Volatility harvesting leverages price fluctuations within markets to generate profits by exploiting cyclical volatility patterns, while directional trading aims to capitalize on anticipated market trends by taking positions aligned with expected asset price movements. Volatility harvesting often involves strategies such as options trading and statistical arbitrage to profit regardless of market direction, contrasting with directional trading's reliance on accurate market predictions. Explore the nuances and strategic implications of volatility harvesting versus directional trading to enhance your trading approach.

Why it is important

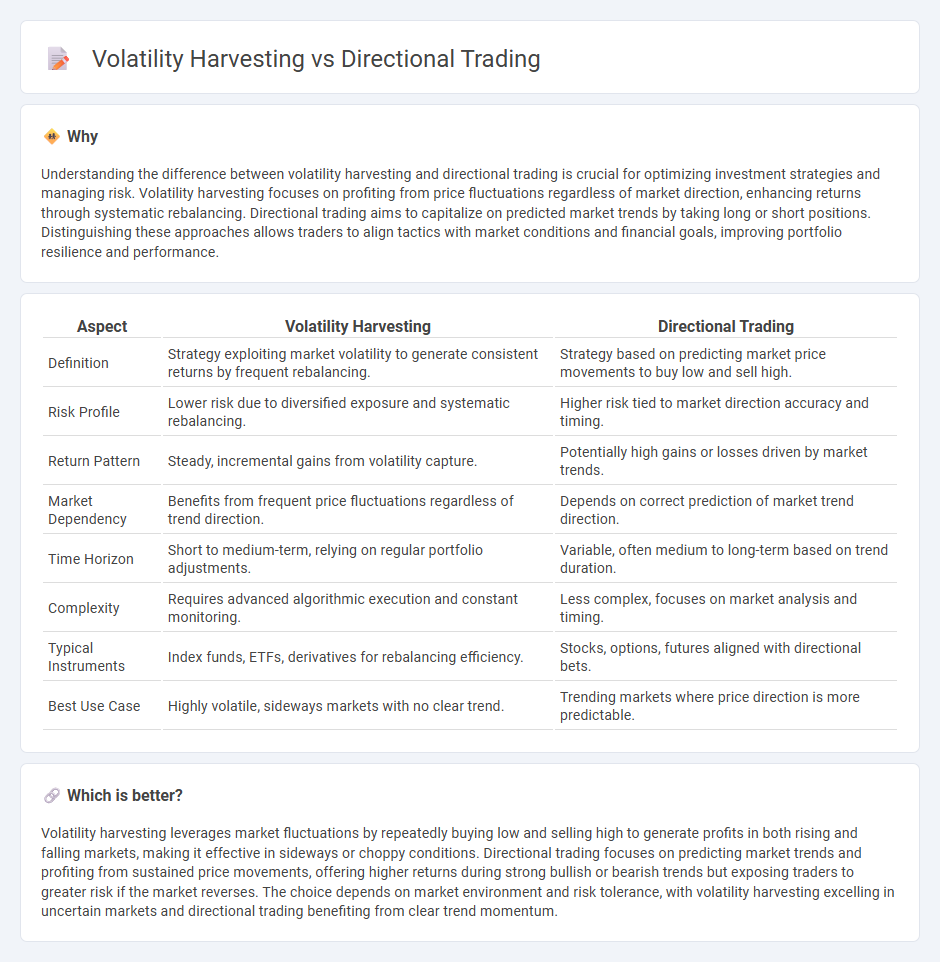

Understanding the difference between volatility harvesting and directional trading is crucial for optimizing investment strategies and managing risk. Volatility harvesting focuses on profiting from price fluctuations regardless of market direction, enhancing returns through systematic rebalancing. Directional trading aims to capitalize on predicted market trends by taking long or short positions. Distinguishing these approaches allows traders to align tactics with market conditions and financial goals, improving portfolio resilience and performance.

Comparison Table

| Aspect | Volatility Harvesting | Directional Trading |

|---|---|---|

| Definition | Strategy exploiting market volatility to generate consistent returns by frequent rebalancing. | Strategy based on predicting market price movements to buy low and sell high. |

| Risk Profile | Lower risk due to diversified exposure and systematic rebalancing. | Higher risk tied to market direction accuracy and timing. |

| Return Pattern | Steady, incremental gains from volatility capture. | Potentially high gains or losses driven by market trends. |

| Market Dependency | Benefits from frequent price fluctuations regardless of trend direction. | Depends on correct prediction of market trend direction. |

| Time Horizon | Short to medium-term, relying on regular portfolio adjustments. | Variable, often medium to long-term based on trend duration. |

| Complexity | Requires advanced algorithmic execution and constant monitoring. | Less complex, focuses on market analysis and timing. |

| Typical Instruments | Index funds, ETFs, derivatives for rebalancing efficiency. | Stocks, options, futures aligned with directional bets. |

| Best Use Case | Highly volatile, sideways markets with no clear trend. | Trending markets where price direction is more predictable. |

Which is better?

Volatility harvesting leverages market fluctuations by repeatedly buying low and selling high to generate profits in both rising and falling markets, making it effective in sideways or choppy conditions. Directional trading focuses on predicting market trends and profiting from sustained price movements, offering higher returns during strong bullish or bearish trends but exposing traders to greater risk if the market reverses. The choice depends on market environment and risk tolerance, with volatility harvesting excelling in uncertain markets and directional trading benefiting from clear trend momentum.

Connection

Volatility harvesting leverages market fluctuations to generate consistent returns by systematically rebalancing portfolios, while directional trading focuses on capitalizing on anticipated market trends. Combining these strategies enhances risk-adjusted performance by exploiting both price movements and market volatility. This integrated approach allows traders to diversify tactics, reducing exposure to market unpredictability and improving overall profitability.

Key Terms

Market Trend

Directional trading exploits market trends by capitalizing on predictable price movements, leveraging momentum to achieve consistent gains. Volatility harvesting involves profiting from price fluctuations regardless of trend direction, employing strategies like mean reversion to capture returns during market instability. Explore further to understand how aligning strategies with market trends can optimize trading performance.

Volatility

Volatility harvesting capitalizes on frequent market fluctuations by systematically buying low and selling high, effectively turning volatility into consistent returns without relying on market direction. Directional trading, in contrast, aims to profit from anticipated price trends but faces higher risks when volatility spikes unpredictably. Explore more about how volatility harvesting strategies optimize risk-adjusted gains amid market uncertainty.

Mean Reversion

Directional trading relies on predicting price trends and capitalizing on sustained market movements, often facing challenges during mean reversion periods when prices revert to their average levels. Volatility harvesting exploits price fluctuations by systematically rebalancing portfolios to capture gains from market oscillations, benefiting particularly in mean reverting environments. Explore the mechanisms of mean reversion strategies to enhance your trading approach and optimize returns.

Source and External Links

Directional Trading Explored (2025): Mechanics, Significance - Directional trading is a strategy where traders predict the market's future price direction (up or down) using technical and fundamental analysis to enter positions aiming to profit from these anticipated moves.

What are Directional Trading Strategies? - Angel One - Directional trading involves strategies based on a trader's view of whether a security or market will rise or fall, allowing them to go long (buy) or short (sell) accordingly to capitalize on price movements.

Directional Trading Strategies - Corporate Finance Institute - Directional trading strategies bet on market price movements by taking long or short positions, and can include option strategies like bull calls that combine buying and selling calls to reduce cost and risk while betting on upward trends.

dowidth.com

dowidth.com