Tokenized assets represent fractional ownership of real-world assets on a blockchain, offering increased liquidity and transparency compared to traditional instruments. Options are derivative contracts giving traders the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain timeframe. Explore the advantages and applications of tokenized assets versus options to enhance your trading strategies.

Why it is important

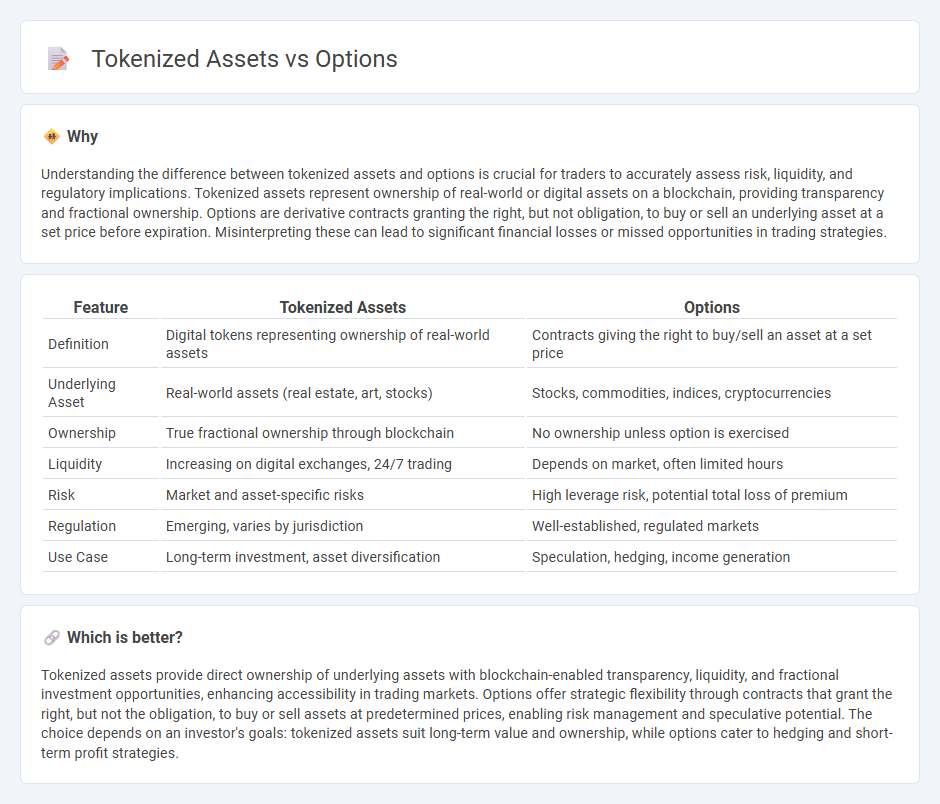

Understanding the difference between tokenized assets and options is crucial for traders to accurately assess risk, liquidity, and regulatory implications. Tokenized assets represent ownership of real-world or digital assets on a blockchain, providing transparency and fractional ownership. Options are derivative contracts granting the right, but not obligation, to buy or sell an underlying asset at a set price before expiration. Misinterpreting these can lead to significant financial losses or missed opportunities in trading strategies.

Comparison Table

| Feature | Tokenized Assets | Options |

|---|---|---|

| Definition | Digital tokens representing ownership of real-world assets | Contracts giving the right to buy/sell an asset at a set price |

| Underlying Asset | Real-world assets (real estate, art, stocks) | Stocks, commodities, indices, cryptocurrencies |

| Ownership | True fractional ownership through blockchain | No ownership unless option is exercised |

| Liquidity | Increasing on digital exchanges, 24/7 trading | Depends on market, often limited hours |

| Risk | Market and asset-specific risks | High leverage risk, potential total loss of premium |

| Regulation | Emerging, varies by jurisdiction | Well-established, regulated markets |

| Use Case | Long-term investment, asset diversification | Speculation, hedging, income generation |

Which is better?

Tokenized assets provide direct ownership of underlying assets with blockchain-enabled transparency, liquidity, and fractional investment opportunities, enhancing accessibility in trading markets. Options offer strategic flexibility through contracts that grant the right, but not the obligation, to buy or sell assets at predetermined prices, enabling risk management and speculative potential. The choice depends on an investor's goals: tokenized assets suit long-term value and ownership, while options cater to hedging and short-term profit strategies.

Connection

Tokenized assets enable fractional ownership and increased liquidity by representing real-world assets on blockchain platforms, while options provide financial derivatives allowing traders to hedge risks or speculate on future price movements of these tokenized assets. Integrating options with tokenized assets enhances market depth and offers versatile investment strategies by combining the transparency of blockchain with traditional options trading mechanisms. This synergy attracts institutional and retail investors seeking diversified risk management tools and improved access to alternative asset classes.

Key Terms

Derivatives

Options represent derivatives that grant the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before expiration, making them a flexible risk management tool. Tokenized assets transform traditional assets into digital tokens on a blockchain, enabling fractional ownership, enhanced liquidity, and streamlined transactions in derivative markets. Explore how integrating options and tokenized assets revolutionizes modern derivatives trading platforms and strategies.

Smart Contracts

Options represent financial derivatives granting the right to buy or sell an asset at a predetermined price, while tokenized assets convert real-world assets into blockchain-based tokens, enabling fractional ownership and enhanced liquidity. Smart contracts automate option exercises and settlements through predefined conditions, whereas in tokenized assets, they manage ownership records, transfers, and compliance protocols on-chain. Explore how smart contracts revolutionize the management of options and tokenized assets by visiting our in-depth analysis.

Liquidity

Options provide flexible trading strategies but often face limited liquidity due to expiration dates and strike prices, restricting market participation. Tokenized assets, leveraging blockchain technology, enhance liquidity by enabling fractional ownership and 24/7 trading on decentralized platforms. Explore how these innovations transform market accessibility and liquidity in modern finance.

Source and External Links

Options | FINRA.org - Options are contracts giving the buyer the right, but not the obligation, to buy or sell an asset at a set price within a timeframe; they come mainly in two types: calls (right to buy) and puts (right to sell) and are used for managing risk or income in investment portfolios.

Option (finance) - Options are derivative contracts traded on exchanges or over-the-counter, allowing holders to buy or sell an underlying asset under standardized or customizable terms, with exchange-traded options being more regulated and OTC options tailored to specific needs.

Options: Calls and Puts - Calls allow investors to buy the underlying asset at the strike price, anticipating a price increase, while puts allow selling the asset at the strike price, anticipating a price decrease; buyers pay a premium and can exercise their rights depending on American or European style contracts.

dowidth.com

dowidth.com