Dark pool aggregation consolidates private trading venues to enhance liquidity and minimize market impact for large orders, while block trading focuses on executing substantial trades directly between parties, often outside public exchanges. By integrating multiple dark pools, traders gain access to a broader pool of counterparties, enabling more efficient price discovery and reduced slippage. Explore the nuances of dark pool aggregation and block trading to optimize your large order execution strategy.

Why it is important

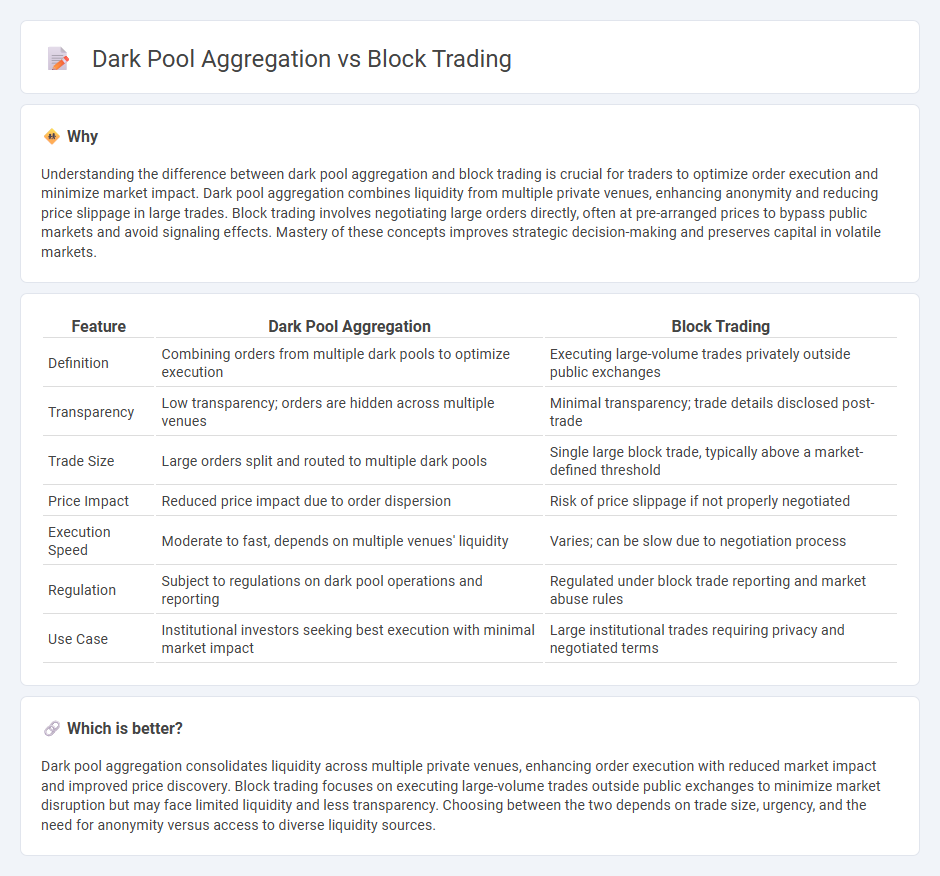

Understanding the difference between dark pool aggregation and block trading is crucial for traders to optimize order execution and minimize market impact. Dark pool aggregation combines liquidity from multiple private venues, enhancing anonymity and reducing price slippage in large trades. Block trading involves negotiating large orders directly, often at pre-arranged prices to bypass public markets and avoid signaling effects. Mastery of these concepts improves strategic decision-making and preserves capital in volatile markets.

Comparison Table

| Feature | Dark Pool Aggregation | Block Trading |

|---|---|---|

| Definition | Combining orders from multiple dark pools to optimize execution | Executing large-volume trades privately outside public exchanges |

| Transparency | Low transparency; orders are hidden across multiple venues | Minimal transparency; trade details disclosed post-trade |

| Trade Size | Large orders split and routed to multiple dark pools | Single large block trade, typically above a market-defined threshold |

| Price Impact | Reduced price impact due to order dispersion | Risk of price slippage if not properly negotiated |

| Execution Speed | Moderate to fast, depends on multiple venues' liquidity | Varies; can be slow due to negotiation process |

| Regulation | Subject to regulations on dark pool operations and reporting | Regulated under block trade reporting and market abuse rules |

| Use Case | Institutional investors seeking best execution with minimal market impact | Large institutional trades requiring privacy and negotiated terms |

Which is better?

Dark pool aggregation consolidates liquidity across multiple private venues, enhancing order execution with reduced market impact and improved price discovery. Block trading focuses on executing large-volume trades outside public exchanges to minimize market disruption but may face limited liquidity and less transparency. Choosing between the two depends on trade size, urgency, and the need for anonymity versus access to diverse liquidity sources.

Connection

Dark pool aggregation consolidates liquidity from multiple private trading venues, enhancing transparency and efficiency in block trading. Block trading involves executing large orders away from public exchanges, where dark pools provide anonymity and minimize market impact. Combining these strategies allows institutional traders to access substantial liquidity discreetly while optimizing execution prices.

Key Terms

Liquidity

Block trading involves executing large orders directly between parties, often resulting in minimal market impact and access to deep liquidity pools through institutional networks. Dark pool aggregation consolidates multiple non-transparent trading venues, enhancing liquidity by minimizing market exposure and reducing price slippage for sizable trades. Explore the nuances of liquidity management in block trading and dark pool aggregation to optimize your trading strategies.

Transparency

Block trading involves the direct exchange of large securities between institutional investors, often conducted on public exchanges or through broker-dealers, which provides a higher level of transparency due to reported trade details and prices. Dark pool aggregation combines multiple dark pools, private venues where orders are matched anonymously, offering reduced market impact but less price and order book transparency compared to block trading. Explore the nuances of transparency in both methods to understand their impact on market efficiency and investor decision-making.

Market Impact

Block trading involves executing large orders directly between parties, which can significantly move market prices due to sudden supply or demand shifts, increasing market impact costs. Dark pool aggregation consolidates multiple dark pool orders to minimize market visibility, reducing price slippage and market impact by dispersing large trades across anonymous venues. Explore the mechanisms of both methods to understand how they mitigate market impact and optimize trade execution.

Source and External Links

Understanding Block Trade in Stock Market - Bajaj Finserv - A block trade is a large-volume transaction in a security, privately negotiated and executed outside of the open market, allowing institutional investors to avoid impacting market prices while maintaining transparency and control over price negotiation.

What is Block Trade: Know its Benefits and Features | Tata Moneyfy - Block trades enable the buying or selling of many securities in a single private transaction to minimize market price disruption and provide liquidity, often facilitated by specialized brokers or block houses using methods such as dark pools and iceberg orders.

Block Trades - What is a Block Trade? - CME Group - Block trades are privately negotiated futures or options transactions that meet certain quantity thresholds and are executed apart from public auction markets, governed by specific regulatory rules requiring bilateral negotiation between counterparties.

dowidth.com

dowidth.com