Zero knowledge proof trading enables private and secure asset exchange by verifying transaction validity without revealing sensitive data, enhancing confidentiality on blockchain networks. Automated market maker (AMM) trading automates liquidity provision and price determination through smart contracts, allowing seamless decentralized trading without order books. Explore the differences and benefits of these innovative trading mechanisms to optimize your blockchain investment strategies.

Why it is important

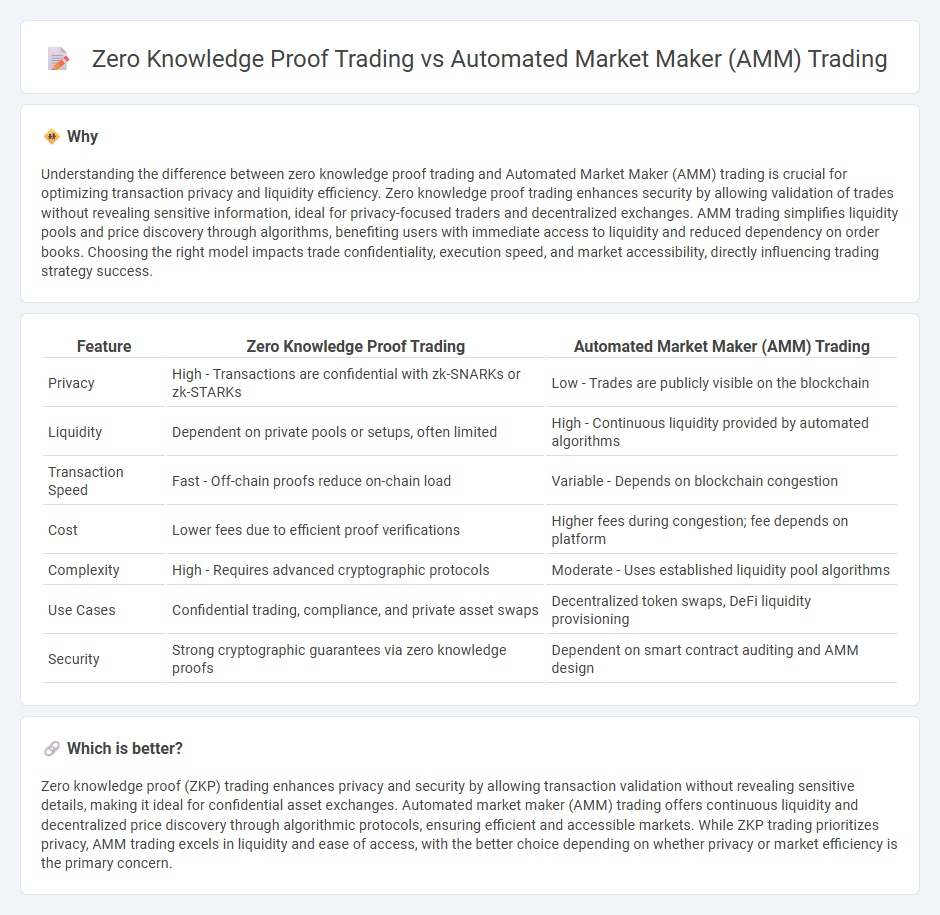

Understanding the difference between zero knowledge proof trading and Automated Market Maker (AMM) trading is crucial for optimizing transaction privacy and liquidity efficiency. Zero knowledge proof trading enhances security by allowing validation of trades without revealing sensitive information, ideal for privacy-focused traders and decentralized exchanges. AMM trading simplifies liquidity pools and price discovery through algorithms, benefiting users with immediate access to liquidity and reduced dependency on order books. Choosing the right model impacts trade confidentiality, execution speed, and market accessibility, directly influencing trading strategy success.

Comparison Table

| Feature | Zero Knowledge Proof Trading | Automated Market Maker (AMM) Trading |

|---|---|---|

| Privacy | High - Transactions are confidential with zk-SNARKs or zk-STARKs | Low - Trades are publicly visible on the blockchain |

| Liquidity | Dependent on private pools or setups, often limited | High - Continuous liquidity provided by automated algorithms |

| Transaction Speed | Fast - Off-chain proofs reduce on-chain load | Variable - Depends on blockchain congestion |

| Cost | Lower fees due to efficient proof verifications | Higher fees during congestion; fee depends on platform |

| Complexity | High - Requires advanced cryptographic protocols | Moderate - Uses established liquidity pool algorithms |

| Use Cases | Confidential trading, compliance, and private asset swaps | Decentralized token swaps, DeFi liquidity provisioning |

| Security | Strong cryptographic guarantees via zero knowledge proofs | Dependent on smart contract auditing and AMM design |

Which is better?

Zero knowledge proof (ZKP) trading enhances privacy and security by allowing transaction validation without revealing sensitive details, making it ideal for confidential asset exchanges. Automated market maker (AMM) trading offers continuous liquidity and decentralized price discovery through algorithmic protocols, ensuring efficient and accessible markets. While ZKP trading prioritizes privacy, AMM trading excels in liquidity and ease of access, with the better choice depending on whether privacy or market efficiency is the primary concern.

Connection

Zero-knowledge proof trading enhances Automated Market Maker (AMM) trading by enabling private and secure transaction verification without revealing sensitive data, thus improving user confidentiality on decentralized exchanges. The integration of zero-knowledge proofs ensures trustless asset swaps within AMMs by validating trades off-chain while maintaining on-chain integrity and liquidity. This synergy fosters a more scalable, transparent, and privacy-preserving trading environment in decentralized finance (DeFi).

Key Terms

Liquidity Pools

Automated Market Maker (AMM) trading utilizes liquidity pools to facilitate decentralized trading by allowing users to trade against a pool of tokens, enhancing market liquidity and reducing reliance on order books. Zero-knowledge proof trading leverages cryptographic techniques to validate transactions privately and securely without revealing underlying data, potentially increasing confidentiality within liquidity pool interactions. Explore how these innovative mechanisms reshape decentralized finance by learning more about their benefits and operational nuances.

Privacy

Automated market maker (AMM) trading provides decentralized and transparent liquidity pools enabling seamless token swaps without relying on order books, but often exposes transaction details publicly on-chain. Zero-knowledge proof (ZKP) trading enhances privacy by cryptographically validating transactions without revealing sensitive information like trade amounts or participants, ensuring confidential asset exchanges. Discover how integrating zero-knowledge proofs with AMMs can revolutionize private, trustless trading ecosystems.

Decentralization

Automated Market Maker (AMM) trading leverages decentralized liquidity pools to enable permissionless asset swaps without intermediaries, ensuring wide accessibility and reduced counterparty risk. Zero Knowledge Proof (ZKP) trading enhances privacy and scalability by validating transactions without revealing sensitive data, preserving decentralization through cryptographic verification rather than relying on network consensus alone. Explore the nuances of AMM and ZKP technologies to better understand their impact on decentralized exchange ecosystems.

Source and External Links

What is an Automated Market Maker (AMM)? AMMs explained - An AMM is an autonomous protocol used by decentralized exchanges to facilitate trading by allowing users to trade assets against liquidity pools via smart contracts, eliminating the need for waiting for counterparties and employing algorithmically determined prices.

What is an Automated Market Maker? - Uniswap Blog - AMMs run on smart contracts instead of order books, using mathematical formulas to price trades automatically 24/7, enabling users to trade a wide range of tokens freely while liquidity providers earn trading fees.

Automated Market Makers (AMMs) - XRP Ledger - AMMs hold two assets in a pool, adjust exchange rates based on pool balances using a constant product formula, and charge trading fees, providing liquidity and enabling trades without direct counterparties on the XRP Ledger decentralized exchange.

dowidth.com

dowidth.com