Market microstructure encompasses the mechanisms and processes that govern how trades are executed and prices are formed in financial markets, focusing on aspects like bid-ask spreads, order flow, and information asymmetry. The limit order book, a core component of market microstructure, aggregates all outstanding buy and sell limit orders, reflecting supply and demand at various price levels and playing a critical role in liquidity and price discovery. Explore further to understand how these concepts shape trading strategies and market efficiency.

Why it is important

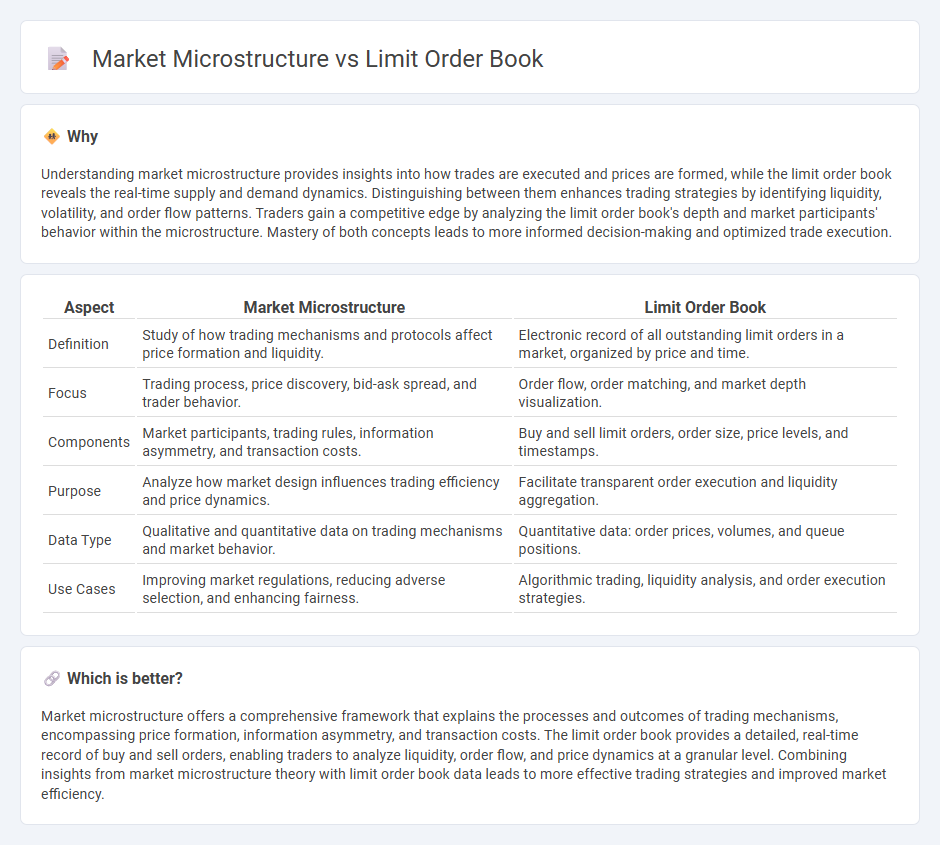

Understanding market microstructure provides insights into how trades are executed and prices are formed, while the limit order book reveals the real-time supply and demand dynamics. Distinguishing between them enhances trading strategies by identifying liquidity, volatility, and order flow patterns. Traders gain a competitive edge by analyzing the limit order book's depth and market participants' behavior within the microstructure. Mastery of both concepts leads to more informed decision-making and optimized trade execution.

Comparison Table

| Aspect | Market Microstructure | Limit Order Book |

|---|---|---|

| Definition | Study of how trading mechanisms and protocols affect price formation and liquidity. | Electronic record of all outstanding limit orders in a market, organized by price and time. |

| Focus | Trading process, price discovery, bid-ask spread, and trader behavior. | Order flow, order matching, and market depth visualization. |

| Components | Market participants, trading rules, information asymmetry, and transaction costs. | Buy and sell limit orders, order size, price levels, and timestamps. |

| Purpose | Analyze how market design influences trading efficiency and price dynamics. | Facilitate transparent order execution and liquidity aggregation. |

| Data Type | Qualitative and quantitative data on trading mechanisms and market behavior. | Quantitative data: order prices, volumes, and queue positions. |

| Use Cases | Improving market regulations, reducing adverse selection, and enhancing fairness. | Algorithmic trading, liquidity analysis, and order execution strategies. |

Which is better?

Market microstructure offers a comprehensive framework that explains the processes and outcomes of trading mechanisms, encompassing price formation, information asymmetry, and transaction costs. The limit order book provides a detailed, real-time record of buy and sell orders, enabling traders to analyze liquidity, order flow, and price dynamics at a granular level. Combining insights from market microstructure theory with limit order book data leads to more effective trading strategies and improved market efficiency.

Connection

Market microstructure examines the processes and rules governing trading, focusing on how the limit order book aggregates buy and sell orders to determine price formation and liquidity. The limit order book serves as a real-time record of outstanding limit orders, reflecting market participants' supply and demand dynamics that directly influence market depth and bid-ask spreads. Understanding the interaction between market microstructure and the limit order book enables traders to optimize order execution strategies and predict short-term price movements more effectively.

Key Terms

Bid-Ask Spread

The limit order book is a dynamic ledger of buy and sell orders that reveals market liquidity and directly influences the bid-ask spread, a key metric in market microstructure reflecting transaction costs and market efficiency. Market microstructure studies the mechanisms and rules governing these price formations and how factors like order flow and information asymmetry affect the bid-ask spread. Explore deeper insights into how bid-ask spread variations signal market conditions and impact trading strategies.

Order Flow

Order flow is a crucial element in both limit order books and market microstructure, capturing the real-time sequence of buy and sell orders that impact price formation and liquidity. Limit order books display pending orders with specified prices, while market microstructure examines the mechanisms of order submission, execution, and information asymmetry influencing order flow dynamics. Explore further insights into how order flow shapes trading strategies and market efficiency.

Price Discovery

The limit order book is a critical component of market microstructure, acting as a dynamic ledger of buy and sell orders that facilitates price discovery by revealing supply and demand at various price levels. Market microstructure studies how these order flows, trade executions, and information asymmetries influence price formation and volatility in financial markets. Explore more about the intricate dynamics between limit order books and price discovery to deepen your understanding of trading mechanisms.

Source and External Links

An Introduction to Limit Order Books | machow.ski - A limit order book is a record of all buy and sell orders for a security, detailing side, quantity, limit price, and submission time, with limit orders specifying the worst acceptable trade price and waiting in queue until matched.

Limit Order Book - QuestDB - The limit order book is a dynamic electronic system organizing all outstanding limit orders by buy (bids) and sell (asks) sides, ranked by price, providing transparency into market depth and facilitating price discovery.

What is a Limit Order Book? Detailed Guide - B2Broker - A limit order book stores all pending market orders with price and time constraints, allowing the smooth operation of financial markets by precisely processing and managing traders' positions in digital trading platforms.

dowidth.com

dowidth.com