Airdrop farming involves strategically participating in cryptocurrency airdrops to acquire free tokens as a form of passive income, leveraging network incentives and new project launches. Grid trading automates buy and sell orders within a set price range, capitalizing on market volatility to generate consistent profits through systematic asset management. Explore the detailed comparison and choose the best strategy suited for your trading goals.

Why it is important

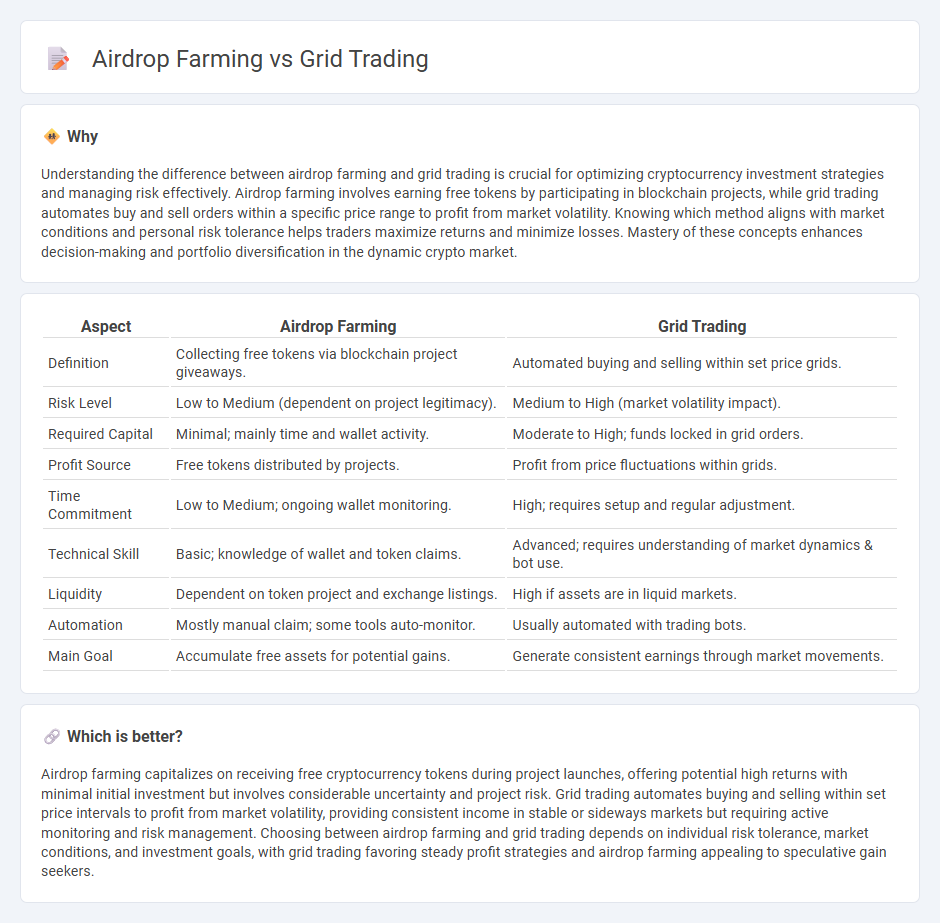

Understanding the difference between airdrop farming and grid trading is crucial for optimizing cryptocurrency investment strategies and managing risk effectively. Airdrop farming involves earning free tokens by participating in blockchain projects, while grid trading automates buy and sell orders within a specific price range to profit from market volatility. Knowing which method aligns with market conditions and personal risk tolerance helps traders maximize returns and minimize losses. Mastery of these concepts enhances decision-making and portfolio diversification in the dynamic crypto market.

Comparison Table

| Aspect | Airdrop Farming | Grid Trading |

|---|---|---|

| Definition | Collecting free tokens via blockchain project giveaways. | Automated buying and selling within set price grids. |

| Risk Level | Low to Medium (dependent on project legitimacy). | Medium to High (market volatility impact). |

| Required Capital | Minimal; mainly time and wallet activity. | Moderate to High; funds locked in grid orders. |

| Profit Source | Free tokens distributed by projects. | Profit from price fluctuations within grids. |

| Time Commitment | Low to Medium; ongoing wallet monitoring. | High; requires setup and regular adjustment. |

| Technical Skill | Basic; knowledge of wallet and token claims. | Advanced; requires understanding of market dynamics & bot use. |

| Liquidity | Dependent on token project and exchange listings. | High if assets are in liquid markets. |

| Automation | Mostly manual claim; some tools auto-monitor. | Usually automated with trading bots. |

| Main Goal | Accumulate free assets for potential gains. | Generate consistent earnings through market movements. |

Which is better?

Airdrop farming capitalizes on receiving free cryptocurrency tokens during project launches, offering potential high returns with minimal initial investment but involves considerable uncertainty and project risk. Grid trading automates buying and selling within set price intervals to profit from market volatility, providing consistent income in stable or sideways markets but requiring active monitoring and risk management. Choosing between airdrop farming and grid trading depends on individual risk tolerance, market conditions, and investment goals, with grid trading favoring steady profit strategies and airdrop farming appealing to speculative gain seekers.

Connection

Airdrop farming leverages multiple crypto holdings to maximize eligibility for token distributions, often increasing portfolio diversification essential for effective grid trading strategies. Grid trading optimizes profit by setting buy and sell orders at predefined intervals, which benefits from the increased asset variety provided by airdrop farming. Combining both strategies enhances opportunities for passive income and risk management within volatile cryptocurrency markets.

Key Terms

**Grid Trading:**

Grid trading is an automated strategy that places buy and sell orders at preset intervals within a defined price range to capitalize on market volatility. It optimizes profit by systematically buying low and selling high without requiring constant market monitoring, making it ideal for sideways markets. Explore in-depth techniques and tools to maximize returns from grid trading strategies.

Price Range

Grid trading relies on setting predefined price ranges to execute buy and sell orders systematically, capitalizing on market volatility within those ranges. Airdrop farming depends less on price fluctuations and more on project participation, with limited emphasis on specific price intervals for earning tokens. Explore detailed strategies to optimize your gains in both grid trading and airdrop farming.

Limit Orders

Grid trading leverages limit orders to strategically place buy and sell orders at predefined price levels, capturing profits from market fluctuations while minimizing risk exposure. Airdrop farming, in contrast, typically involves holding tokens or meeting specific platform criteria without the targeted price-level execution characteristic of limit orders. Explore detailed strategies and benefits of each method to enhance your trading efficiency and passive income.

Source and External Links

A Primer on Grid Trading Strategy - QuantPedia - Grid trading is an automated strategy where an investor creates a "price grid" of buy and sell orders at set price intervals, aiming to profit from price fluctuations by buying low and selling high repeatedly within a defined price range based on historical volatility.

Grid trading - OctoBot Cloud - Grid trading involves placing multiple buy and sell orders at fixed price intervals, creating a grid that capitalizes on market volatility to gain profit from the difference between buying and selling without needing to forecast price trends.

What is Grid Trading? A Smart Strategy for Market Volatility - Axiory - Grid trading is mostly an automated system placing buy/sell orders at predefined intervals within a price range, aiming to profit from price oscillations across various asset classes without predicting market direction, but it carries significant risk if the market trends strongly.

dowidth.com

dowidth.com