Dark pool activity involves private trading venues where large institutional investors execute orders with minimal market impact, often resulting in limited transparency compared to traditional exchanges. Off-exchange trading encompasses transactions conducted outside formal exchange platforms, including dark pools and other alternative trading systems, offering flexibility and reduced transaction costs. Explore the differences between these trading methods to optimize your investment strategy.

Why it is important

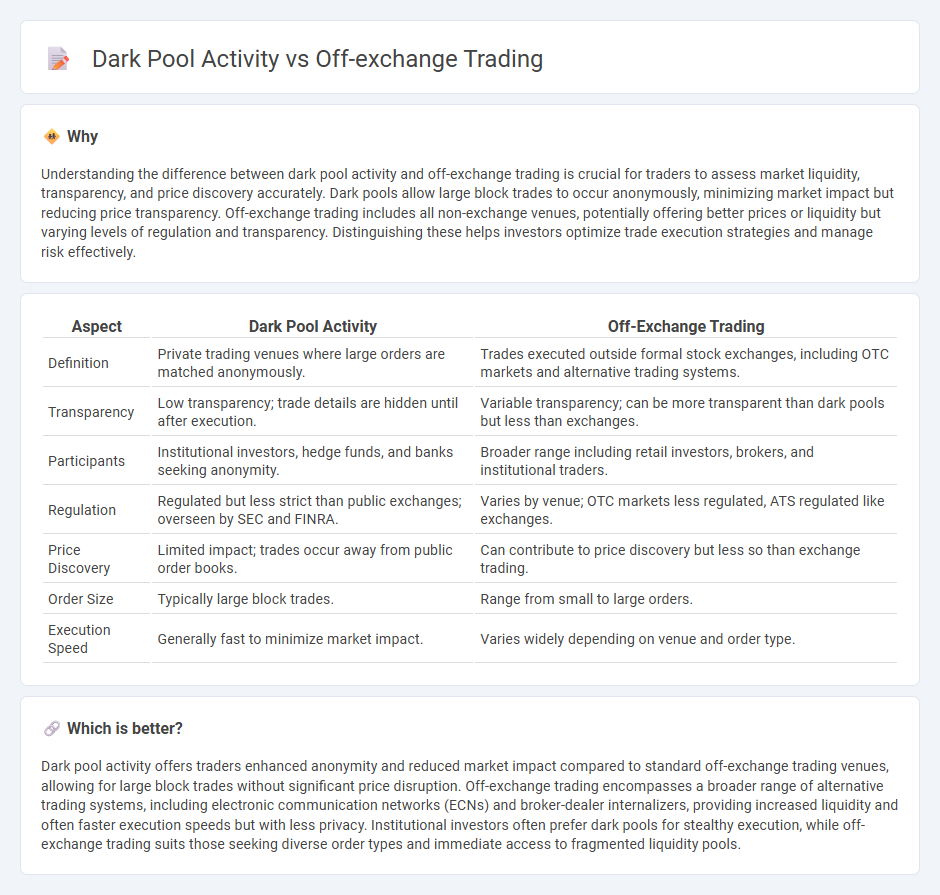

Understanding the difference between dark pool activity and off-exchange trading is crucial for traders to assess market liquidity, transparency, and price discovery accurately. Dark pools allow large block trades to occur anonymously, minimizing market impact but reducing price transparency. Off-exchange trading includes all non-exchange venues, potentially offering better prices or liquidity but varying levels of regulation and transparency. Distinguishing these helps investors optimize trade execution strategies and manage risk effectively.

Comparison Table

| Aspect | Dark Pool Activity | Off-Exchange Trading |

|---|---|---|

| Definition | Private trading venues where large orders are matched anonymously. | Trades executed outside formal stock exchanges, including OTC markets and alternative trading systems. |

| Transparency | Low transparency; trade details are hidden until after execution. | Variable transparency; can be more transparent than dark pools but less than exchanges. |

| Participants | Institutional investors, hedge funds, and banks seeking anonymity. | Broader range including retail investors, brokers, and institutional traders. |

| Regulation | Regulated but less strict than public exchanges; overseen by SEC and FINRA. | Varies by venue; OTC markets less regulated, ATS regulated like exchanges. |

| Price Discovery | Limited impact; trades occur away from public order books. | Can contribute to price discovery but less so than exchange trading. |

| Order Size | Typically large block trades. | Range from small to large orders. |

| Execution Speed | Generally fast to minimize market impact. | Varies widely depending on venue and order type. |

Which is better?

Dark pool activity offers traders enhanced anonymity and reduced market impact compared to standard off-exchange trading venues, allowing for large block trades without significant price disruption. Off-exchange trading encompasses a broader range of alternative trading systems, including electronic communication networks (ECNs) and broker-dealer internalizers, providing increased liquidity and often faster execution speeds but with less privacy. Institutional investors often prefer dark pools for stealthy execution, while off-exchange trading suits those seeking diverse order types and immediate access to fragmented liquidity pools.

Connection

Dark pool activity refers to private trading venues where large orders are executed away from public exchanges, minimizing market impact and revealing less information to other traders. Off-exchange trading encompasses transactions occurring outside traditional stock exchanges, including dark pools, which facilitate anonymity and reduce price slippage for institutional investors. These interconnected mechanisms enhance liquidity and price discovery efficiency by allowing sizable trades to be executed discreetly without influencing the broader market.

Key Terms

Transparency

Off-exchange trading and dark pool activity differ significantly in transparency levels; off-exchange venues like alternative trading systems disclose trade details publicly, enhancing market visibility, while dark pools operate with limited transparency to protect large orders from market impact. The reduced visibility of dark pools can obscure true market liquidity and price discovery, raising regulatory scrutiny and investor concerns about fair access. Explore deeper insights into how transparency variations impact market efficiency and investor confidence.

Liquidity

Off-exchange trading and dark pool activity both play crucial roles in enhancing market liquidity by facilitating large block trades away from public exchanges, reducing market impact and price volatility. Dark pools allow institutional investors to transact anonymously, preserving order size and minimizing information leakage, whereas off-exchange venues, including Electronic Communication Networks (ECNs), offer alternative liquidity sources that complement traditional exchanges. Explore in-depth analysis to understand how these trading mechanisms optimize liquidity and impact market dynamics.

Price Discovery

Off-exchange trading and dark pool activity both significantly influence price discovery by providing alternative venues for large orders, reducing market impact and minimizing information leakage. While off-exchange trades often occur through electronic communication networks (ECNs) or broker-dealers, dark pools offer private trading environments with limited transparency, which can delay price signals in public markets. Explore more about how these trading mechanisms affect market efficiency and price formation dynamics.

Source and External Links

Off-Exchange Trading Increases Across All Types of Stocks - Off-exchange trading refers to stock transactions executed outside traditional exchanges, and it accounted for over 45% of volume across all market caps by early 2025, driven mostly by bilateral trading rather than dark pools.

Does Off-Exchange Trading Affect Prices and Liquidity on Exchanges? - Off-exchange trading often provides investors better prices but can cause brief changes in liquidity on exchanges, impacting odd-lot orders that represent significant but fleeting liquidity.

Analyzing the Meaning Behind the Level of Off-Exchange Trading - Off-exchange trading includes both retail and institutional trades and is a function of market structure rather than a decline in market quality, reflecting growing trading volumes especially among retail investors and low-price stocks.

dowidth.com

dowidth.com