Dark pool activity involves private trading venues where large orders are executed away from public exchanges to minimize market impact. Spoofing, a manipulative tactic, entails placing deceptive orders to mislead other traders and distort price discovery. Explore the nuances of dark pools and spoofing to better understand their impact on market integrity.

Why it is important

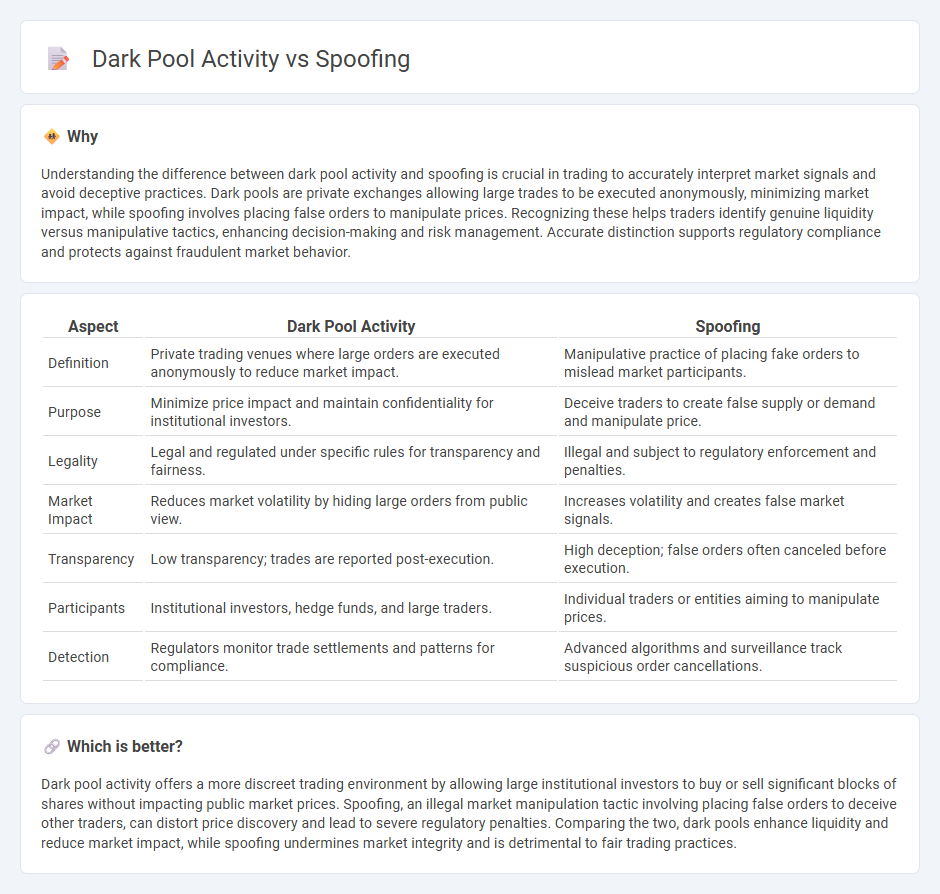

Understanding the difference between dark pool activity and spoofing is crucial in trading to accurately interpret market signals and avoid deceptive practices. Dark pools are private exchanges allowing large trades to be executed anonymously, minimizing market impact, while spoofing involves placing false orders to manipulate prices. Recognizing these helps traders identify genuine liquidity versus manipulative tactics, enhancing decision-making and risk management. Accurate distinction supports regulatory compliance and protects against fraudulent market behavior.

Comparison Table

| Aspect | Dark Pool Activity | Spoofing |

|---|---|---|

| Definition | Private trading venues where large orders are executed anonymously to reduce market impact. | Manipulative practice of placing fake orders to mislead market participants. |

| Purpose | Minimize price impact and maintain confidentiality for institutional investors. | Deceive traders to create false supply or demand and manipulate price. |

| Legality | Legal and regulated under specific rules for transparency and fairness. | Illegal and subject to regulatory enforcement and penalties. |

| Market Impact | Reduces market volatility by hiding large orders from public view. | Increases volatility and creates false market signals. |

| Transparency | Low transparency; trades are reported post-execution. | High deception; false orders often canceled before execution. |

| Participants | Institutional investors, hedge funds, and large traders. | Individual traders or entities aiming to manipulate prices. |

| Detection | Regulators monitor trade settlements and patterns for compliance. | Advanced algorithms and surveillance track suspicious order cancellations. |

Which is better?

Dark pool activity offers a more discreet trading environment by allowing large institutional investors to buy or sell significant blocks of shares without impacting public market prices. Spoofing, an illegal market manipulation tactic involving placing false orders to deceive other traders, can distort price discovery and lead to severe regulatory penalties. Comparing the two, dark pools enhance liquidity and reduce market impact, while spoofing undermines market integrity and is detrimental to fair trading practices.

Connection

Dark pool activity and spoofing intersect through the manipulation of market transparency and order flow. Spoofers place large, deceptive orders in dark pools to create false demand or supply signals, influencing other traders and causing price distortions. This covert manipulation exploits the non-displayed nature of dark pools, amplifying market inefficiencies and increasing the risk of unfair trading practices.

Key Terms

Order Book Manipulation

Spoofing is a deceptive trading practice where traders place large orders with no intention of execution to mislead market participants and manipulate the order book. Dark pool activity involves private, non-transparent trading venues where large block orders are executed away from public exchanges, affecting liquidity and price discovery without immediate order book visibility. Explore more to understand how these tactics impact market integrity and trading strategies.

Hidden Liquidity

Hidden liquidity, often associated with dark pool activity, plays a crucial role in modern financial markets by allowing large traders to execute sizable orders without revealing their intentions. Spoofing, an illegal tactic, manipulates market perception by placing false orders to create deceptive liquidity, contrasting with the genuine discreet trading facilitated by dark pools. Explore more to understand how hidden liquidity impacts market transparency and trading strategies.

Trade Transparency

Spoofing involves placing large orders with the intent to cancel before execution, deceiving market participants and impacting price discovery, while dark pools are private trading venues that enable large trades away from public exchanges, potentially reducing trade transparency. Regulatory scrutiny aims to ensure that dark pool activities do not facilitate manipulative practices like spoofing, preserving market integrity and fairness. Discover how enhanced monitoring and regulation improve trade transparency in combating spoofing and managing dark pool operations.

Source and External Links

What is Spoofing & How to Prevent it - Spoofing is when a cybercriminal impersonates a trusted entity or device, often using fake emails or websites combined with social engineering to manipulate victims into actions like transferring money or revealing credentials, leading to serious consequences such as data breaches or malware infections.

Spoofing | Spoof Calls | What is a Spoofing Attack - Spoofing in cybersecurity refers to pretending to be something else to gain trust or access, with many forms including email, website, caller ID, and GPS spoofing; attackers often mimic trusted organizations to trick victims into revealing sensitive information or downloading malware.

What Is Spoofing? Definition, Types & More - Spoofing is a tactic used by threat actors to disguise unauthorized sources as trusted ones across emails, calls, or network data to deceive victims and gain trust, potentially causing data breaches, financial loss, or reputation damage, with protection methods including email authentication protocols and security training.

dowidth.com

dowidth.com