Dark pool activity involves trading large blocks of securities privately to minimize market impact and maintain anonymity, contrasting with lit exchange trading where orders are transparent and accessible to all market participants. Dark pools offer institutional investors the ability to execute substantial trades without revealing their intentions, potentially avoiding price swings common in lit markets. Discover the key differences and benefits between dark pools and lit exchanges to optimize your trading strategies.

Why it is important

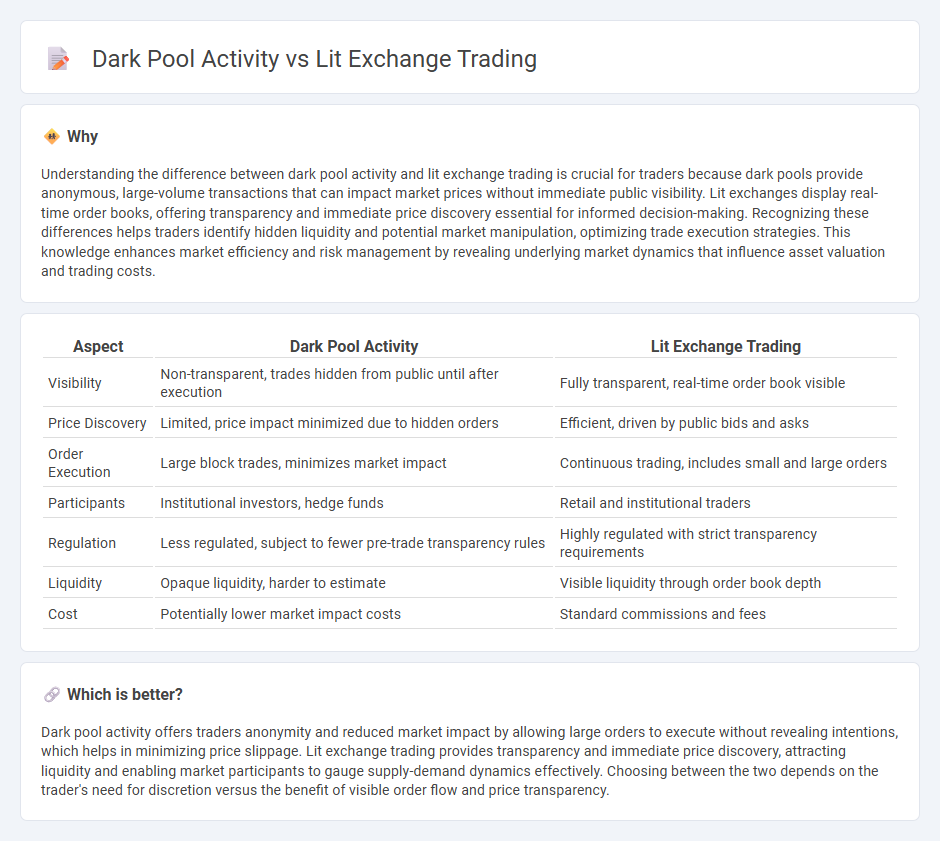

Understanding the difference between dark pool activity and lit exchange trading is crucial for traders because dark pools provide anonymous, large-volume transactions that can impact market prices without immediate public visibility. Lit exchanges display real-time order books, offering transparency and immediate price discovery essential for informed decision-making. Recognizing these differences helps traders identify hidden liquidity and potential market manipulation, optimizing trade execution strategies. This knowledge enhances market efficiency and risk management by revealing underlying market dynamics that influence asset valuation and trading costs.

Comparison Table

| Aspect | Dark Pool Activity | Lit Exchange Trading |

|---|---|---|

| Visibility | Non-transparent, trades hidden from public until after execution | Fully transparent, real-time order book visible |

| Price Discovery | Limited, price impact minimized due to hidden orders | Efficient, driven by public bids and asks |

| Order Execution | Large block trades, minimizes market impact | Continuous trading, includes small and large orders |

| Participants | Institutional investors, hedge funds | Retail and institutional traders |

| Regulation | Less regulated, subject to fewer pre-trade transparency rules | Highly regulated with strict transparency requirements |

| Liquidity | Opaque liquidity, harder to estimate | Visible liquidity through order book depth |

| Cost | Potentially lower market impact costs | Standard commissions and fees |

Which is better?

Dark pool activity offers traders anonymity and reduced market impact by allowing large orders to execute without revealing intentions, which helps in minimizing price slippage. Lit exchange trading provides transparency and immediate price discovery, attracting liquidity and enabling market participants to gauge supply-demand dynamics effectively. Choosing between the two depends on the trader's need for discretion versus the benefit of visible order flow and price transparency.

Connection

Dark pool activity and lit exchange trading are interconnected through the flow of market liquidity, with dark pools providing a venue for large institutional orders to execute without revealing their intentions, thereby minimizing market impact. Trades executed in dark pools can influence price discovery and volatility on lit exchanges, as the hidden transactions eventually affect supply and demand dynamics when orders become visible. Regulatory frameworks and advanced algorithms continuously monitor and bridge these trading environments to ensure transparency and market efficiency.

Key Terms

Transparency

Lit exchanges prioritize transparency by publicly displaying real-time order books and trade information, enabling investors to make informed decisions based on visible market depth and price movements. Dark pools operate with limited transparency, executing large block trades away from public view to minimize market impact and preserve anonymity. Explore more to understand how transparency impacts trading strategies and market dynamics in both venues.

Order Book

Lit exchange trading offers transparent order book visibility, allowing market participants to see real-time bids, asks, and depth of market, which facilitates price discovery and market efficiency. Dark pool activity, by contrast, hides order book details, enabling large traders to execute sizable trades anonymously, reducing market impact and minimizing price slippage. Discover more about how order book dynamics influence trading strategies across lit exchanges and dark pools.

Market Impact

Lit exchange trading involves public order books where trade sizes and prices are visible, leading to higher market impact due to transparent liquidity and immediate execution. Dark pool activity occurs in private trading venues that conceal order details, minimizing market impact by preventing price movements caused by large trades. Explore further to understand how market impact varies between these trading environments and influences execution strategies.

Source and External Links

Dark Pool vs. Lit Exchange: Transparency Trade-Offs - A lit exchange is a public, regulated trading venue with full transparency, allowing all participants to see the order book and facilitating real-time price discovery and fair market pricing.

Lit pool - Wikipedia - Lit pools, or lit markets, are stock exchanges where bids and offers are publicly displayed, making them the opposite of dark pools and accounting for about 70% of trades due to their transparency.

Lit pool: Explained - TIOmarkets - Lit pools provide transparency and price discovery benefits but also carry risks like price slippage and information leakage, as all trading activity and order books are publicly visible.

dowidth.com

dowidth.com