Statistical arbitrage and pairs trading both leverage market inefficiencies by exploiting price relationships between securities, with statistical arbitrage utilizing complex quantitative models to identify mispricings across numerous assets and pairs trading focusing on the relative pricing between two correlated stocks. Statistical arbitrage employs advanced statistical techniques such as mean reversion, co-integration, and machine learning, while pairs trading typically involves selecting two historically correlated securities, monitoring their price ratio, and capitalizing when the spread deviates from its average. Explore further to understand how these strategies differ in execution, risk management, and market applicability.

Why it is important

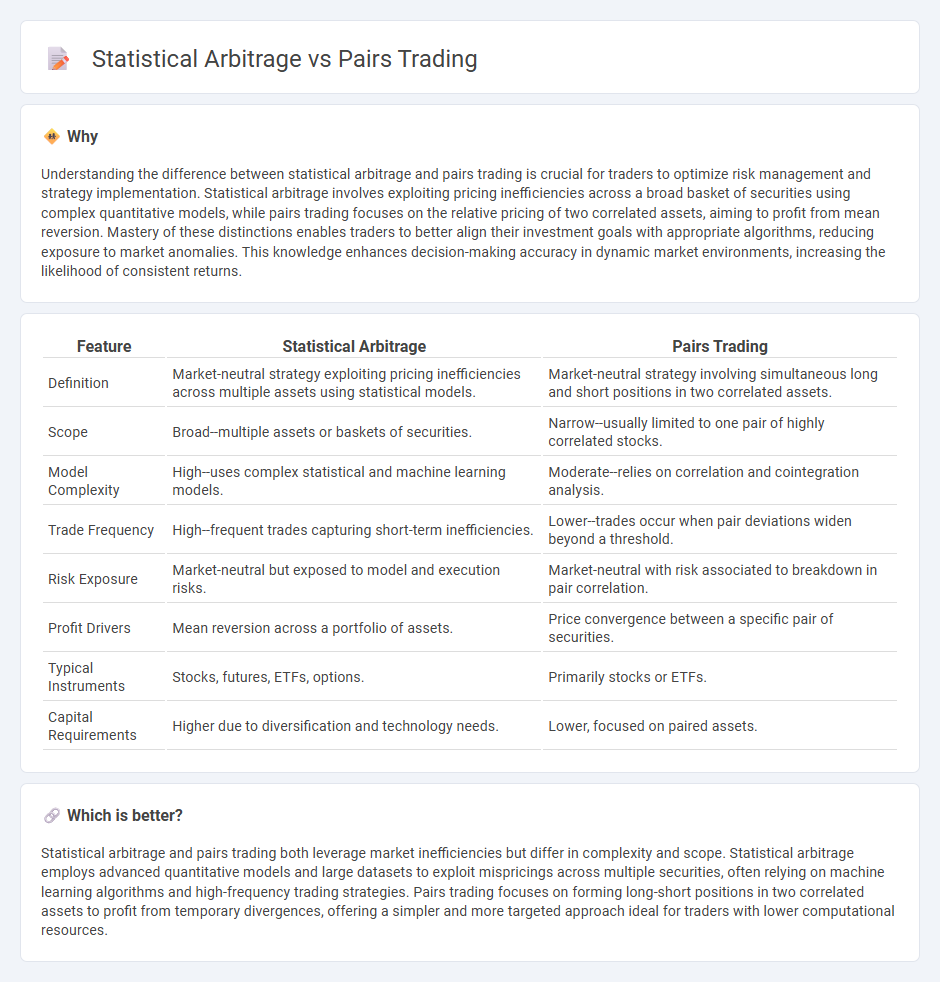

Understanding the difference between statistical arbitrage and pairs trading is crucial for traders to optimize risk management and strategy implementation. Statistical arbitrage involves exploiting pricing inefficiencies across a broad basket of securities using complex quantitative models, while pairs trading focuses on the relative pricing of two correlated assets, aiming to profit from mean reversion. Mastery of these distinctions enables traders to better align their investment goals with appropriate algorithms, reducing exposure to market anomalies. This knowledge enhances decision-making accuracy in dynamic market environments, increasing the likelihood of consistent returns.

Comparison Table

| Feature | Statistical Arbitrage | Pairs Trading |

|---|---|---|

| Definition | Market-neutral strategy exploiting pricing inefficiencies across multiple assets using statistical models. | Market-neutral strategy involving simultaneous long and short positions in two correlated assets. |

| Scope | Broad--multiple assets or baskets of securities. | Narrow--usually limited to one pair of highly correlated stocks. |

| Model Complexity | High--uses complex statistical and machine learning models. | Moderate--relies on correlation and cointegration analysis. |

| Trade Frequency | High--frequent trades capturing short-term inefficiencies. | Lower--trades occur when pair deviations widen beyond a threshold. |

| Risk Exposure | Market-neutral but exposed to model and execution risks. | Market-neutral with risk associated to breakdown in pair correlation. |

| Profit Drivers | Mean reversion across a portfolio of assets. | Price convergence between a specific pair of securities. |

| Typical Instruments | Stocks, futures, ETFs, options. | Primarily stocks or ETFs. |

| Capital Requirements | Higher due to diversification and technology needs. | Lower, focused on paired assets. |

Which is better?

Statistical arbitrage and pairs trading both leverage market inefficiencies but differ in complexity and scope. Statistical arbitrage employs advanced quantitative models and large datasets to exploit mispricings across multiple securities, often relying on machine learning algorithms and high-frequency trading strategies. Pairs trading focuses on forming long-short positions in two correlated assets to profit from temporary divergences, offering a simpler and more targeted approach ideal for traders with lower computational resources.

Connection

Statistical arbitrage relies on identifying price inefficiencies between related financial instruments, which directly underpins the strategy of pairs trading by exploiting correlated asset pairs with temporary price divergences. Both methods analyze historical price data and statistical relationships, using mean-reversion techniques to predict asset price convergence. Implementing pairs trading involves rigorous quantitative models to detect and capitalize on short-term mispricings within securities sharing strong statistical ties.

Key Terms

Cointegration

Pairs trading relies heavily on cointegration to identify statistically related asset pairs whose price spreads converge over time, enabling traders to exploit mean-reversion opportunities. Statistical arbitrage encompasses a broader range of strategies including cointegration but also leverages other statistical methods like factor models and machine learning to detect mispricings across large portfolios. Explore deeper insights on how cointegration enhances risk-adjusted returns in both pairs trading and advanced statistical arbitrage strategies.

Mean Reversion

Pairs trading is a subset of statistical arbitrage that specifically exploits mean reversion between two correlated assets by identifying price divergences and executing simultaneous long and short positions. Statistical arbitrage encompasses a broader range of quantitative strategies, including multi-asset, multi-factor models that predict mean reversion beyond simple pairs. Explore deeper insights into how mean reversion drives profitability in these strategies and the latest quantitative models behind them.

Spread

Pairs trading relies on identifying two historically correlated assets and exploiting deviations in their price spread to generate returns, maintaining a long position in the undervalued asset while shorting the overvalued one. Statistical arbitrage expands beyond pairs by analyzing a wider set of securities and complex spreads, using advanced statistical and machine learning models to identify temporary mispricings across multiple asset combinations. Explore our detailed analysis to understand how these strategies leverage spread dynamics for enhanced trading performance.

Source and External Links

Pairs trade - Wikipedia - Pairs trading is a market neutral, statistical arbitrage strategy that profits when two historically correlated securities diverge temporarily and then converge, involving simultaneously shorting the outperforming stock and going long on the underperforming one.

What Is Pairs Trading? - Fidelity Investments - Pairs trading seeks to exploit imbalances between two correlated financial instruments by statistically analyzing their relationship to trade the spread without directional market bets, aiming to gain when the spread corrects itself.

The Comprehensive Introduction to Pairs Trading - Hudson & Thames - Pairs trading involves taking long and short positions in mispriced co-moving assets to profit from their price convergence, trading a mean-reverting spread without needing forecasts about future price directions.

dowidth.com

dowidth.com