Paper trading platforms simulate real market conditions, allowing traders to practice strategies without financial risk. Live trading platforms execute actual trades with real capital, providing real-time market exposure and profit or loss outcomes. Explore the key differences between paper trading and live trading platforms to enhance your trading skills effectively.

Why it is important

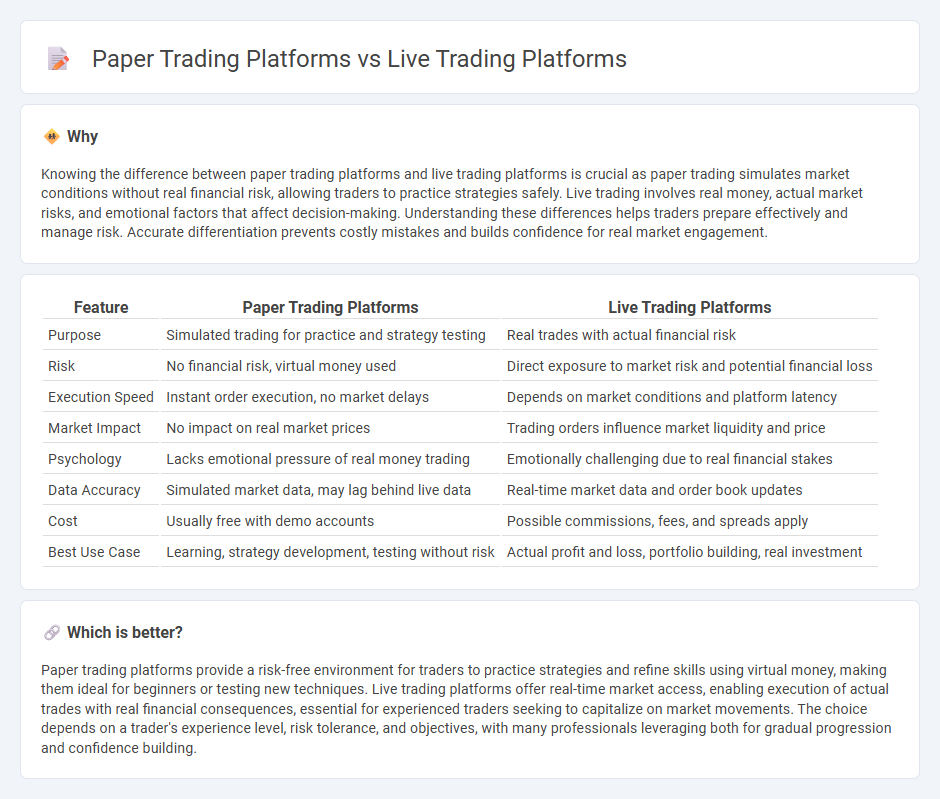

Knowing the difference between paper trading platforms and live trading platforms is crucial as paper trading simulates market conditions without real financial risk, allowing traders to practice strategies safely. Live trading involves real money, actual market risks, and emotional factors that affect decision-making. Understanding these differences helps traders prepare effectively and manage risk. Accurate differentiation prevents costly mistakes and builds confidence for real market engagement.

Comparison Table

| Feature | Paper Trading Platforms | Live Trading Platforms |

|---|---|---|

| Purpose | Simulated trading for practice and strategy testing | Real trades with actual financial risk |

| Risk | No financial risk, virtual money used | Direct exposure to market risk and potential financial loss |

| Execution Speed | Instant order execution, no market delays | Depends on market conditions and platform latency |

| Market Impact | No impact on real market prices | Trading orders influence market liquidity and price |

| Psychology | Lacks emotional pressure of real money trading | Emotionally challenging due to real financial stakes |

| Data Accuracy | Simulated market data, may lag behind live data | Real-time market data and order book updates |

| Cost | Usually free with demo accounts | Possible commissions, fees, and spreads apply |

| Best Use Case | Learning, strategy development, testing without risk | Actual profit and loss, portfolio building, real investment |

Which is better?

Paper trading platforms provide a risk-free environment for traders to practice strategies and refine skills using virtual money, making them ideal for beginners or testing new techniques. Live trading platforms offer real-time market access, enabling execution of actual trades with real financial consequences, essential for experienced traders seeking to capitalize on market movements. The choice depends on a trader's experience level, risk tolerance, and objectives, with many professionals leveraging both for gradual progression and confidence building.

Connection

Paper trading platforms simulate real market conditions by using historical and real-time data feeds identical to those in live trading platforms, enabling users to practice strategies without financial risk. These platforms share APIs and data sources to ensure price movements, order execution, and market depth reflect live market behavior for accurate simulation. Integration between paper and live trading environments allows seamless transition for traders to test strategies before applying them in actual markets.

Key Terms

Real-time Execution

Live trading platforms provide real-time execution by directly connecting traders to financial markets, enabling immediate order processing and price updates essential for capitalizing on market movements. Paper trading platforms simulate market conditions without actual financial risk, lacking the instantaneous execution speed and emotional pressure of live trading. Explore the critical differences in execution speeds and trading experiences to choose the platform that suits your investment strategy best.

Simulated Orders

Simulated orders on paper trading platforms replicate live market conditions without financial risk, enabling traders to practice strategies and test algorithms using virtual funds. Live trading platforms execute real orders that impact actual market positions and capital, requiring robust order management systems to handle slippage, latency, and execution risks. Explore the nuances between simulated and live trading orders to enhance your market engagement strategy.

Risk Exposure

Live trading platforms expose investors to real market risks, including financial loss, liquidity constraints, and emotional stress caused by actual capital at stake. Paper trading platforms simulate market conditions without risking real money, allowing traders to practice strategies and understand market dynamics without financial consequences. Explore more insights on managing risk exposure across different trading platforms to enhance your investment approach.

Source and External Links

Best Day Trading Platforms: 2025 Top Picks - NerdWallet - Offers a comparison of top live trading platforms for day trading including Robinhood, Interactive Brokers, Webull, Charles Schwab, and Public, featuring zero or low fees and no account minimums suitable for various trader preferences.

NinjaTrader: Futures Trading - Provides a customizable, cloud-based live trading platform designed for futures traders with access across devices, low margins, low commissions, unlimited free simulated trading, and a large community.

Match-Trader: All-in-one trading platform with TradingView Charts - An all-in-one trading platform offering full server control, integration with TradingView charts, multiple APIs, and mobile-first access for live Forex and proprietary trading with 24/7 support.

dowidth.com

dowidth.com