, minimizing market impact and providing insights into hidden liquidity. This covert activity influences retail flow chasing by creating price movements based on unseen large orders, linking retail behavior to dark pool dynamics.

Key Terms

Liquidity

Dark pool trading offers institutional investors access to large blocks of liquidity without exposing their orders to the public market, reducing price impact and slippage. Retail flow chasing involves smaller traders attempting to capitalize on the same liquidity dynamics but often encounters higher costs and less favorable execution due to fragmented order books. Explore the nuances of liquidity provision and execution strategies to better understand the advantages and risks of each trading approach.

Order Execution

Dark pool trading enhances order execution by providing institutional investors with anonymity and reduced market impact, enabling large block trades without revealing intentions to the broader market. Retail flow chasing often results in delayed order execution and higher slippage due to fragmented liquidity and slower access to market data. Explore the nuances of these trading strategies to optimize your execution outcomes and improve market participation.

Information Asymmetry

Dark pool trading leverages significant information asymmetry by allowing institutional investors to execute large orders anonymously, thus preventing market impact and signaling to others about their trades. Retail flow chasing involves smaller investors attempting to capitalize on public price movements, often reacting late to information already exploited by informed traders in dark pools. Explore further to understand how information asymmetry shapes trading strategies across market participants.

Source and External Links

Dark Pool - Overview, How It Works, Pros and Cons - A dark pool is a private trading venue where large orders can be executed anonymously, reducing market impact and price fluctuations, mainly used by institutional investors to trade big blocks without revealing their intentions to the public markets.

Dark pool - Dark pools are private forums for trading securities, allowing large institutional investors to buy or sell large blocks without revealing order size or identity until after the trade, which limits market impact but reduces transparency and can disadvantage retail investors.

Can You Swim in a Dark Pool? - Dark pools let institutional investors execute large trades anonymously to avoid moving stock prices, but the trades occur away from public exchanges, potentially impacting price discovery and market transparency.

dowidth.com

dowidth.com