Retail flow chasing involves traders capitalizing on large retail order patterns to anticipate market moves, leveraging behavioral trends for strategic entries. High-frequency trading (HFT) uses sophisticated algorithms and ultra-low latency infrastructures to execute a massive volume of trades within microseconds, aiming for minimal margins on rapid positional changes. Explore the nuances between retail flow chasing and high-frequency trading to enhance your trading strategy insights.

Why it is important

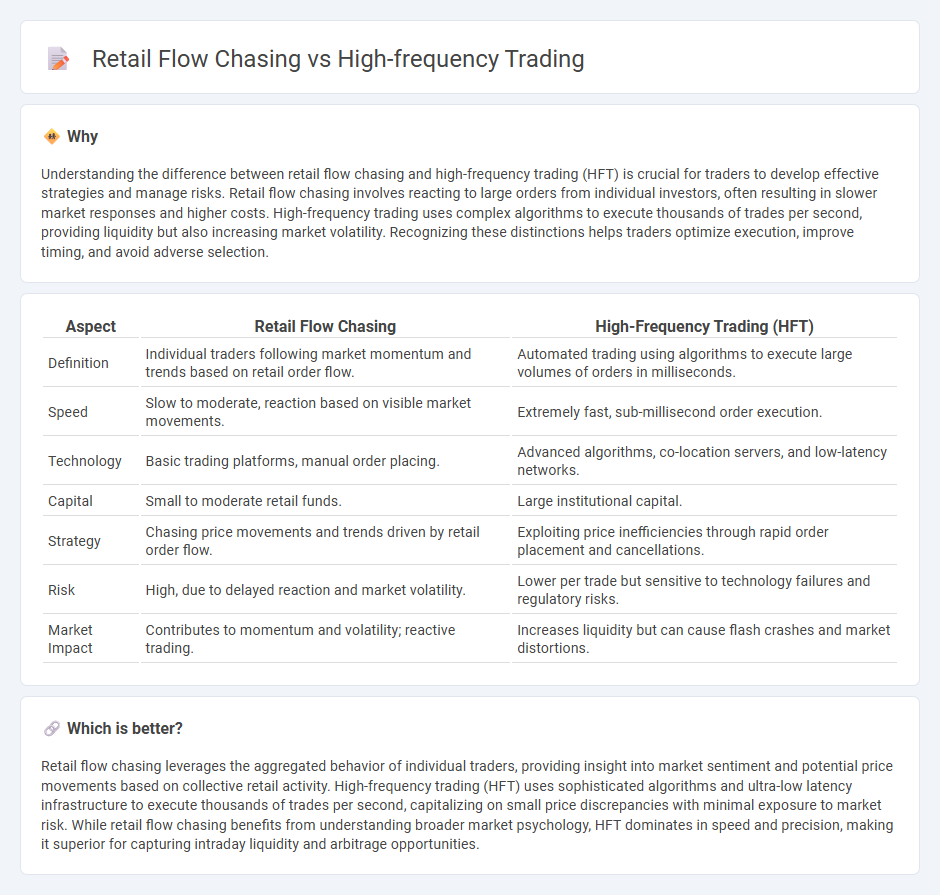

Understanding the difference between retail flow chasing and high-frequency trading (HFT) is crucial for traders to develop effective strategies and manage risks. Retail flow chasing involves reacting to large orders from individual investors, often resulting in slower market responses and higher costs. High-frequency trading uses complex algorithms to execute thousands of trades per second, providing liquidity but also increasing market volatility. Recognizing these distinctions helps traders optimize execution, improve timing, and avoid adverse selection.

Comparison Table

| Aspect | Retail Flow Chasing | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Individual traders following market momentum and trends based on retail order flow. | Automated trading using algorithms to execute large volumes of orders in milliseconds. |

| Speed | Slow to moderate, reaction based on visible market movements. | Extremely fast, sub-millisecond order execution. |

| Technology | Basic trading platforms, manual order placing. | Advanced algorithms, co-location servers, and low-latency networks. |

| Capital | Small to moderate retail funds. | Large institutional capital. |

| Strategy | Chasing price movements and trends driven by retail order flow. | Exploiting price inefficiencies through rapid order placement and cancellations. |

| Risk | High, due to delayed reaction and market volatility. | Lower per trade but sensitive to technology failures and regulatory risks. |

| Market Impact | Contributes to momentum and volatility; reactive trading. | Increases liquidity but can cause flash crashes and market distortions. |

Which is better?

Retail flow chasing leverages the aggregated behavior of individual traders, providing insight into market sentiment and potential price movements based on collective retail activity. High-frequency trading (HFT) uses sophisticated algorithms and ultra-low latency infrastructure to execute thousands of trades per second, capitalizing on small price discrepancies with minimal exposure to market risk. While retail flow chasing benefits from understanding broader market psychology, HFT dominates in speed and precision, making it superior for capturing intraday liquidity and arbitrage opportunities.

Connection

Retail flow chasing involves algorithms that detect and exploit retail investor order patterns, creating opportunities for high-frequency trading (HFT) firms to capitalize on predictable price movements. HFT strategies use ultra-low latency technology to respond instantly to retail order flows, executing trades within microseconds to capture arbitrage and market-making profits. The interaction between retail flow chasing and HFT increases market liquidity but can also contribute to short-term volatility and price inefficiencies.

Key Terms

Latency

High-frequency trading (HFT) leverages ultra-low latency to execute large volumes of trades within microseconds, gaining an edge by reacting faster than the market. Retail flow chasing strategies operate with higher latency, often resulting in delayed order execution that can lead to slippage and less favorable prices. Explore deeper insights into how latency impacts trading efficiency and profitability in both domains.

Order Flow

High-frequency trading (HFT) leverages advanced algorithms to execute large volumes of trades within milliseconds, capitalizing on minute market inefficiencies. Retail flow chasing involves traders reacting to aggregated retail order flow data, aiming to align their positions with crowd sentiment for potential short-term gains. Explore deeper insights into the dynamics and strategies behind order flow for a comprehensive understanding of market behavior.

Market Microstructure

Market microstructure analysis reveals that high-frequency trading (HFT) leverages sophisticated algorithms to exploit minuscule price discrepancies within milliseconds, improving liquidity and price efficiency in electronic markets. In contrast, retail flow chasing strategies attempt to capitalize on detectable patterns in retail investor orders but face challenges due to latency disadvantages and less advanced technological infrastructure. Explore further to understand the nuanced impacts of these trading approaches on market dynamics and participant behavior.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do ... - High-frequency trading is automated trading using powerful computers to execute massive numbers of transactions in microseconds, capturing small price differences across markets for profit through speed and volume.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading with extremely high-speed executions and short-term horizons, mainly conducted by institutional investors to profit from small price fluctuations and arbitrage across exchanges.

High-frequency trading - HFT employs quantitative, computerized models to rapidly execute trades, focusing on strategies like market-making and arbitrage, relying on speed and processing large data volumes to gain a competitive edge.

dowidth.com

dowidth.com