Stop hunting exploits market volatility to trigger stop-loss orders, forcing price movements that benefit larger traders while shaking out smaller investors. False breakouts deceive traders by suggesting a trend continuation or reversal, only to quickly reverse direction and trap those acting on the breakout signal. Explore these tactics in depth to enhance your trading strategy and manage risk effectively.

Why it is important

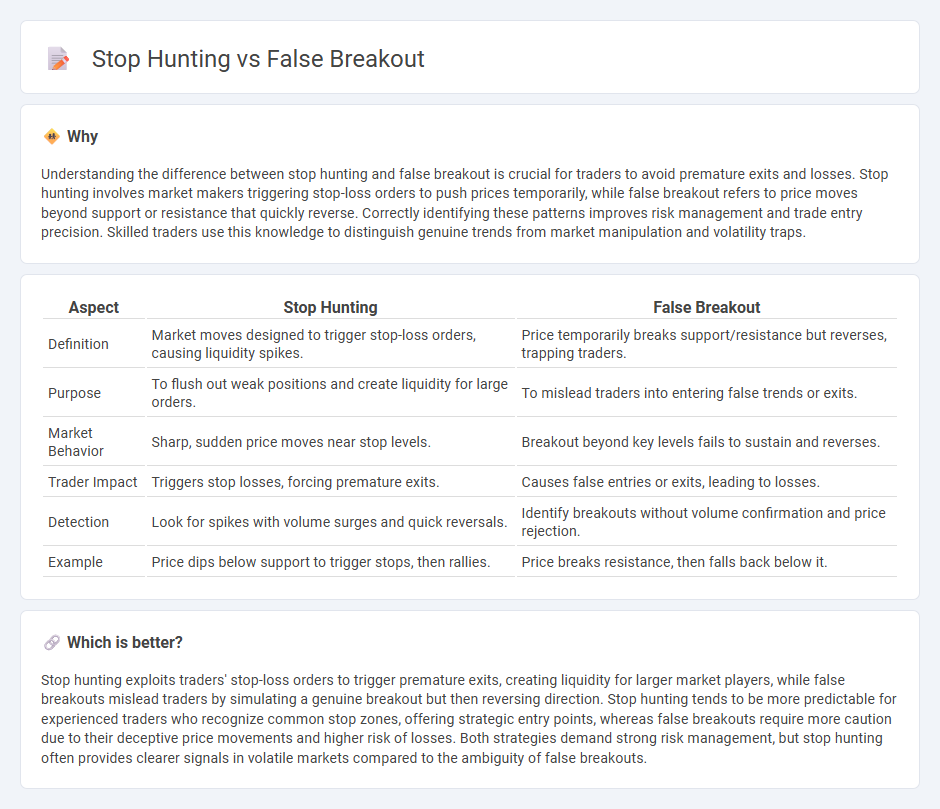

Understanding the difference between stop hunting and false breakout is crucial for traders to avoid premature exits and losses. Stop hunting involves market makers triggering stop-loss orders to push prices temporarily, while false breakout refers to price moves beyond support or resistance that quickly reverse. Correctly identifying these patterns improves risk management and trade entry precision. Skilled traders use this knowledge to distinguish genuine trends from market manipulation and volatility traps.

Comparison Table

| Aspect | Stop Hunting | False Breakout |

|---|---|---|

| Definition | Market moves designed to trigger stop-loss orders, causing liquidity spikes. | Price temporarily breaks support/resistance but reverses, trapping traders. |

| Purpose | To flush out weak positions and create liquidity for large orders. | To mislead traders into entering false trends or exits. |

| Market Behavior | Sharp, sudden price moves near stop levels. | Breakout beyond key levels fails to sustain and reverses. |

| Trader Impact | Triggers stop losses, forcing premature exits. | Causes false entries or exits, leading to losses. |

| Detection | Look for spikes with volume surges and quick reversals. | Identify breakouts without volume confirmation and price rejection. |

| Example | Price dips below support to trigger stops, then rallies. | Price breaks resistance, then falls back below it. |

Which is better?

Stop hunting exploits traders' stop-loss orders to trigger premature exits, creating liquidity for larger market players, while false breakouts mislead traders by simulating a genuine breakout but then reversing direction. Stop hunting tends to be more predictable for experienced traders who recognize common stop zones, offering strategic entry points, whereas false breakouts require more caution due to their deceptive price movements and higher risk of losses. Both strategies demand strong risk management, but stop hunting often provides clearer signals in volatile markets compared to the ambiguity of false breakouts.

Connection

Stop hunting manipulates market prices to trigger clustered stop-loss orders, causing sharp price movements exploited by traders. False breakouts occur when price briefly moves past support or resistance levels, only to reverse quickly, often triggered by stop hunting activities. This connection allows market participants to capitalize on the sudden liquidity created by stop orders being activated prematurely.

Key Terms

Liquidity

False breakouts occur when price temporarily moves beyond a support or resistance level but fails to sustain momentum, often triggering traders' stop orders and liquidity pools. Stop hunting involves intentional market maneuvers by larger participants to trigger these stop orders, creating volatility around key liquidity zones to enter or exit positions with minimal slippage. Explore deeper insights into how liquidity dynamics influence false breakouts and stop hunting strategies.

Support and Resistance

False breakouts occur when price temporarily moves beyond support or resistance levels, tricking traders into entering positions before reversing direction. Stop hunting targets these same levels by triggering stop-loss orders placed just beyond support or resistance, causing rapid price moves to trigger liquidity. Learn more about distinguishing false breakouts from stop hunting tactics to improve trading accuracy.

Order Flow

False breakout involves price temporarily moving beyond a support or resistance level before reversing, often trapping traders who entered positions expecting a sustained move. Stop hunting exploits these breakout zones by deliberately triggering stop-loss orders through sudden, sharp price movements, allowing larger traders to accumulate favorable positions. Explore the intricate mechanics of order flow to distinguish between genuine breakouts and manipulative stop hunting tactics.

Source and External Links

What is a false breakout and how can you avoid it? - IG - A false breakout occurs when price briefly moves beyond a support or resistance level but fails to sustain momentum and quickly reverses back, unlike a true breakout where the momentum continues beyond that level.

5 False Breakout Strategies for Traders - Traders can identify and profit from false breakouts using strategies based on momentum reversal, price trends, news volatility, multi-timeframe analysis, and options data to confirm breakout validity.

False Breakout Strategy: A Simple Yet Powerful Approach - A false breakout is defined as a move and close beyond a support or resistance level followed by a reversal back below or above it, with emphasis on using higher timeframes like 4-hour or daily charts to avoid noise in identifying true false breakouts.

dowidth.com

dowidth.com