Market microstructure examines the processes and mechanisms through which securities are traded, focusing on the roles of order types, trading platforms, and liquidity providers. Price discovery refers to how market prices emerge from the interaction of supply and demand, reflecting all available information and trader behavior. Explore the dynamics between market microstructure and price discovery to better understand trading efficiency and market transparency.

Why it is important

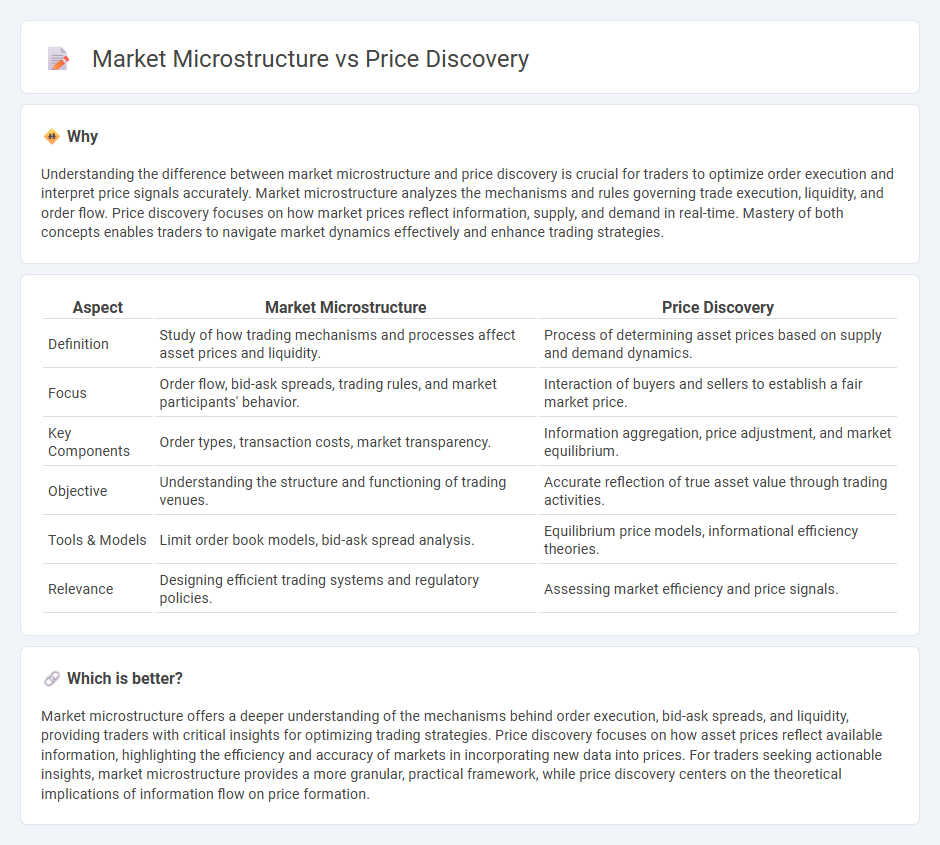

Understanding the difference between market microstructure and price discovery is crucial for traders to optimize order execution and interpret price signals accurately. Market microstructure analyzes the mechanisms and rules governing trade execution, liquidity, and order flow. Price discovery focuses on how market prices reflect information, supply, and demand in real-time. Mastery of both concepts enables traders to navigate market dynamics effectively and enhance trading strategies.

Comparison Table

| Aspect | Market Microstructure | Price Discovery |

|---|---|---|

| Definition | Study of how trading mechanisms and processes affect asset prices and liquidity. | Process of determining asset prices based on supply and demand dynamics. |

| Focus | Order flow, bid-ask spreads, trading rules, and market participants' behavior. | Interaction of buyers and sellers to establish a fair market price. |

| Key Components | Order types, transaction costs, market transparency. | Information aggregation, price adjustment, and market equilibrium. |

| Objective | Understanding the structure and functioning of trading venues. | Accurate reflection of true asset value through trading activities. |

| Tools & Models | Limit order book models, bid-ask spread analysis. | Equilibrium price models, informational efficiency theories. |

| Relevance | Designing efficient trading systems and regulatory policies. | Assessing market efficiency and price signals. |

Which is better?

Market microstructure offers a deeper understanding of the mechanisms behind order execution, bid-ask spreads, and liquidity, providing traders with critical insights for optimizing trading strategies. Price discovery focuses on how asset prices reflect available information, highlighting the efficiency and accuracy of markets in incorporating new data into prices. For traders seeking actionable insights, market microstructure provides a more granular, practical framework, while price discovery centers on the theoretical implications of information flow on price formation.

Connection

Market microstructure, which studies the processes and mechanisms of trading, directly influences price discovery by determining how information is incorporated into asset prices through order flow and liquidity. The interaction of buyers and sellers within various market structures impacts the bid-ask spread, transaction costs, and the speed at which prices adjust to new information. Efficient price discovery depends on transparent and liquid markets where microstructural elements facilitate accurate reflection of supply and demand dynamics.

Key Terms

**Price Discovery:**

Price discovery refers to the process through which markets determine the price of an asset based on supply, demand, and available information. It plays a crucial role in efficient markets by reflecting all pertinent data into the asset's price, allowing investors to make informed decisions. Explore deeper insights into price discovery mechanisms and their impact on market efficiency.

Bid-Ask Spread

Price discovery refers to the process through which markets determine the fair value of an asset based on supply and demand dynamics, while market microstructure studies the mechanisms that facilitate trading, including order flow and bid-ask spreads. The bid-ask spread serves as a key indicator in market microstructure, reflecting transaction costs, liquidity, and information asymmetry between buyers and sellers. Explore more to understand how bid-ask spreads influence price efficiency and trading strategies.

Order Flow

Price discovery involves the process through which markets determine the equilibrium price of assets based on supply and demand dynamics, while market microstructure examines the detailed mechanisms and rules that facilitate trading. Order flow, representing the stream of buy and sell orders, plays a crucial role in both by affecting liquidity, transaction costs, and price formation efficiency. Explore more insights on how order flow integrates within price discovery and market microstructure to enhance trading strategies and market analysis.

Source and External Links

Price discovery - Wikipedia - Price discovery is the process of determining the price of an asset in the marketplace through interactions of buyers and sellers, involving factors like market mechanisms, available information, and risk management choices.

Price Discovery - CME Group - Price discovery refers to finding a common price for an asset via buyer-seller interactions, especially transparent and efficient in futures markets where bid/ask prices update instantly worldwide.

Price Discovery in Cryptocurrency Markets - Price discovery varies across exchanges and time for cryptocurrencies, with more integrated markets sharing price shocks across exchanges, while segmented markets show divergent price formation.

dowidth.com

dowidth.com