Liquidity mining enables traders to earn rewards by providing assets to decentralized finance protocols, enhancing market depth and asset availability. Social trading allows investors to replicate the strategies of experienced traders, benefiting from collective expertise and real-time market insights. Explore the differences between liquidity mining and social trading to discover which approach suits your investment goals.

Why it is important

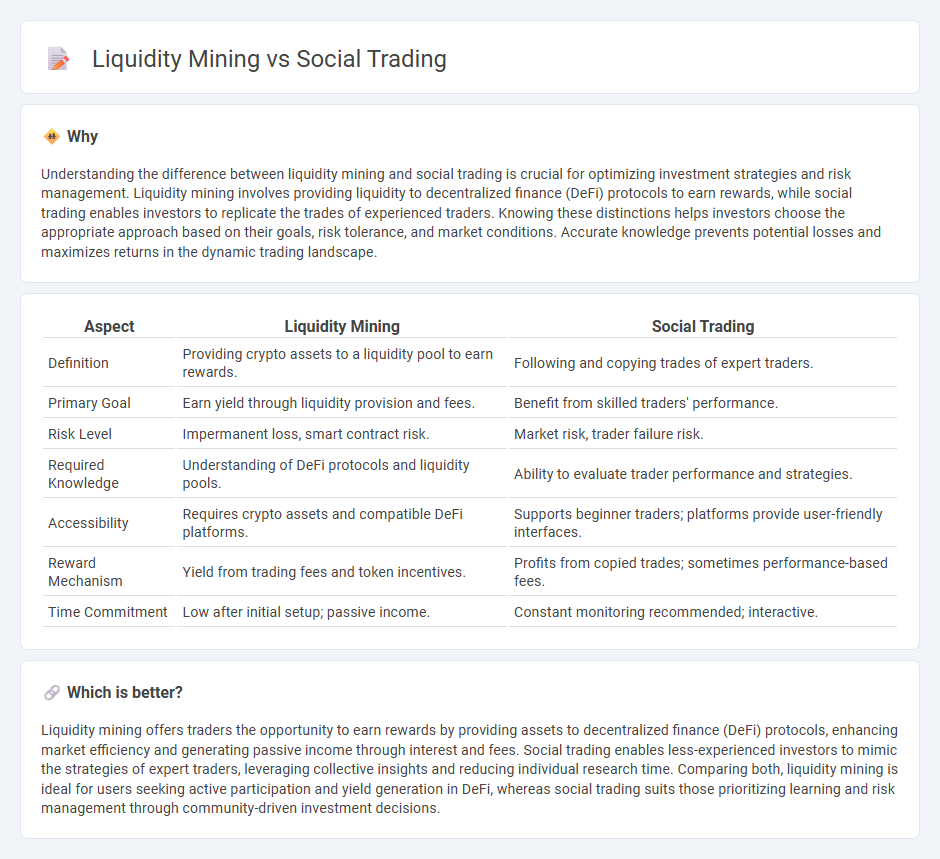

Understanding the difference between liquidity mining and social trading is crucial for optimizing investment strategies and risk management. Liquidity mining involves providing liquidity to decentralized finance (DeFi) protocols to earn rewards, while social trading enables investors to replicate the trades of experienced traders. Knowing these distinctions helps investors choose the appropriate approach based on their goals, risk tolerance, and market conditions. Accurate knowledge prevents potential losses and maximizes returns in the dynamic trading landscape.

Comparison Table

| Aspect | Liquidity Mining | Social Trading |

|---|---|---|

| Definition | Providing crypto assets to a liquidity pool to earn rewards. | Following and copying trades of expert traders. |

| Primary Goal | Earn yield through liquidity provision and fees. | Benefit from skilled traders' performance. |

| Risk Level | Impermanent loss, smart contract risk. | Market risk, trader failure risk. |

| Required Knowledge | Understanding of DeFi protocols and liquidity pools. | Ability to evaluate trader performance and strategies. |

| Accessibility | Requires crypto assets and compatible DeFi platforms. | Supports beginner traders; platforms provide user-friendly interfaces. |

| Reward Mechanism | Yield from trading fees and token incentives. | Profits from copied trades; sometimes performance-based fees. |

| Time Commitment | Low after initial setup; passive income. | Constant monitoring recommended; interactive. |

Which is better?

Liquidity mining offers traders the opportunity to earn rewards by providing assets to decentralized finance (DeFi) protocols, enhancing market efficiency and generating passive income through interest and fees. Social trading enables less-experienced investors to mimic the strategies of expert traders, leveraging collective insights and reducing individual research time. Comparing both, liquidity mining is ideal for users seeking active participation and yield generation in DeFi, whereas social trading suits those prioritizing learning and risk management through community-driven investment decisions.

Connection

Liquidity mining enhances decentralized exchange platforms by incentivizing users to provide liquidity through rewards, increasing market depth and reducing slippage. Social trading leverages this improved liquidity by allowing traders to mirror successful strategies in a more stable and efficient market environment. Together, they create a synergistic ecosystem where user participation boosts liquidity while enabling informed trading decisions based on collective insights.

Key Terms

Social Trading:

Social trading enables investors to replicate the strategies of experienced traders through platforms like eToro and ZuluTrade, promoting collaborative decision-making and real-time market insights. This approach reduces the learning curve for novices by leveraging community expertise and transparent performance metrics. Explore how social trading can transform your investment strategy and enhance portfolio diversification.

Copy Trading

Social trading allows investors to replicate the trades of experienced traders, while liquidity mining involves providing assets to decentralized platforms in exchange for rewards. Copy trading, a subset of social trading, enables automatic mirroring of expert portfolios, enhancing accessibility for beginners seeking passive income. Explore the benefits and risks of copy trading to optimize your investment strategy.

Signal Providers

Social trading platforms rely heavily on Signal Providers, who offer real-time trade signals and strategies, enabling followers to replicate successful trades and enhance portfolio performance. In liquidity mining, the role of Signal Providers is minimal as the focus is on users supplying assets to decentralized finance (DeFi) protocols for yield generation through token rewards. Explore how Signal Providers impact trading efficiency and profitability in both ecosystems to maximize your investment strategy.

Source and External Links

Social Trading Explained for Beginners at JustMarkets - Social trading is a method where traders observe, follow, and copy the strategies of more experienced traders, retaining full control over their accounts; it helps beginners learn trading faster while allowing them to invest based on others' successful strategies.

Social trading - Wikipedia - Social trading enables investors to watch and replicate the trades of peers or expert traders through platforms that facilitate copy trading or mirror trading, integrating social indicators with traditional investment analysis.

Social Trading: Everything You Need To Know - Social trading platforms let investors mimic experienced traders by copying trades automatically or manually, offering community insights and requiring careful trader selection and monitoring due to associated risks.

dowidth.com

dowidth.com