Liquidity sweeps involve executing large trades across multiple public exchanges to quickly access available liquidity without significantly impacting market prices, while dark pools are private trading venues where large orders occur anonymously to prevent market disruption. Both strategies aim to optimize trade execution by minimizing market impact and information leakage. Explore more insights to understand how these mechanisms influence advanced trading strategies.

Why it is important

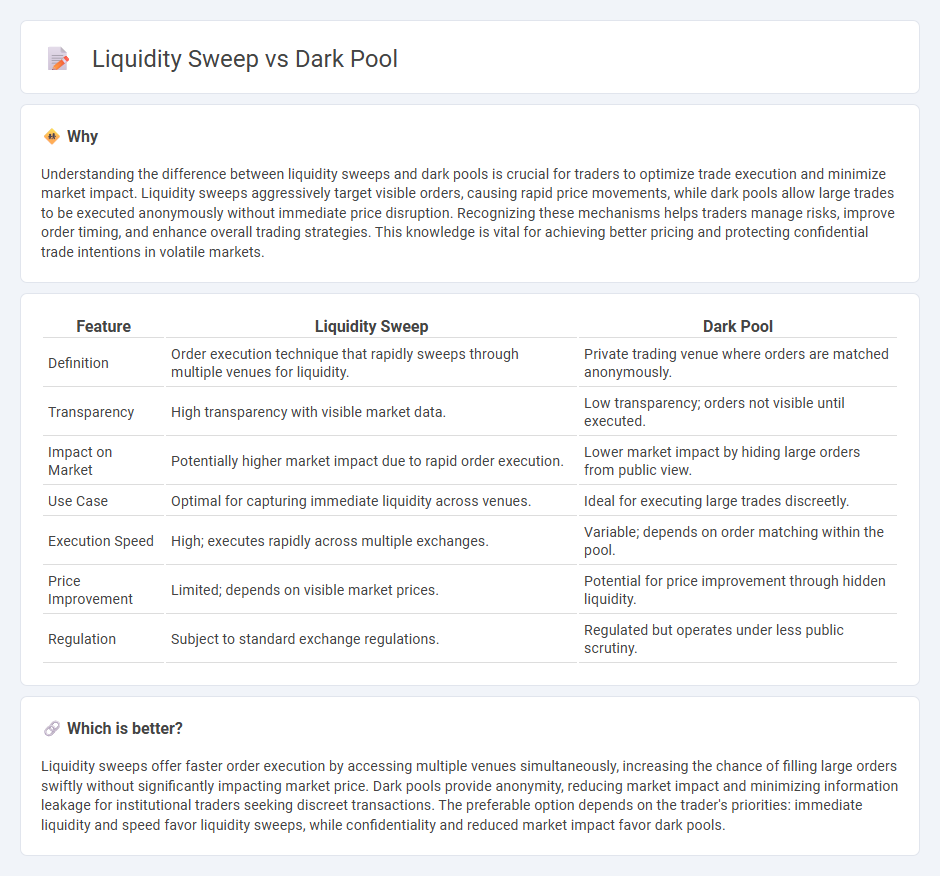

Understanding the difference between liquidity sweeps and dark pools is crucial for traders to optimize trade execution and minimize market impact. Liquidity sweeps aggressively target visible orders, causing rapid price movements, while dark pools allow large trades to be executed anonymously without immediate price disruption. Recognizing these mechanisms helps traders manage risks, improve order timing, and enhance overall trading strategies. This knowledge is vital for achieving better pricing and protecting confidential trade intentions in volatile markets.

Comparison Table

| Feature | Liquidity Sweep | Dark Pool |

|---|---|---|

| Definition | Order execution technique that rapidly sweeps through multiple venues for liquidity. | Private trading venue where orders are matched anonymously. |

| Transparency | High transparency with visible market data. | Low transparency; orders not visible until executed. |

| Impact on Market | Potentially higher market impact due to rapid order execution. | Lower market impact by hiding large orders from public view. |

| Use Case | Optimal for capturing immediate liquidity across venues. | Ideal for executing large trades discreetly. |

| Execution Speed | High; executes rapidly across multiple exchanges. | Variable; depends on order matching within the pool. |

| Price Improvement | Limited; depends on visible market prices. | Potential for price improvement through hidden liquidity. |

| Regulation | Subject to standard exchange regulations. | Regulated but operates under less public scrutiny. |

Which is better?

Liquidity sweeps offer faster order execution by accessing multiple venues simultaneously, increasing the chance of filling large orders swiftly without significantly impacting market price. Dark pools provide anonymity, reducing market impact and minimizing information leakage for institutional traders seeking discreet transactions. The preferable option depends on the trader's priorities: immediate liquidity and speed favor liquidity sweeps, while confidentiality and reduced market impact favor dark pools.

Connection

Liquidity sweeps involve rapidly executing large orders by accessing multiple trading venues, including dark pools, to minimize market impact and slippage. Dark pools provide a private trading environment where large liquidity can be accessed anonymously, making them essential for executing liquidity sweeps efficiently. Using dark pools in liquidity sweeps helps traders reduce information leakage and achieve better pricing in high-volume trades.

Key Terms

Order Execution

Dark pools are private trading venues where large blocks of securities are executed anonymously to minimize market impact and preserve order confidentiality. Liquidity sweeps involve rapidly executing orders across multiple venues, including dark pools, to access fragmented liquidity and achieve best possible fills. Explore detailed strategies and technology solutions to optimize order execution between dark pools and liquidity sweeps.

Market Transparency

Dark pools are private exchanges where large institutional investors trade securities without revealing their intentions to the public, reducing market transparency. Liquidity sweeps involve aggressive order execution strategies that quickly consume available liquidity across multiple venues, often impacting price discovery and market transparency. Discover more about how these mechanisms influence trading dynamics and regulatory considerations.

Price Discovery

Dark pools enable large institutional investors to trade sizable blocks of shares anonymously, minimizing market impact and preserving price discovery efficiency by reducing information leakage. Liquidity sweeps aggressively target hidden and displayed liquidity across multiple venues to execute large orders quickly, potentially causing short-term price distortions but enhancing price transparency over time. Explore how these trading mechanisms influence market dynamics and price discovery in detail.

Source and External Links

Dark Pool - Overview, How It Works, Pros and Cons - A dark pool is a privately organized financial exchange where large block trades can be made anonymously, allowing institutional investors to trade without public exposure until after execution, thus avoiding market impact.

Can You Swim in a Dark Pool? | FINRA.org - Dark pools are alternative trading systems designed mainly for large institutional trades to occur anonymously and avoid large market swings, with trade data disclosed only after execution.

Dark pool - Wikipedia - Dark pools are private forums for trading securities that provide institutional investors with anonymity to trade large blocks without revealing orders in advance, but their opaque nature can reduce market transparency and efficiency.

dowidth.com

dowidth.com