Funded account programs provide traders with capital from external sources, allowing them to trade without risking personal funds, while proprietary trading involves firms using their own capital for trading activities. Both models offer opportunities for skilled traders to profit from the markets, but funded accounts often include profit-sharing and evaluation phases, contrasting with the direct risk and reward structure of prop trading. Explore detailed comparisons to determine which trading pathway best suits your financial goals and risk tolerance.

Why it is important

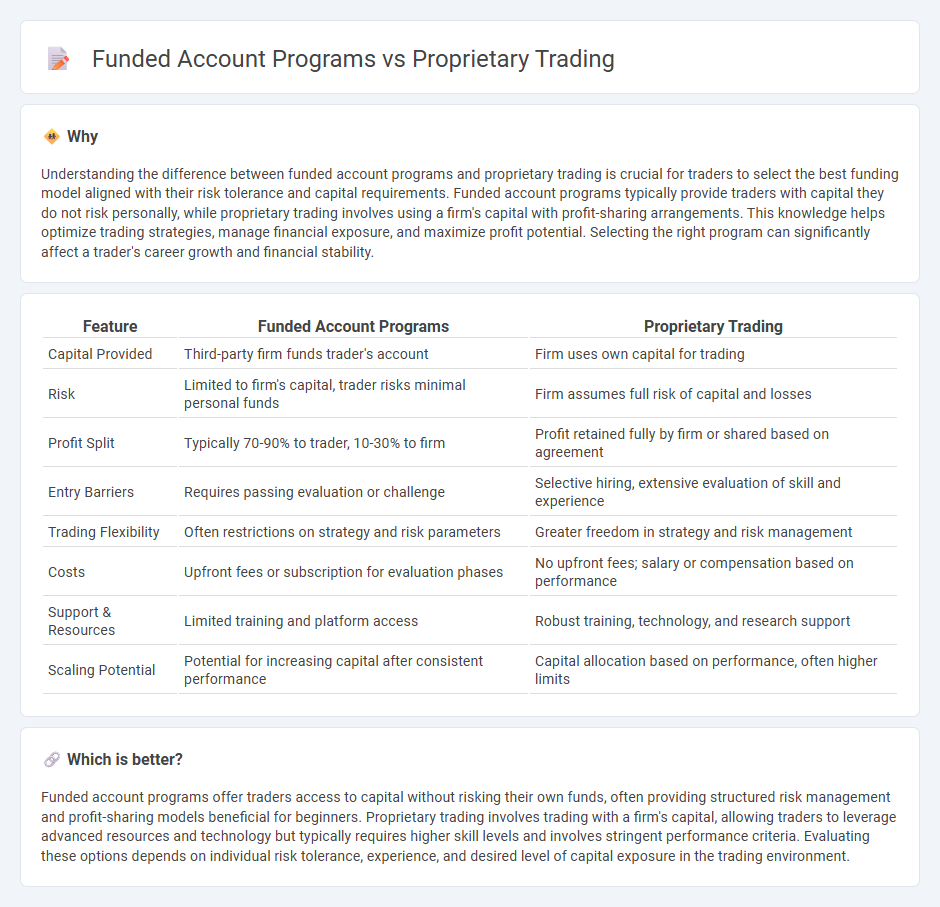

Understanding the difference between funded account programs and proprietary trading is crucial for traders to select the best funding model aligned with their risk tolerance and capital requirements. Funded account programs typically provide traders with capital they do not risk personally, while proprietary trading involves using a firm's capital with profit-sharing arrangements. This knowledge helps optimize trading strategies, manage financial exposure, and maximize profit potential. Selecting the right program can significantly affect a trader's career growth and financial stability.

Comparison Table

| Feature | Funded Account Programs | Proprietary Trading |

|---|---|---|

| Capital Provided | Third-party firm funds trader's account | Firm uses own capital for trading |

| Risk | Limited to firm's capital, trader risks minimal personal funds | Firm assumes full risk of capital and losses |

| Profit Split | Typically 70-90% to trader, 10-30% to firm | Profit retained fully by firm or shared based on agreement |

| Entry Barriers | Requires passing evaluation or challenge | Selective hiring, extensive evaluation of skill and experience |

| Trading Flexibility | Often restrictions on strategy and risk parameters | Greater freedom in strategy and risk management |

| Costs | Upfront fees or subscription for evaluation phases | No upfront fees; salary or compensation based on performance |

| Support & Resources | Limited training and platform access | Robust training, technology, and research support |

| Scaling Potential | Potential for increasing capital after consistent performance | Capital allocation based on performance, often higher limits |

Which is better?

Funded account programs offer traders access to capital without risking their own funds, often providing structured risk management and profit-sharing models beneficial for beginners. Proprietary trading involves trading with a firm's capital, allowing traders to leverage advanced resources and technology but typically requires higher skill levels and involves stringent performance criteria. Evaluating these options depends on individual risk tolerance, experience, and desired level of capital exposure in the trading environment.

Connection

Funded account programs provide traders with capital from proprietary trading firms to execute trades without risking their own money, creating a direct link between individual traders and the firm's resources. These programs assess traders' skills through evaluation phases, ensuring only proficient traders manage the firm's capital. Proprietary trading firms benefit by sharing profits generated from funded accounts, aligning incentives for successful trading strategies.

Key Terms

Capital Ownership

Proprietary trading involves traders using the firm's capital to execute trades, where profits and losses directly impact both the trader and the company's equity. In funded account programs, traders manage allocated funds provided by the firm, typically sharing a percentage of profits while the firm retains full capital ownership. Explore the distinct advantages and implications of capital ownership in these models to optimize your trading strategy.

Risk Responsibility

Proprietary trading involves traders using the firm's capital, assuming full risk responsibility for profits and losses, often requiring substantial risk management skills. Funded account programs provide traders with allocated capital, where the risk is shared or borne by the funding company, allowing traders to focus more on strategy execution than risk capital exposure. Explore detailed comparisons to understand how risk management frameworks differ between these trading models.

Profit Split

Profit split in proprietary trading typically ranges from 70% to 90%, offering traders a more substantial share of generated profits compared to funded account programs, which often provide splits between 50% and 80%. Prop trading firms assume the trading capital risk, enabling traders to leverage firm resources without risking personal funds, while funded account programs may require traders to meet minimum performance benchmarks before profit sharing. Explore detailed comparisons and strategies to maximize profit splits in both trading models to enhance your earning potential.

Source and External Links

Proprietary trading - Proprietary trading (prop trading) is when firms trade financial instruments with their own money to earn profits, using strategies like arbitrage and global macro trading without involving client funds.

Proprietary Trading: Meaning, Working & Benefits - Prop trading involves firms using their own capital and proprietary strategies, often with high-tech software, aiming for high returns while accepting risks like market unpredictability and regulatory scrutiny.

Proprietary Trading - What is Prop Trading & How Does It Work - Prop trading is a bank or firm's practice of trading with its own funds, enabling them to capture full trading profits and often employing sophisticated models and software despite being considered risky and regulated under rules like the Volcker Rule.

dowidth.com

dowidth.com