Grid trading employs a systematic approach placing buy and sell orders at predetermined price intervals to capitalize on market volatility without relying on direction prediction. Mean reversion strategies focus on identifying asset prices that deviate significantly from their historical averages, anticipating a return to typical levels. Explore deeper insights into how these trading techniques can enhance portfolio performance.

Why it is important

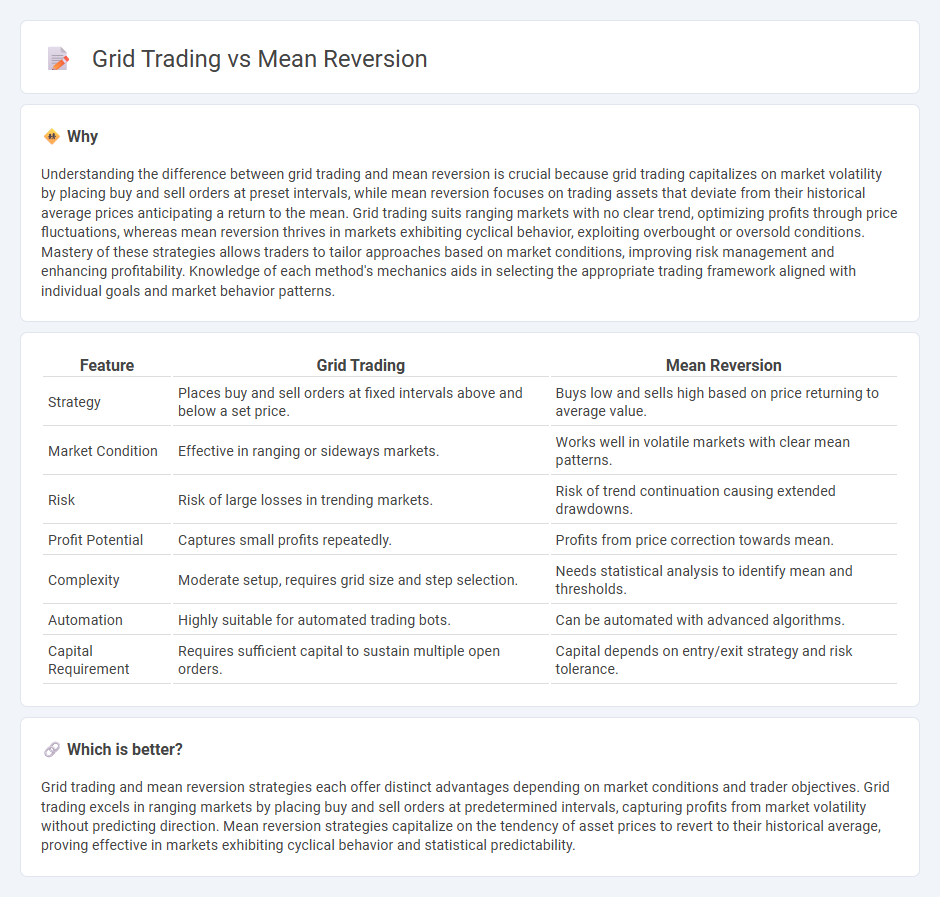

Understanding the difference between grid trading and mean reversion is crucial because grid trading capitalizes on market volatility by placing buy and sell orders at preset intervals, while mean reversion focuses on trading assets that deviate from their historical average prices anticipating a return to the mean. Grid trading suits ranging markets with no clear trend, optimizing profits through price fluctuations, whereas mean reversion thrives in markets exhibiting cyclical behavior, exploiting overbought or oversold conditions. Mastery of these strategies allows traders to tailor approaches based on market conditions, improving risk management and enhancing profitability. Knowledge of each method's mechanics aids in selecting the appropriate trading framework aligned with individual goals and market behavior patterns.

Comparison Table

| Feature | Grid Trading | Mean Reversion |

|---|---|---|

| Strategy | Places buy and sell orders at fixed intervals above and below a set price. | Buys low and sells high based on price returning to average value. |

| Market Condition | Effective in ranging or sideways markets. | Works well in volatile markets with clear mean patterns. |

| Risk | Risk of large losses in trending markets. | Risk of trend continuation causing extended drawdowns. |

| Profit Potential | Captures small profits repeatedly. | Profits from price correction towards mean. |

| Complexity | Moderate setup, requires grid size and step selection. | Needs statistical analysis to identify mean and thresholds. |

| Automation | Highly suitable for automated trading bots. | Can be automated with advanced algorithms. |

| Capital Requirement | Requires sufficient capital to sustain multiple open orders. | Capital depends on entry/exit strategy and risk tolerance. |

Which is better?

Grid trading and mean reversion strategies each offer distinct advantages depending on market conditions and trader objectives. Grid trading excels in ranging markets by placing buy and sell orders at predetermined intervals, capturing profits from market volatility without predicting direction. Mean reversion strategies capitalize on the tendency of asset prices to revert to their historical average, proving effective in markets exhibiting cyclical behavior and statistical predictability.

Connection

Grid trading and mean reversion strategies both capitalize on price fluctuations by systematically placing buy and sell orders within predetermined levels. Grid trading exploits the market's tendency to oscillate within a range, creating profits as prices revert to the mean. Mean reversion identifies when asset prices deviate from their average value, signaling potential entry points for grid trading setups that benefit from price corrections.

Key Terms

Price deviation

Mean reversion trading strategies capitalize on price deviation by anticipating that asset prices will revert to their historical average after significant divergence. Grid trading systematically places buy and sell orders at predetermined price intervals, profiting from market fluctuations without relying on trend prediction. Explore detailed comparisons to understand which approach aligns best with your trading goals and risk appetite.

Entry/exit levels

Mean reversion trading capitalizes on the idea that asset prices will return to their historical average, establishing entry points when prices deviate significantly from the mean and exit levels near the average price. Grid trading sets multiple predetermined entry and exit levels at fixed intervals, creating a series of buy and sell orders to profit from price fluctuations within a specified range. Explore detailed strategies and optimal setups to enhance your trading performance in these systems.

Position sizing

Mean reversion strategies rely on statistically determined position sizing to capitalize on price deviations from an asset's historical average, often adjusting exposure based on volatility and signal strength. Grid trading employs a systematic position sizing approach by placing staggered buy and sell orders at preset price intervals, aiming to profit from market fluctuations regardless of trend direction. Explore deeper insights into optimizing position sizing within these strategies to enhance risk management and profitability.

Source and External Links

Mean Reversion Strategies: Introduction, Trading ... - Mean reversion is a financial theory that asset prices and historical returns tend to revert back to their long-term average, and traders use this by identifying deviations from the mean to generate buy or sell signals based on expected price corrections.

Mean reversion (finance) - Mean reversion is the assumption that asset prices tend to converge to their average price over time, and deviations from this average are expected to revert, forming the basis for many trading strategies involving moving averages and quantitative analysis.

Mean Reversion - Overview, Trading, Impact of Catalysts - This theory implies asset prices and returns move toward their long-term mean with the probability of reversion increasing as deviation grows; traders use this to determine buying below the mean and selling above it, also considering catalysts that affect price action.

dowidth.com

dowidth.com