Funded account programs provide traders with capital from a proprietary trading firm, allowing them to trade assets without risking personal funds, typically involving profit-sharing models and strict performance criteria. Margin accounts enable traders to borrow funds from brokers to leverage positions, increasing potential gains and losses with interest on borrowed amounts. Explore the differences in risk, capital exposure, and trading flexibility to determine the best fit for your strategy.

Why it is important

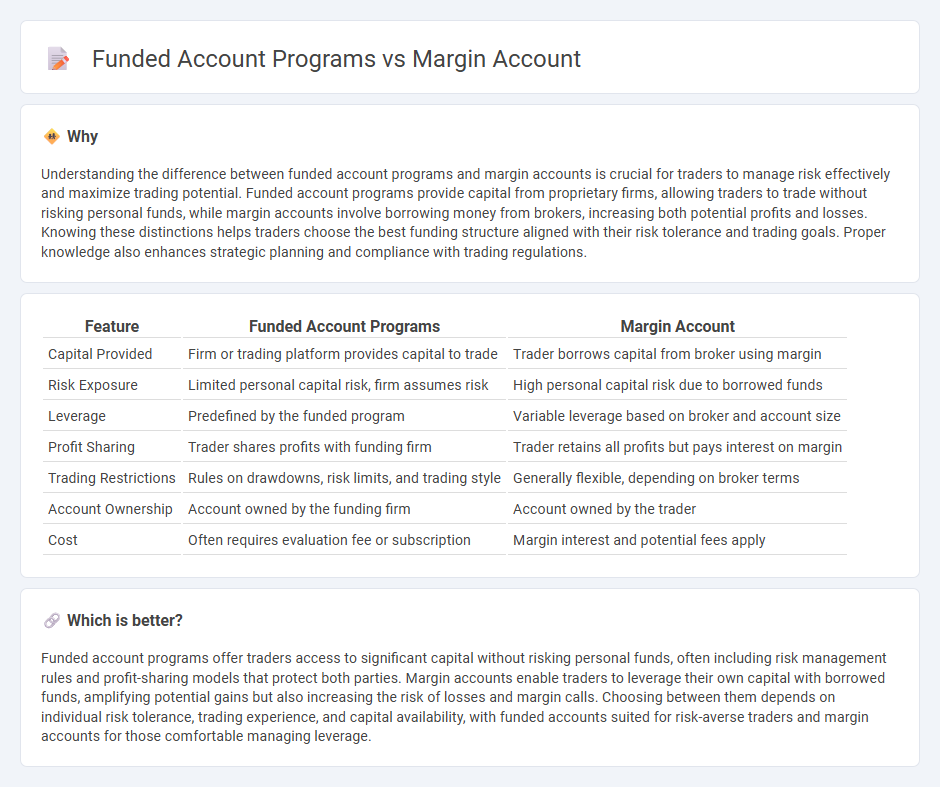

Understanding the difference between funded account programs and margin accounts is crucial for traders to manage risk effectively and maximize trading potential. Funded account programs provide capital from proprietary firms, allowing traders to trade without risking personal funds, while margin accounts involve borrowing money from brokers, increasing both potential profits and losses. Knowing these distinctions helps traders choose the best funding structure aligned with their risk tolerance and trading goals. Proper knowledge also enhances strategic planning and compliance with trading regulations.

Comparison Table

| Feature | Funded Account Programs | Margin Account |

|---|---|---|

| Capital Provided | Firm or trading platform provides capital to trade | Trader borrows capital from broker using margin |

| Risk Exposure | Limited personal capital risk, firm assumes risk | High personal capital risk due to borrowed funds |

| Leverage | Predefined by the funded program | Variable leverage based on broker and account size |

| Profit Sharing | Trader shares profits with funding firm | Trader retains all profits but pays interest on margin |

| Trading Restrictions | Rules on drawdowns, risk limits, and trading style | Generally flexible, depending on broker terms |

| Account Ownership | Account owned by the funding firm | Account owned by the trader |

| Cost | Often requires evaluation fee or subscription | Margin interest and potential fees apply |

Which is better?

Funded account programs offer traders access to significant capital without risking personal funds, often including risk management rules and profit-sharing models that protect both parties. Margin accounts enable traders to leverage their own capital with borrowed funds, amplifying potential gains but also increasing the risk of losses and margin calls. Choosing between them depends on individual risk tolerance, trading experience, and capital availability, with funded accounts suited for risk-averse traders and margin accounts for those comfortable managing leverage.

Connection

Funded account programs provide traders with capital to execute trades without risking their own money, often requiring adherence to strict risk management rules similar to those in margin accounts. Margin accounts enable traders to borrow funds from brokers to increase their buying power, which can amplify both potential profits and losses. The connection lies in risk management and leveraging strategies, where funded accounts mimic margin trading conditions to ensure disciplined, scalable trading performance.

Key Terms

Leverage

Margin accounts enable traders to borrow funds from brokers, increasing their buying power through leverage typically ranging from 2:1 to 10:1 depending on the asset class and regulatory constraints. Funded account programs provide traders with capital to trade on behalf of proprietary firms, often offering leverage ratios between 5:1 and 20:1 with risk parameters set by the firm to protect their investment. Explore the differences in leverage structures and risk management strategies to optimize your trading approach.

Proprietary Trading (Prop Firm)

In Proprietary Trading, a margin account allows traders to borrow capital from the firm to increase their buying power, subject to margin requirements and interest charges, enabling amplified exposure to financial markets. Funded account programs provide traders with firm capital without personal financial risk, typically requiring traders to pass evaluation stages based on performance and risk management metrics before accessing larger funds. Explore comprehensive comparisons and criteria to select the ideal prop trading model tailored to your trading goals.

Risk Management

Margin accounts allow traders to borrow funds to increase their buying power, significantly amplifying both potential profits and losses, necessitating strict risk management strategies. Funded account programs provide traders with capital from third parties, often including risk controls such as drawdown limits and profit-sharing arrangements to mitigate losses. Explore how these account types balance leverage and risk to optimize trading performance.

Source and External Links

Brokerage Accounts | FINRA.org - A margin account allows you to borrow money from a brokerage firm to buy securities, requiring an initial margin deposit (typically 50%) and maintenance margin to avoid margin calls and forced liquidation of assets if equity falls below required levels.

Margin Account, Buying Stock on Margin - Wells Fargo - Margin is a loan collateralized by securities in your brokerage account that can be used to buy additional stocks or meet other financing needs, but it involves significant risks and requires understanding account requirements and potential margin calls.

How a Margin Account Works | Ally Invest(r) - Ally - A margin account lets you borrow against the securities in your portfolio to increase your buying power or access cash, with the loan secured by your holdings and subject to interest, amplifying both potential gains and losses.

dowidth.com

dowidth.com