Paper trading competitions offer a risk-free environment for traders to practice and refine strategies using simulated market data, enhancing skill development without financial loss. Trading hackathons focus on collaborative innovation, where participants build and test algorithmic trading solutions under time constraints, fostering creativity and technical expertise. Explore more to understand which format aligns best with your trading goals and skillset.

Why it is important

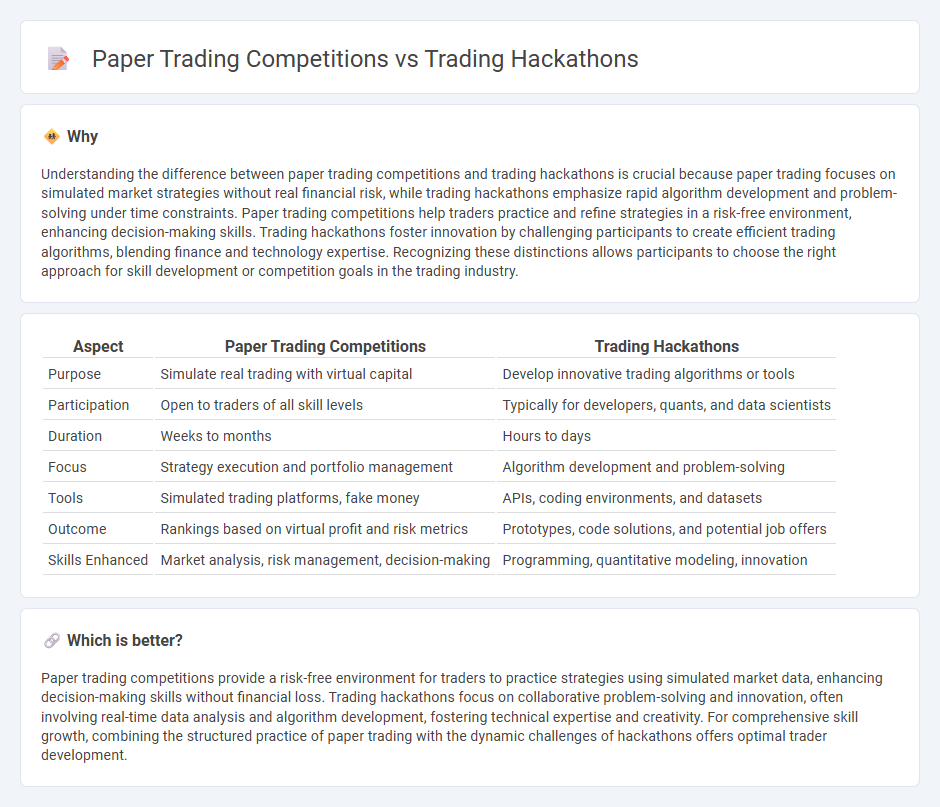

Understanding the difference between paper trading competitions and trading hackathons is crucial because paper trading focuses on simulated market strategies without real financial risk, while trading hackathons emphasize rapid algorithm development and problem-solving under time constraints. Paper trading competitions help traders practice and refine strategies in a risk-free environment, enhancing decision-making skills. Trading hackathons foster innovation by challenging participants to create efficient trading algorithms, blending finance and technology expertise. Recognizing these distinctions allows participants to choose the right approach for skill development or competition goals in the trading industry.

Comparison Table

| Aspect | Paper Trading Competitions | Trading Hackathons |

|---|---|---|

| Purpose | Simulate real trading with virtual capital | Develop innovative trading algorithms or tools |

| Participation | Open to traders of all skill levels | Typically for developers, quants, and data scientists |

| Duration | Weeks to months | Hours to days |

| Focus | Strategy execution and portfolio management | Algorithm development and problem-solving |

| Tools | Simulated trading platforms, fake money | APIs, coding environments, and datasets |

| Outcome | Rankings based on virtual profit and risk metrics | Prototypes, code solutions, and potential job offers |

| Skills Enhanced | Market analysis, risk management, decision-making | Programming, quantitative modeling, innovation |

Which is better?

Paper trading competitions provide a risk-free environment for traders to practice strategies using simulated market data, enhancing decision-making skills without financial loss. Trading hackathons focus on collaborative problem-solving and innovation, often involving real-time data analysis and algorithm development, fostering technical expertise and creativity. For comprehensive skill growth, combining the structured practice of paper trading with the dynamic challenges of hackathons offers optimal trader development.

Connection

Paper trading competitions and trading hackathons are connected through their focus on skill development and strategy testing within risk-free environments. Both platforms enable participants to simulate real market conditions using historical or live data to refine algorithms and decision-making processes without financial loss. This hands-on experience fosters innovation and sharpens trading acumen among professionals and enthusiasts alike.

Key Terms

Source and External Links

Algorithmic Trading Hackathon - LINC - An annual full-day hackathon at Lund University where students develop algorithmic trading strategies in Python, testing them in real-time against market dynamics with guidance from financial firm professionals.

Stock Hacks: Empower Finance, Ignite Idea - Devpost - A creative finance-focused hackathon inviting participants to build innovative trading, investment, or market analysis solutions with prize opportunities and judged on creativity, practicality, and effort.

Competitions - Optiver - Features global coding contests including algorithmic trading challenges like Ready Trader Go and data science competitions predicting stock market movements, open to various experience levels and offering monetary prizes.

dowidth.com

dowidth.com