Altcoin sniping targets newly listed cryptocurrencies on exchanges to capitalize on initial price surges, leveraging rapid transaction speeds and bot automation. Arbitrage exploits price discrepancies of the same altcoin across different platforms, ensuring profit through simultaneous buy and sell orders. Explore the strategic differences and technical setups behind altcoin sniping versus arbitrage trading.

Why it is important

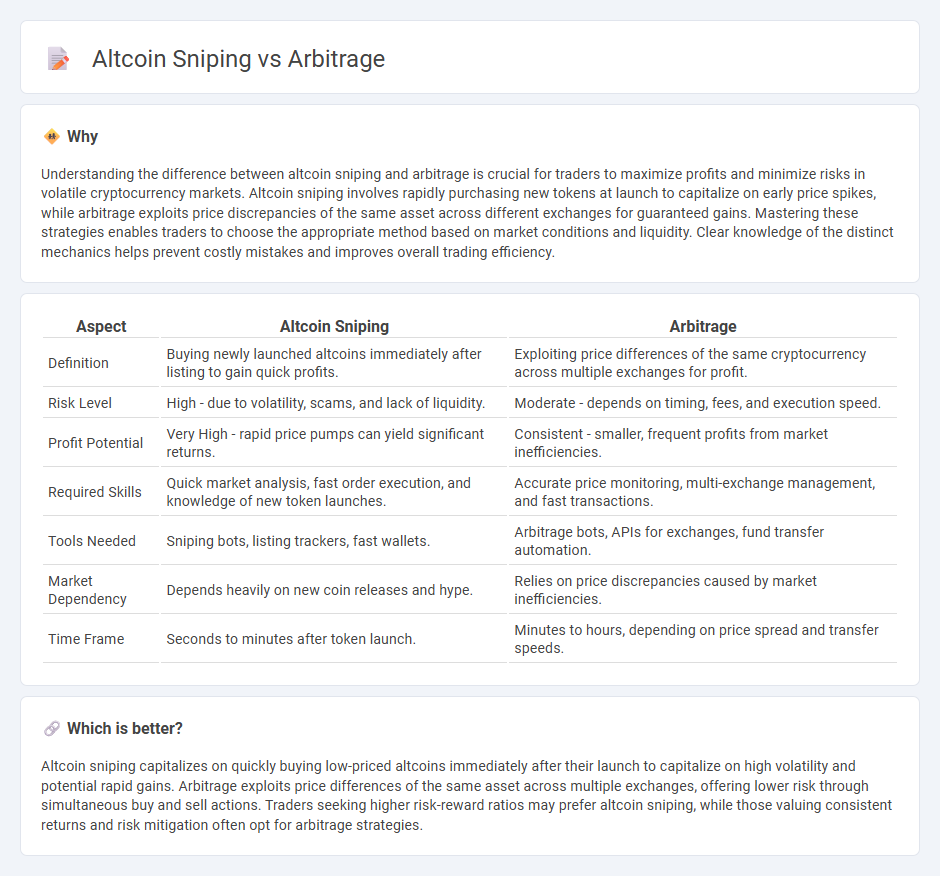

Understanding the difference between altcoin sniping and arbitrage is crucial for traders to maximize profits and minimize risks in volatile cryptocurrency markets. Altcoin sniping involves rapidly purchasing new tokens at launch to capitalize on early price spikes, while arbitrage exploits price discrepancies of the same asset across different exchanges for guaranteed gains. Mastering these strategies enables traders to choose the appropriate method based on market conditions and liquidity. Clear knowledge of the distinct mechanics helps prevent costly mistakes and improves overall trading efficiency.

Comparison Table

| Aspect | Altcoin Sniping | Arbitrage |

|---|---|---|

| Definition | Buying newly launched altcoins immediately after listing to gain quick profits. | Exploiting price differences of the same cryptocurrency across multiple exchanges for profit. |

| Risk Level | High - due to volatility, scams, and lack of liquidity. | Moderate - depends on timing, fees, and execution speed. |

| Profit Potential | Very High - rapid price pumps can yield significant returns. | Consistent - smaller, frequent profits from market inefficiencies. |

| Required Skills | Quick market analysis, fast order execution, and knowledge of new token launches. | Accurate price monitoring, multi-exchange management, and fast transactions. |

| Tools Needed | Sniping bots, listing trackers, fast wallets. | Arbitrage bots, APIs for exchanges, fund transfer automation. |

| Market Dependency | Depends heavily on new coin releases and hype. | Relies on price discrepancies caused by market inefficiencies. |

| Time Frame | Seconds to minutes after token launch. | Minutes to hours, depending on price spread and transfer speeds. |

Which is better?

Altcoin sniping capitalizes on quickly buying low-priced altcoins immediately after their launch to capitalize on high volatility and potential rapid gains. Arbitrage exploits price differences of the same asset across multiple exchanges, offering lower risk through simultaneous buy and sell actions. Traders seeking higher risk-reward ratios may prefer altcoin sniping, while those valuing consistent returns and risk mitigation often opt for arbitrage strategies.

Connection

Altcoin sniping and arbitrage are interconnected trading strategies that exploit price inefficiencies in cryptocurrency markets. Altcoin sniping involves rapidly purchasing newly listed tokens at lower prices before they surge, enabling traders to capitalize on initial volatility. Arbitrage complements this by simultaneously buying and selling these tokens across different exchanges to lock in risk-free profits from price discrepancies.

Key Terms

Price Discrepancy

Arbitrage exploits price discrepancies of the same asset across different exchanges, enabling traders to buy low on one platform and sell high on another for guaranteed profits. Altcoin sniping targets momentary price inefficiencies or early price surges of newly launched or low-liquidity tokens before the market stabilizes, aiming for rapid gains. Discover more strategies and tools to master price discrepancy opportunities in crypto trading.

Execution Speed

Execution speed is crucial in both arbitrage and altcoin sniping strategies, directly impacting profitability by enabling traders to capitalize on fleeting market inefficiencies and token launches. Arbitrage leverages rapid identification and transaction across different exchanges, while altcoin sniping prioritizes ultra-fast order execution right after new token listings to secure tokens at the lowest possible price. Explore detailed techniques to optimize execution speed and enhance your trading advantage.

Liquidity

Arbitrage involves capitalizing on price differences of the same asset across multiple exchanges, relying heavily on deep liquidity to execute large volume trades swiftly and with minimal slippage. Altcoin sniping targets newly listed or low-liquidity tokens to acquire coins at initial low prices before the market corrects, often risking higher volatility and price impact due to limited liquidity pools. Explore detailed insights on liquidity strategies and risk management in arbitrage and altcoin sniping to enhance your trading effectiveness.

Source and External Links

Arbitrage - Wikipedia - Arbitrage is the practice of simultaneously buying and selling assets in different markets to profit from price differences, often considered risk-free in theory but with varying risks in practice.

What Is Arbitrage? 3 Strategies to Know - Arbitrage is an investment strategy that exploits price differences of the same asset across different markets, including types such as pure arbitrage, merger arbitrage, and convertible arbitrage.

What is arbitrage and how does it work in financial markets | StoneX - Arbitrage involves trading the same asset in multiple markets to benefit from price discrepancies, with specific forms like merger arbitrage, triangular arbitrage in currencies, and pure arbitrage explained.

dowidth.com

dowidth.com