Front running involves executing trades based on advance knowledge of pending orders to capitalize on anticipated price movements, often seen in high-frequency trading environments. Tape reading focuses on analyzing real-time order flow and price action from the time and sales data to make informed trading decisions. Explore deeper insights into these strategies to enhance your trading edge.

Why it is important

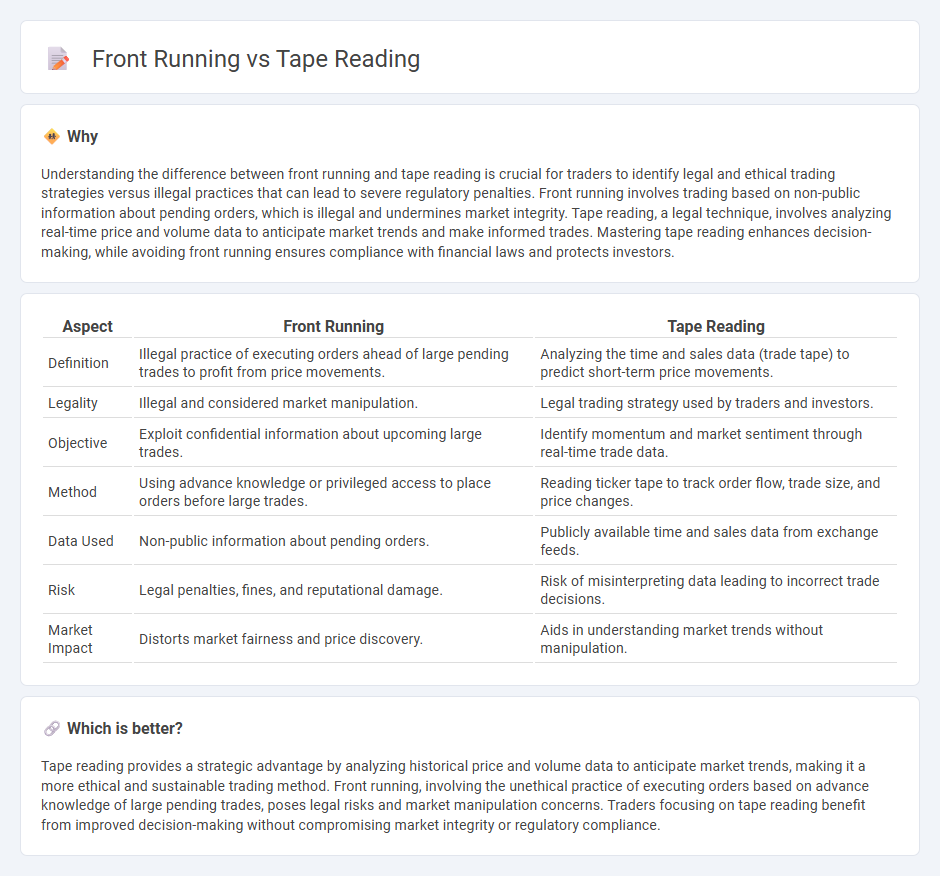

Understanding the difference between front running and tape reading is crucial for traders to identify legal and ethical trading strategies versus illegal practices that can lead to severe regulatory penalties. Front running involves trading based on non-public information about pending orders, which is illegal and undermines market integrity. Tape reading, a legal technique, involves analyzing real-time price and volume data to anticipate market trends and make informed trades. Mastering tape reading enhances decision-making, while avoiding front running ensures compliance with financial laws and protects investors.

Comparison Table

| Aspect | Front Running | Tape Reading |

|---|---|---|

| Definition | Illegal practice of executing orders ahead of large pending trades to profit from price movements. | Analyzing the time and sales data (trade tape) to predict short-term price movements. |

| Legality | Illegal and considered market manipulation. | Legal trading strategy used by traders and investors. |

| Objective | Exploit confidential information about upcoming large trades. | Identify momentum and market sentiment through real-time trade data. |

| Method | Using advance knowledge or privileged access to place orders before large trades. | Reading ticker tape to track order flow, trade size, and price changes. |

| Data Used | Non-public information about pending orders. | Publicly available time and sales data from exchange feeds. |

| Risk | Legal penalties, fines, and reputational damage. | Risk of misinterpreting data leading to incorrect trade decisions. |

| Market Impact | Distorts market fairness and price discovery. | Aids in understanding market trends without manipulation. |

Which is better?

Tape reading provides a strategic advantage by analyzing historical price and volume data to anticipate market trends, making it a more ethical and sustainable trading method. Front running, involving the unethical practice of executing orders based on advance knowledge of large pending trades, poses legal risks and market manipulation concerns. Traders focusing on tape reading benefit from improved decision-making without compromising market integrity or regulatory compliance.

Connection

Front running and tape reading are connected through their reliance on market order flow information to gain a trading advantage. Tape reading involves analyzing the time and sales data to interpret real-time buying and selling pressure, which front runners exploit by placing orders ahead of anticipated large trades. Both strategies aim to predict market movements by monitoring the sequence and volume of executed trades, enhancing the probability of profitable positions.

Key Terms

**Tape Reading:**

Tape reading involves analyzing real-time price and volume data from stock market transactions to gauge market sentiment and anticipate short-term price movements. Traders use Level II quotes, time and sales data, and order flow patterns to interpret supply and demand dynamics. Explore further to understand how tape reading sharpens trading decisions in fast-paced markets.

Time and Sales

Tape reading involves analyzing real-time Time and Sales data to gauge market sentiment and predict short-term price movements by observing the flow of actual trades. Front running, considered an unethical practice, exploits non-public knowledge of large pending orders to execute trades ahead, often bypassing Time and Sales transparency. Explore the intricacies of Time and Sales to better understand how these trading tactics impact market efficiency and investor decisions.

Order Flow

Tape reading analyzes historical and real-time order flow to identify buying and selling pressure, capturing the market's pulse through price, volume, and time data. Front running involves anticipating and exploiting large upcoming orders by accessing or predicting order flow before public execution, often raising ethical and legal concerns. Discover more about how mastering order flow can enhance trading strategies in both tape reading and front running.

Source and External Links

What Is Tape Reading and How Does It Work - Earn2Trade Blog - Tape reading is a traditional technique that analyzes price and volume data by capturing the flow of trades to identify support and resistance levels, but it must be complemented with other analysis tools for full market insight.

What is Tape Reading Today? - Bookmap - Tape reading today refers to analyzing real-time Time & Sales data showing transaction price, volume, and time to understand order flow, though it provides only part of the market picture without order book and liquidity depth.

Level 2 Trading Secrets (How to Read the Tape Using Time & Sales) - Tape reading involves interpreting Time & Sales data (the "tape") combined with Level 2 order book information to gauge price action, bid-ask dynamics, and trader behavior for better intraday trading decisions.

dowidth.com

dowidth.com