Front running involves executing trades based on non-public information about pending orders to gain an unfair advantage, often considered illegal in regulated markets. Order anticipation strategies analyze market signals and order book data to predict large trades, aiming to capitalize on price movements without breaching regulations. Explore the nuances and legal distinctions between these trading tactics to enhance your market understanding.

Why it is important

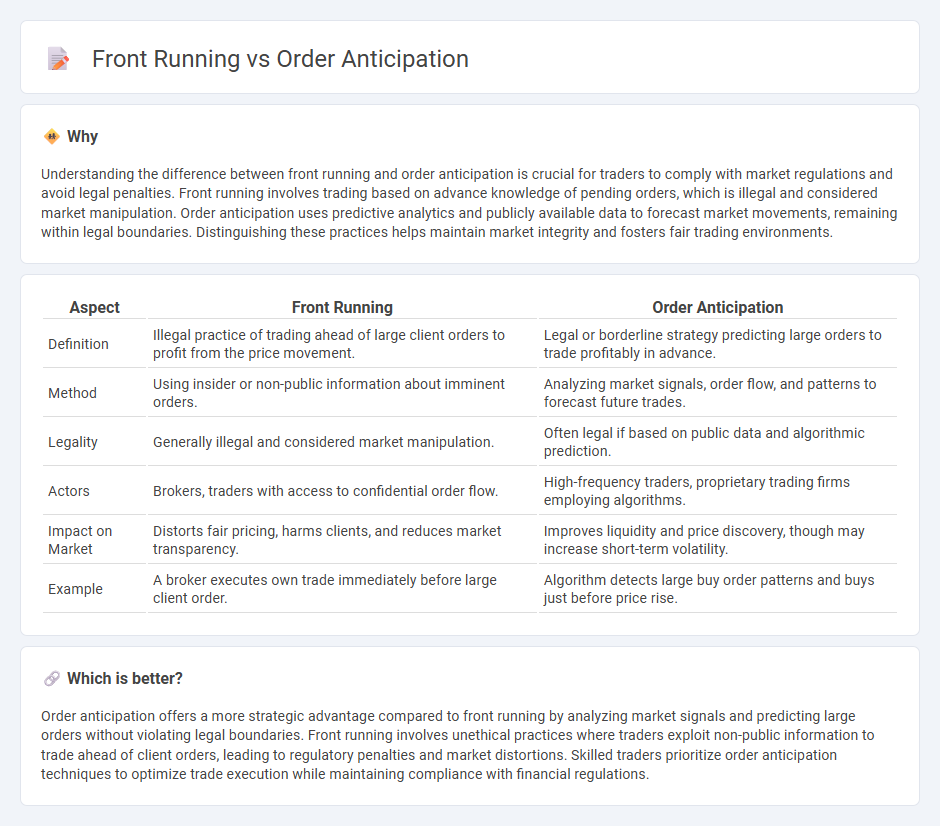

Understanding the difference between front running and order anticipation is crucial for traders to comply with market regulations and avoid legal penalties. Front running involves trading based on advance knowledge of pending orders, which is illegal and considered market manipulation. Order anticipation uses predictive analytics and publicly available data to forecast market movements, remaining within legal boundaries. Distinguishing these practices helps maintain market integrity and fosters fair trading environments.

Comparison Table

| Aspect | Front Running | Order Anticipation |

|---|---|---|

| Definition | Illegal practice of trading ahead of large client orders to profit from the price movement. | Legal or borderline strategy predicting large orders to trade profitably in advance. |

| Method | Using insider or non-public information about imminent orders. | Analyzing market signals, order flow, and patterns to forecast future trades. |

| Legality | Generally illegal and considered market manipulation. | Often legal if based on public data and algorithmic prediction. |

| Actors | Brokers, traders with access to confidential order flow. | High-frequency traders, proprietary trading firms employing algorithms. |

| Impact on Market | Distorts fair pricing, harms clients, and reduces market transparency. | Improves liquidity and price discovery, though may increase short-term volatility. |

| Example | A broker executes own trade immediately before large client order. | Algorithm detects large buy order patterns and buys just before price rise. |

Which is better?

Order anticipation offers a more strategic advantage compared to front running by analyzing market signals and predicting large orders without violating legal boundaries. Front running involves unethical practices where traders exploit non-public information to trade ahead of client orders, leading to regulatory penalties and market distortions. Skilled traders prioritize order anticipation techniques to optimize trade execution while maintaining compliance with financial regulations.

Connection

Front running and order anticipation both exploit non-public information about pending large trades to gain a market advantage. Front running involves executing orders ahead of suspicious clients to capture profits, while order anticipation predicts imminent trades through algorithmic analysis to strategically position orders. These practices manipulate market efficiency by leveraging timing and information asymmetry to benefit certain traders at the expense of others.

Key Terms

Insider Information

Order anticipation involves traders using non-public information about pending large orders to execute trades that profit from expected price movements, while front running refers to brokers or traders exploiting insider information about client orders before executing their own trades. Both practices exploit informational asymmetry, potentially leading to unfair market advantages and regulatory scrutiny. Explore further to understand the nuances and legal implications surrounding insider information in market trading.

Execution Priority

Order anticipation involves predicting and acting on large pending orders to secure favorable execution priority, whereas front running entails executing trades ahead of known orders to capitalize on expected price movements. Execution priority in order anticipation is based on timing and order size, while front running often exploits insider knowledge or latency advantages. Explore more to understand the legal implications and trading strategies behind these concepts.

Market Manipulation

Order anticipation and front running are two forms of market manipulation where traders exploit advance knowledge of large orders to gain unfair profit. Front running involves brokers or traders executing orders based on non-public information before client trades, while order anticipation uses algorithmic strategies to detect and pre-empt others' orders in high-frequency trading. Explore detailed insights on how regulatory bodies combat these manipulative trading practices.

Source and External Links

Order Anticipation around Predictable Trades - This paper studies order anticipation strategies by analyzing predictable patterns in large order trades, showing that stronger anticipation signals correlate with higher execution costs and that such activity is influenced by market structure changes like SEC regulations and noise trading.

Trading anonymity and order anticipation - This research finds that revealing broker identities enables order anticipation by signaling trader size, which impacts liquidity and execution costs, while full anonymity among traders improves market liquidity and reduces costs, especially for large traders.

Seeking and Hiding Fundamental Information in Order Flows - Describes order anticipation as "back-running," where strategic traders detect and exploit large institutional orders' information content, resulting in delayed price discovery and increased value of order flows, with institutional investors trying to disguise their trading patterns to avoid being anticipated.

dowidth.com

dowidth.com