Alternative data signals leverage unconventional sources like satellite imagery, social media trends, and credit card transactions to provide unique trading insights. Machine learning signals analyze vast amounts of structured and unstructured data, identifying complex patterns and predictive indicators that traditional methods might miss. Explore how integrating both approaches can enhance trading strategy accuracy and decision-making.

Why it is important

Understanding the difference between alternative data signals and machine learning signals is crucial for effective trading strategies, as alternative data offers raw, unconventional insights like social media trends or satellite imagery, while machine learning signals are derived from sophisticated algorithms analyzing vast datasets for predictive patterns. Traders leveraging alternative data can identify unique market opportunities that traditional data overlooks, whereas machine learning signals enhance decision-making through automated pattern recognition and risk prediction. Knowing the distinction allows investors to optimize signal integration, improving portfolio performance and reducing false positives. Mastery of both data types drives innovative trading models that adapt quickly to changing market conditions.

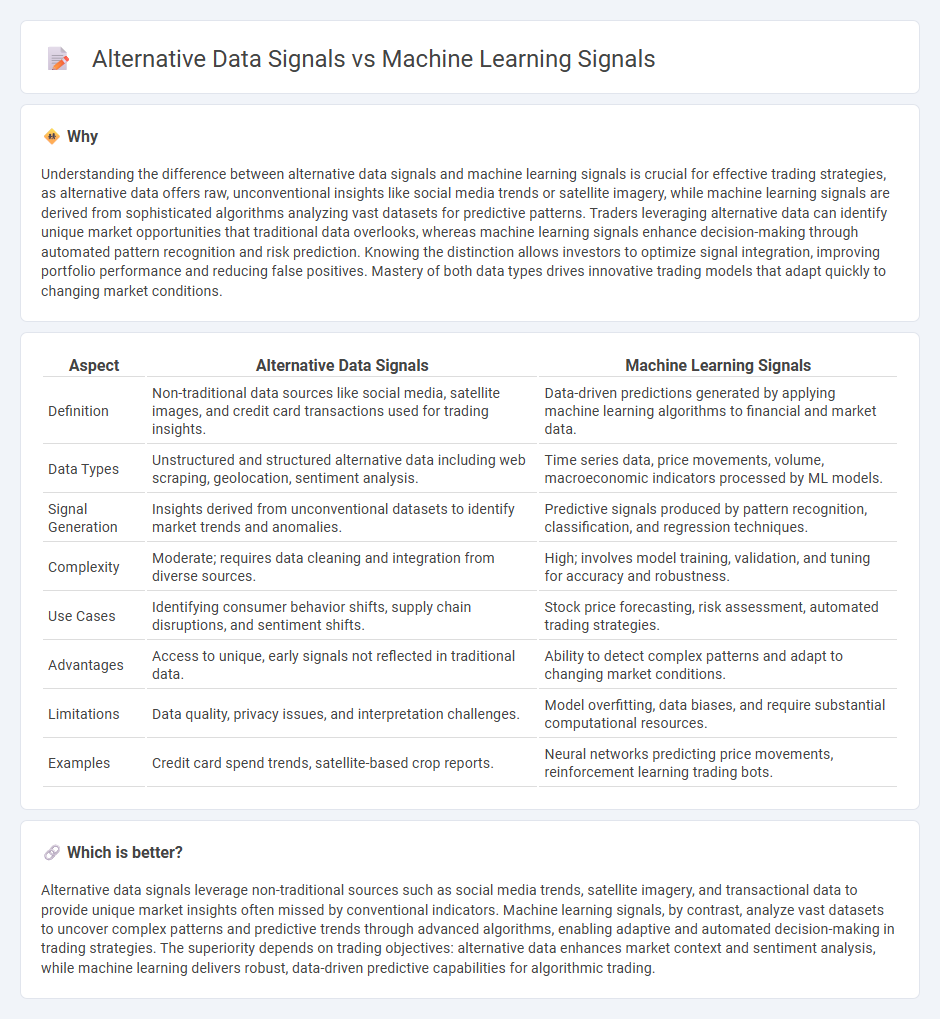

Comparison Table

| Aspect | Alternative Data Signals | Machine Learning Signals |

|---|---|---|

| Definition | Non-traditional data sources like social media, satellite images, and credit card transactions used for trading insights. | Data-driven predictions generated by applying machine learning algorithms to financial and market data. |

| Data Types | Unstructured and structured alternative data including web scraping, geolocation, sentiment analysis. | Time series data, price movements, volume, macroeconomic indicators processed by ML models. |

| Signal Generation | Insights derived from unconventional datasets to identify market trends and anomalies. | Predictive signals produced by pattern recognition, classification, and regression techniques. |

| Complexity | Moderate; requires data cleaning and integration from diverse sources. | High; involves model training, validation, and tuning for accuracy and robustness. |

| Use Cases | Identifying consumer behavior shifts, supply chain disruptions, and sentiment shifts. | Stock price forecasting, risk assessment, automated trading strategies. |

| Advantages | Access to unique, early signals not reflected in traditional data. | Ability to detect complex patterns and adapt to changing market conditions. |

| Limitations | Data quality, privacy issues, and interpretation challenges. | Model overfitting, data biases, and require substantial computational resources. |

| Examples | Credit card spend trends, satellite-based crop reports. | Neural networks predicting price movements, reinforcement learning trading bots. |

Which is better?

Alternative data signals leverage non-traditional sources such as social media trends, satellite imagery, and transactional data to provide unique market insights often missed by conventional indicators. Machine learning signals, by contrast, analyze vast datasets to uncover complex patterns and predictive trends through advanced algorithms, enabling adaptive and automated decision-making in trading strategies. The superiority depends on trading objectives: alternative data enhances market context and sentiment analysis, while machine learning delivers robust, data-driven predictive capabilities for algorithmic trading.

Connection

Alternative data signals provide unstructured and non-traditional information such as social media trends, satellite imagery, and transaction data, which enhance the predictive power of machine learning models in trading. Machine learning algorithms analyze and identify patterns from this diverse alternative data, enabling more accurate forecasting of market movements and asset prices. The integration of alternative data with machine learning signals improves trading strategies by uncovering hidden insights beyond conventional financial indicators.

Key Terms

Feature Engineering

Machine learning signals rely on algorithmically extracted patterns from structured datasets, emphasizing precise feature engineering techniques such as normalization, encoding, and dimensionality reduction to enhance model accuracy. Alternative data signals incorporate unstructured or unconventional data sources like satellite imagery, social media feeds, and sensor data, requiring innovative feature extraction methods to uncover predictive value. Explore our in-depth analysis to understand how advanced feature engineering differentiates machine learning signals from alternative data in driving superior insights.

Sentiment Analysis

Machine learning signals in sentiment analysis leverage algorithms to decode textual data from social media, news, and reviews, extracting emotional tone and public opinion with high accuracy. Alternative data signals encompass unconventional data sources such as satellite imagery, transaction records, and sensor outputs, providing context-rich insights beyond traditional text-based sentiment. Explore the nuances of integrating machine learning and alternative data signals to enhance sentiment analysis efficacy.

Alpha Generation

Machine learning signals leverage algorithmic patterns extracted from large financial datasets to enhance alpha generation by identifying complex market trends and inefficiencies. Alternative data signals, derived from unconventional sources such as satellite imagery, social media activity, and transaction data, provide unique insights that traditional datasets may overlook, offering a competitive edge in predictive modeling. Explore how integrating machine learning with alternative data can maximize alpha potential and transform investment strategies.

Source and External Links

A Data Scientist's Guide to Signal Processing - DataCamp - Signal processing extracts valuable features from raw data like audio, temperature, or financial time-series to enable machine learning tasks such as forecasting, anomaly detection, and classification by cleaning and transforming the signals for better modeling and prediction accuracy.

On the Intersection of Signal Processing and Machine Learning - arXiv - Signal processing involves transforming signals (e.g., using Fourier or wavelet transforms) to new domains for feature extraction, denoising, and analysis, which are foundational steps integrated with machine learning to improve classification and prediction from complex signals.

Signal processing and machine learning - SINTEF - The combination of signal processing and machine learning is pivotal in IoT and edge computing applications, where embedded AI uses signal processing expertise to filter, classify, and analyze data from sensors for intelligent decision-making across domains like wireless communications, speech technology, and cyber-physical systems.

dowidth.com

dowidth.com