Copy trading allows investors to replicate the trades of experienced traders in real-time, ensuring portfolio diversification without deep market analysis. Signal following relies on receiving trade alerts or recommendations based on technical indicators and market trends, offering a more hands-off approach but requiring timely execution. Explore the advantages and nuances of both strategies to optimize your trading performance.

Why it is important

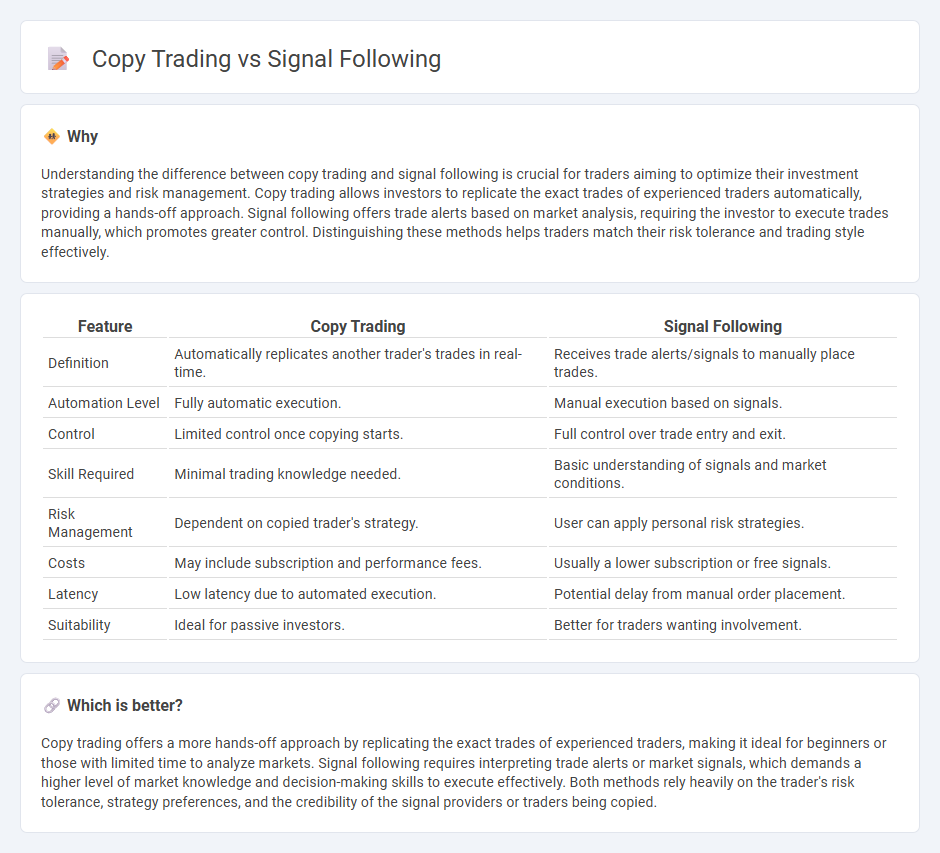

Understanding the difference between copy trading and signal following is crucial for traders aiming to optimize their investment strategies and risk management. Copy trading allows investors to replicate the exact trades of experienced traders automatically, providing a hands-off approach. Signal following offers trade alerts based on market analysis, requiring the investor to execute trades manually, which promotes greater control. Distinguishing these methods helps traders match their risk tolerance and trading style effectively.

Comparison Table

| Feature | Copy Trading | Signal Following |

|---|---|---|

| Definition | Automatically replicates another trader's trades in real-time. | Receives trade alerts/signals to manually place trades. |

| Automation Level | Fully automatic execution. | Manual execution based on signals. |

| Control | Limited control once copying starts. | Full control over trade entry and exit. |

| Skill Required | Minimal trading knowledge needed. | Basic understanding of signals and market conditions. |

| Risk Management | Dependent on copied trader's strategy. | User can apply personal risk strategies. |

| Costs | May include subscription and performance fees. | Usually a lower subscription or free signals. |

| Latency | Low latency due to automated execution. | Potential delay from manual order placement. |

| Suitability | Ideal for passive investors. | Better for traders wanting involvement. |

Which is better?

Copy trading offers a more hands-off approach by replicating the exact trades of experienced traders, making it ideal for beginners or those with limited time to analyze markets. Signal following requires interpreting trade alerts or market signals, which demands a higher level of market knowledge and decision-making skills to execute effectively. Both methods rely heavily on the trader's risk tolerance, strategy preferences, and the credibility of the signal providers or traders being copied.

Connection

Copy trading and signal following share a direct connection through their reliance on external trade insights to execute investment decisions. Both strategies enable traders to emulate the actions or recommendations of experienced investors or automated systems, reducing the need for personal market analysis. This relationship enhances accessibility and efficiency in trading by leveraging proven expertise and algorithm-generated signals.

Key Terms

Autotrading

Signal following involves receiving trade alerts from experts and executing orders manually, while copy trading automates the process by replicating the trades of chosen investors in real-time. Autotrading platforms integrate advanced algorithms and APIs to enable seamless trade execution based on predefined strategies, reducing emotional bias and improving speed. Discover more about optimizing your trading performance through autotrading solutions.

Strategy Provider

Signal following relies on receiving trade alerts from expert Strategy Providers who analyze market trends and execute well-reasoned entries and exits. Copy trading enables investors to automatically replicate the trades of selected Strategy Providers in real-time, ensuring consistent alignment with their strategies. Discover how choosing the right Strategy Provider can optimize your trading performance.

Trade Mirroring

Trade mirroring automates exact replication of trades from a lead trader's account to a follower's account, ensuring synchronized buying and selling actions. Signal following requires manual execution based on trade alerts, often leading to delayed responses and potential slippage. Explore trade mirroring to understand its precision and efficiency benefits.

Source and External Links

Signal Follower - YouTube - The Signal Follower measures the volume level at its location in a track or sampler effects chain and crafts an output signal from this volume input to automate parameters of chosen effects, typically used for modulation akin to side-chaining in audio production.

Signal (IPC) - Wikipedia - Signals are standardized asynchronous messages sent to running programs or threads to trigger specific behaviors such as interrupting, suspending, or terminating processes, commonly used in Unix and POSIX-compliant systems.

signal(7) - Linux manual page - man7.org - Signals in Linux are mechanisms for delivering asynchronous notifications to processes, which can install handlers to execute specific routines when particular signals are received, enabling inter-process communication and event handling.

dowidth.com

dowidth.com