A gamma squeeze occurs when options market makers buy the underlying stock to hedge their positions as option prices rise, driving the stock price sharply higher. A short ladder attack involves coordinated short selling at incrementally lower prices to create a false impression of a declining stock, triggering panic selling among other investors. Explore these trading tactics further to understand their impact on market dynamics.

Why it is important

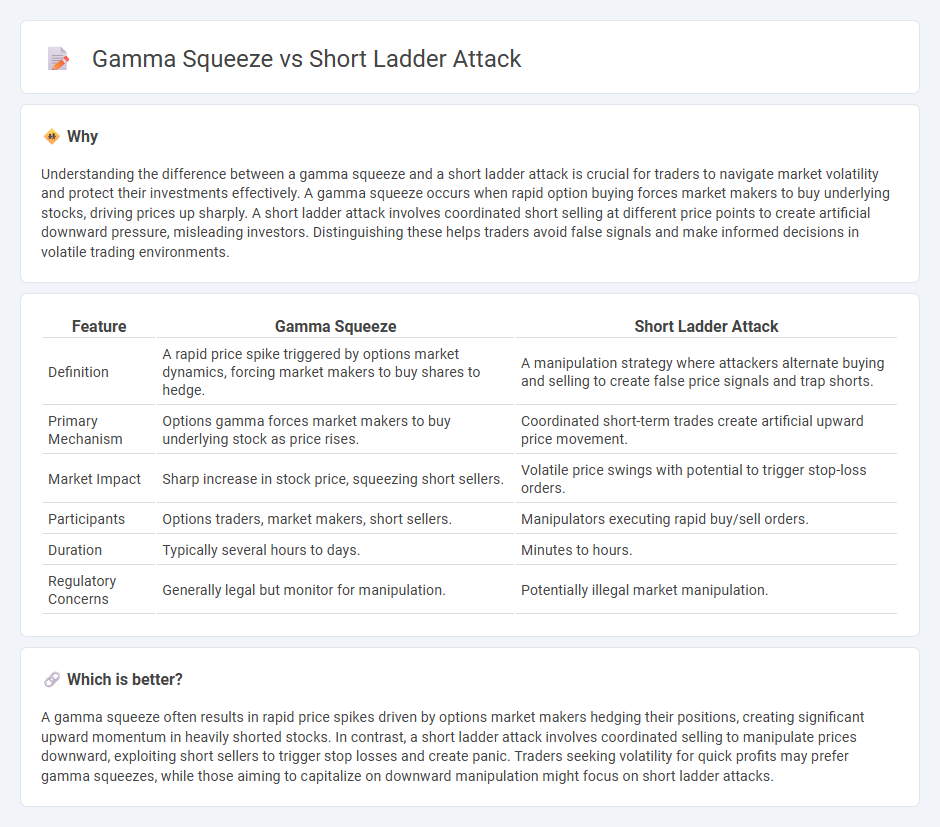

Understanding the difference between a gamma squeeze and a short ladder attack is crucial for traders to navigate market volatility and protect their investments effectively. A gamma squeeze occurs when rapid option buying forces market makers to buy underlying stocks, driving prices up sharply. A short ladder attack involves coordinated short selling at different price points to create artificial downward pressure, misleading investors. Distinguishing these helps traders avoid false signals and make informed decisions in volatile trading environments.

Comparison Table

| Feature | Gamma Squeeze | Short Ladder Attack |

|---|---|---|

| Definition | A rapid price spike triggered by options market dynamics, forcing market makers to buy shares to hedge. | A manipulation strategy where attackers alternate buying and selling to create false price signals and trap shorts. |

| Primary Mechanism | Options gamma forces market makers to buy underlying stock as price rises. | Coordinated short-term trades create artificial upward price movement. |

| Market Impact | Sharp increase in stock price, squeezing short sellers. | Volatile price swings with potential to trigger stop-loss orders. |

| Participants | Options traders, market makers, short sellers. | Manipulators executing rapid buy/sell orders. |

| Duration | Typically several hours to days. | Minutes to hours. |

| Regulatory Concerns | Generally legal but monitor for manipulation. | Potentially illegal market manipulation. |

Which is better?

A gamma squeeze often results in rapid price spikes driven by options market makers hedging their positions, creating significant upward momentum in heavily shorted stocks. In contrast, a short ladder attack involves coordinated selling to manipulate prices downward, exploiting short sellers to trigger stop losses and create panic. Traders seeking volatility for quick profits may prefer gamma squeezes, while those aiming to capitalize on downward manipulation might focus on short ladder attacks.

Connection

Gamma squeeze occurs when options market makers buy underlying shares to hedge their positions as the stock price rises, intensifying upward momentum. Short ladder attack involves coordinated short selling to artificially depress the stock price, often triggering stop-loss orders and panic selling. Both strategies manipulate price dynamics--gamma squeeze drives prices up through hedging mechanics, while short ladder attack pushes prices down via orchestrated shorting pressure.

Key Terms

Naked Short Selling

Naked short selling occurs when traders sell shares without borrowing them, often triggering short-term market volatility seen in ladder attacks, where rapid price drops are engineered. Gamma squeezes involve options strategies that compel market makers to buy shares, pushing prices higher, contrasting with the destabilizing impact of naked short selling in ladder attacks. Explore the intricate dynamics between naked short selling, ladder attacks, and gamma squeezes to better understand their market implications.

Options Contracts

A short ladder attack manipulates option prices by executing a series of coordinated buy and sell orders to create false demand, causing a temporary rise in options contract premiums. A gamma squeeze occurs when rapid buying of call options forces market makers to hedge by purchasing the underlying stock, driving the price higher and amplifying option contract values. Explore the detailed mechanics and risk factors of both strategies to better navigate options trading.

Market Maker

A short ladder attack involves coordinated short selling to drive down a stock's price, often exploited by market makers to profit from price manipulation. In contrast, a gamma squeeze occurs when market makers hedge call option exposure by buying the underlying asset, causing a rapid price increase due to increased demand. Explore how market makers influence these dynamics to better understand the impact on stock price volatility.

Source and External Links

What Is a Short Ladder Attack? - A short ladder attack is a tactic where hedge fund sellers collectively drive down a stock price already experiencing bearish pressure, aiming to induce retail investors to sell and cause a further drop in price by creating the impression the asset is worth less than bullish investors believe.

Wallstreetbets Conspiracy Theorists Claim a 'Short Ladder Attack' - The short ladder attack is described by retail investors as shorts manipulating supply and demand by flooding the offer side with counterfeit shares to make prices look like they are falling, but many professional short sellers deny knowledge or existence of this strategy.

THE MASSIVE SHORT LADDER ATTACK TODAY - A short ladder attack involves traders controlling both buying and selling to artificially devalue a stock, often seen as blatant market manipulation to push the price down rapidly within short trading periods.

dowidth.com

dowidth.com