Liquidity sweeps target stop-loss orders clustered around key price levels, enabling traders to capture rapid market moves when these levels are triggered. Range breakout strategies focus on identifying consolidation zones and entering trades as price breaks above resistance or below support, signaling potential trend continuation. Explore these tactics to enhance your trading precision and timing.

Why it is important

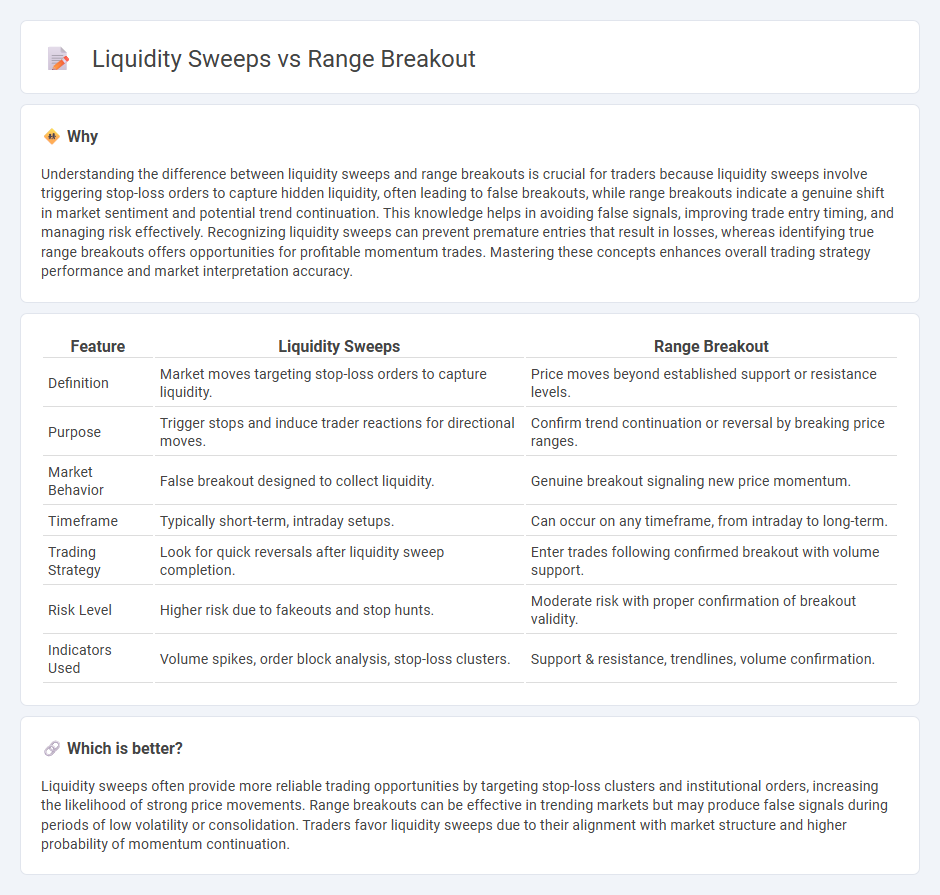

Understanding the difference between liquidity sweeps and range breakouts is crucial for traders because liquidity sweeps involve triggering stop-loss orders to capture hidden liquidity, often leading to false breakouts, while range breakouts indicate a genuine shift in market sentiment and potential trend continuation. This knowledge helps in avoiding false signals, improving trade entry timing, and managing risk effectively. Recognizing liquidity sweeps can prevent premature entries that result in losses, whereas identifying true range breakouts offers opportunities for profitable momentum trades. Mastering these concepts enhances overall trading strategy performance and market interpretation accuracy.

Comparison Table

| Feature | Liquidity Sweeps | Range Breakout |

|---|---|---|

| Definition | Market moves targeting stop-loss orders to capture liquidity. | Price moves beyond established support or resistance levels. |

| Purpose | Trigger stops and induce trader reactions for directional moves. | Confirm trend continuation or reversal by breaking price ranges. |

| Market Behavior | False breakout designed to collect liquidity. | Genuine breakout signaling new price momentum. |

| Timeframe | Typically short-term, intraday setups. | Can occur on any timeframe, from intraday to long-term. |

| Trading Strategy | Look for quick reversals after liquidity sweep completion. | Enter trades following confirmed breakout with volume support. |

| Risk Level | Higher risk due to fakeouts and stop hunts. | Moderate risk with proper confirmation of breakout validity. |

| Indicators Used | Volume spikes, order block analysis, stop-loss clusters. | Support & resistance, trendlines, volume confirmation. |

Which is better?

Liquidity sweeps often provide more reliable trading opportunities by targeting stop-loss clusters and institutional orders, increasing the likelihood of strong price movements. Range breakouts can be effective in trending markets but may produce false signals during periods of low volatility or consolidation. Traders favor liquidity sweeps due to their alignment with market structure and higher probability of momentum continuation.

Connection

Liquidity sweeps occur when price temporarily moves beyond established support or resistance levels, triggering stop orders and capturing dormant liquidity. Range breakouts follow liquidity sweeps as the price gains momentum after absorbing the trapped orders, leading to a sustained directional move. Traders often monitor liquidity sweeps to confirm genuine breakouts and reduce false signals in range trading strategies.

Key Terms

Support and Resistance

Range breakouts occur when price decisively moves beyond established support or resistance levels, signaling potential trend continuation or reversal. Liquidity sweeps involve temporary price spikes below support or above resistance to trigger stop-losses and capture liquidity before reversing direction. Explore deeper insights into how traders leverage support and resistance in range breakouts and liquidity sweeps for strategic advantage.

Stop-Loss Orders

Range breakouts often trigger clusters of stop-loss orders placed just beyond established support or resistance levels, causing rapid price movements as these orders execute. Liquidity sweeps target these stop-loss zones by intentionally pushing prices beyond key levels to access hidden liquidity, facilitating larger institutional trades. Explore the mechanics of stop-loss order activation during range breakouts and liquidity sweeps to enhance your trading strategy.

Order Book Liquidity

Range breakouts occur when price moves beyond established support or resistance levels, signaling potential sustained momentum, while liquidity sweeps involve aggressive order execution that targets hidden liquidity in the order book to trigger stop-loss orders and induce rapid price moves. Understanding order book liquidity dynamics is crucial for distinguishing between genuine breakouts and false signals caused by liquidity hunts. Explore detailed strategies to leverage order book insights for improved trade execution and market analysis.

Source and External Links

Opening Range Breakout Trading Strategy - The opening range breakout strategy involves taking a position when the price breaks above or below the previous candle's high or low within a defined opening range, often the first 15 minutes to one hour after market open, offering clear entry and exit points based on the early trading volatility.

Opening Range Breakout Trading Strategy - Option Alpha - This strategy triggers a trade when price moves beyond the high or low of the opening range, typically set at 15, 30, or 60 minutes after market open, and is popular among short-term options traders to capitalize on initial market momentum.

Opening Range Breakout (ORB) Trading Strategy Explained - The ORB strategy exploits the increased volatility at market open using lower timeframes (1 to 5 minutes) to identify breakout trades with defined entry and exit points, aiming to follow the initial market direction once the opening range is established.

dowidth.com

dowidth.com