Funded account programs provide traders with capital from proprietary firms, allowing them to trade without risking personal funds while sharing profits with the firm. Social trading platforms enable individuals to replicate the trades of experienced investors, fostering a community-driven approach to market participation. Explore the differences and benefits of funded accounts and social trading to enhance your trading strategy.

Why it is important

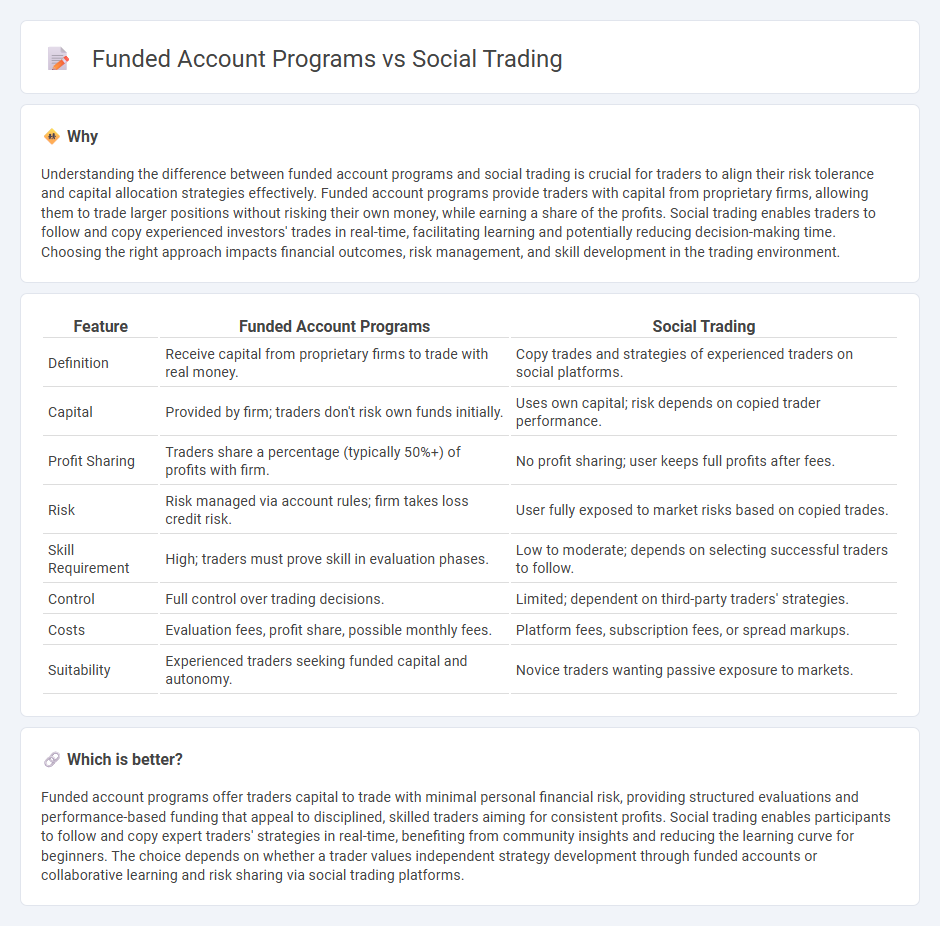

Understanding the difference between funded account programs and social trading is crucial for traders to align their risk tolerance and capital allocation strategies effectively. Funded account programs provide traders with capital from proprietary firms, allowing them to trade larger positions without risking their own money, while earning a share of the profits. Social trading enables traders to follow and copy experienced investors' trades in real-time, facilitating learning and potentially reducing decision-making time. Choosing the right approach impacts financial outcomes, risk management, and skill development in the trading environment.

Comparison Table

| Feature | Funded Account Programs | Social Trading |

|---|---|---|

| Definition | Receive capital from proprietary firms to trade with real money. | Copy trades and strategies of experienced traders on social platforms. |

| Capital | Provided by firm; traders don't risk own funds initially. | Uses own capital; risk depends on copied trader performance. |

| Profit Sharing | Traders share a percentage (typically 50%+) of profits with firm. | No profit sharing; user keeps full profits after fees. |

| Risk | Risk managed via account rules; firm takes loss credit risk. | User fully exposed to market risks based on copied trades. |

| Skill Requirement | High; traders must prove skill in evaluation phases. | Low to moderate; depends on selecting successful traders to follow. |

| Control | Full control over trading decisions. | Limited; dependent on third-party traders' strategies. |

| Costs | Evaluation fees, profit share, possible monthly fees. | Platform fees, subscription fees, or spread markups. |

| Suitability | Experienced traders seeking funded capital and autonomy. | Novice traders wanting passive exposure to markets. |

Which is better?

Funded account programs offer traders capital to trade with minimal personal financial risk, providing structured evaluations and performance-based funding that appeal to disciplined, skilled traders aiming for consistent profits. Social trading enables participants to follow and copy expert traders' strategies in real-time, benefiting from community insights and reducing the learning curve for beginners. The choice depends on whether a trader values independent strategy development through funded accounts or collaborative learning and risk sharing via social trading platforms.

Connection

Funded account programs provide traders with capital to trade without risking personal funds, creating an environment where social trading platforms can thrive by sharing strategies and performance metrics. Social trading benefits funded account holders by enabling them to observe and replicate successful trading methods in real-time, enhancing learning and potential profitability. The synergy between these programs accelerates trader development and fosters a collaborative trading community focused on risk-managed growth.

Key Terms

Copy Trading

Copy trading enables investors to replicate the trades of experienced traders in real-time, leveraging their expertise to potentially enhance returns without active management. Funded account programs provide traders with capital from proprietary firms, allowing them to trade larger volumes while sharing profits, but do not inherently involve copying others' strategies. Explore the nuances of copy trading and funded account programs to optimize your trading approach and risk management strategies.

Signal Providers

Signal providers in social trading platforms offer real-time trade recommendations based on expert analysis, allowing followers to replicate strategies without managing accounts independently. Funded account programs, on the other hand, involve traders being evaluated and allocated capital by firms, with performance tracked for profit sharing. Discover the distinct advantages and applications of signal providers versus funded accounts to optimize your trading approach.

Profit Split

Profit split in social trading typically involves sharing a portion of the trader's gains with the platform or signal providers, often ranging between 20% to 40%. Funded account programs offer traders capital and take a profit share that can vary from 10% up to 50%, depending on the program's terms and trader performance. Explore the intricacies of profit splits in both models to optimize your trading strategy and maximize returns.

Source and External Links

Social trading - Social trading is a form of investing allowing individuals to observe and copy the trading behavior of expert and peer traders to potentially improve their investment outcomes.

Social Trading Explained for Beginners at JustMarkets - Social trading lets less experienced traders follow, learn from, and copy successful traders, maintaining full control over their funds while benefiting from shared knowledge and strategies in a social environment.

Social Trading: Everything You Need To Know - Social trading platforms enable investors to mimic experienced traders' strategies automatically or manually, providing access to community insights, while requiring careful selection and risk management due to potential high risks, especially with leveraged instruments like CFDs.

dowidth.com

dowidth.com