Trading on modular blockchains enhances scalability and customization by separating consensus, execution, and data availability layers, improving transaction speed and security. Liquidity pools aggregate users' assets to facilitate decentralized trading with reduced slippage and continuous market making. Explore the detailed benefits and mechanisms behind modular blockchain trading and liquidity pools to optimize your trading strategy.

Why it is important

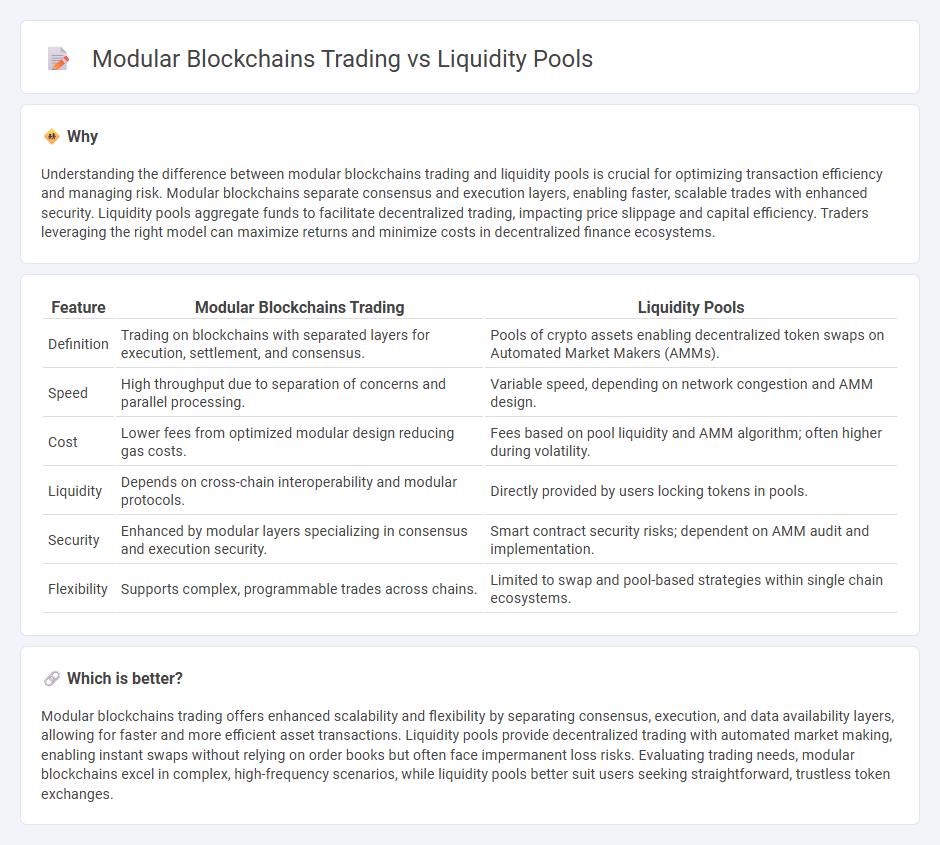

Understanding the difference between modular blockchains trading and liquidity pools is crucial for optimizing transaction efficiency and managing risk. Modular blockchains separate consensus and execution layers, enabling faster, scalable trades with enhanced security. Liquidity pools aggregate funds to facilitate decentralized trading, impacting price slippage and capital efficiency. Traders leveraging the right model can maximize returns and minimize costs in decentralized finance ecosystems.

Comparison Table

| Feature | Modular Blockchains Trading | Liquidity Pools |

|---|---|---|

| Definition | Trading on blockchains with separated layers for execution, settlement, and consensus. | Pools of crypto assets enabling decentralized token swaps on Automated Market Makers (AMMs). |

| Speed | High throughput due to separation of concerns and parallel processing. | Variable speed, depending on network congestion and AMM design. |

| Cost | Lower fees from optimized modular design reducing gas costs. | Fees based on pool liquidity and AMM algorithm; often higher during volatility. |

| Liquidity | Depends on cross-chain interoperability and modular protocols. | Directly provided by users locking tokens in pools. |

| Security | Enhanced by modular layers specializing in consensus and execution security. | Smart contract security risks; dependent on AMM audit and implementation. |

| Flexibility | Supports complex, programmable trades across chains. | Limited to swap and pool-based strategies within single chain ecosystems. |

Which is better?

Modular blockchains trading offers enhanced scalability and flexibility by separating consensus, execution, and data availability layers, allowing for faster and more efficient asset transactions. Liquidity pools provide decentralized trading with automated market making, enabling instant swaps without relying on order books but often face impermanent loss risks. Evaluating trading needs, modular blockchains excel in complex, high-frequency scenarios, while liquidity pools better suit users seeking straightforward, trustless token exchanges.

Connection

Modular blockchains enhance trading efficiency by separating consensus and execution layers, enabling faster transaction processing and scalability crucial for liquidity pools. Liquidity pools depend on these blockchains to provide seamless asset swaps and maintain continuous market depth without relying on traditional order books. This integration reduces slippage and boosts decentralized finance (DeFi) trading volumes by optimizing resource allocation across interconnected blockchain modules.

Key Terms

Automated Market Maker (AMM)

Liquidity pools in Automated Market Makers (AMMs) enable decentralized trading by using pooled tokens to facilitate seamless asset swaps without relying on traditional order books, providing enhanced liquidity and reduced slippage. Modular blockchains improve on scalability and customization by separating consensus, execution, and data availability layers, optimizing AMM operations for faster transaction finality and lower fees. Explore how integrating AMMs in modular blockchain architectures revolutionizes decentralized finance and trading efficiency.

Interoperability

Liquidity pools enhance interoperability by enabling seamless asset swaps across decentralized exchanges without centralized intermediaries, thereby increasing trading efficiency and liquidity depth. Modular blockchains prioritize interoperability by separating consensus, execution, and data availability layers, allowing specialized chains to interact and share information securely and quickly. Explore how these technologies redefine cross-chain transactions and foster a connected blockchain ecosystem.

Cross-chain Swaps

Liquidity pools enhance decentralized trading by providing continuous asset availability through smart contracts, enabling seamless token swaps without traditional order books. Modular blockchains optimize cross-chain swaps by segregating consensus, execution, and data availability layers, allowing efficient interoperability and scalability across diverse blockchain ecosystems. Explore how these innovative mechanisms transform cross-chain swap efficiency and security in decentralized finance.

Source and External Links

Liquidity Pools Explained: How They Work, Key Risks & ... - Liquidity pools are collections of cryptocurrency tokens locked in smart contracts that facilitate decentralized trading by anyone who can provide liquidity, earning fees and potentially yield farming rewards, with various types like traditional, stablecoin, and concentrated liquidity pools existing to suit different needs.

Liquidity Pools for Beginners: DeFi 101 - Liquidity pools enable decentralized and efficient trading in DeFi by allowing users to deposit token pairs and earn fees when others trade against the pool, making financial markets more inclusive and providing passive income opportunities.

The role of liquidity pools in cryptocurrency markets - Liquidity pools support decentralized exchanges by using smart contracts to pool assets from users for seamless trading, removing intermediaries and order books, while offering rewards and risks such as impermanent loss.

dowidth.com

dowidth.com