Retail flow chasing involves individual traders reacting to market trends and news, often resulting in buying high and selling low due to emotional decision-making. Smart money flow represents the strategic actions of institutional investors who use advanced analytics and market insights to anticipate price movements and capitalize on inefficiencies. Discover how understanding these contrasting flows can enhance your trading strategy and improve market timing.

Why it is important

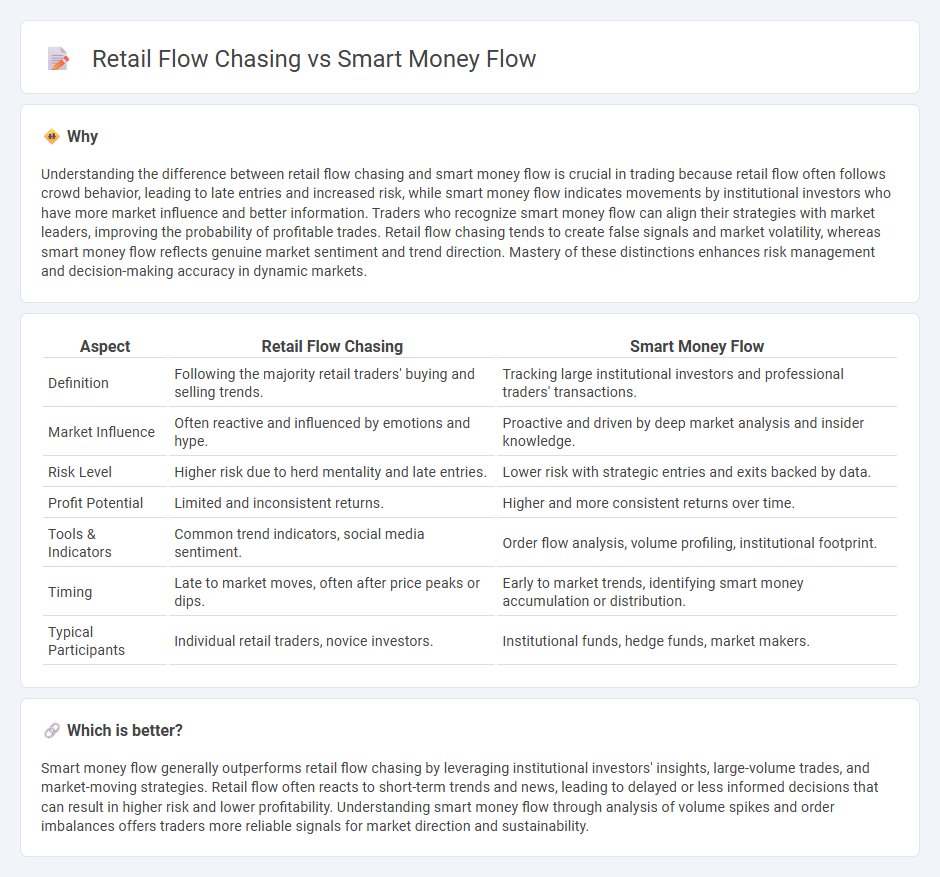

Understanding the difference between retail flow chasing and smart money flow is crucial in trading because retail flow often follows crowd behavior, leading to late entries and increased risk, while smart money flow indicates movements by institutional investors who have more market influence and better information. Traders who recognize smart money flow can align their strategies with market leaders, improving the probability of profitable trades. Retail flow chasing tends to create false signals and market volatility, whereas smart money flow reflects genuine market sentiment and trend direction. Mastery of these distinctions enhances risk management and decision-making accuracy in dynamic markets.

Comparison Table

| Aspect | Retail Flow Chasing | Smart Money Flow |

|---|---|---|

| Definition | Following the majority retail traders' buying and selling trends. | Tracking large institutional investors and professional traders' transactions. |

| Market Influence | Often reactive and influenced by emotions and hype. | Proactive and driven by deep market analysis and insider knowledge. |

| Risk Level | Higher risk due to herd mentality and late entries. | Lower risk with strategic entries and exits backed by data. |

| Profit Potential | Limited and inconsistent returns. | Higher and more consistent returns over time. |

| Tools & Indicators | Common trend indicators, social media sentiment. | Order flow analysis, volume profiling, institutional footprint. |

| Timing | Late to market moves, often after price peaks or dips. | Early to market trends, identifying smart money accumulation or distribution. |

| Typical Participants | Individual retail traders, novice investors. | Institutional funds, hedge funds, market makers. |

Which is better?

Smart money flow generally outperforms retail flow chasing by leveraging institutional investors' insights, large-volume trades, and market-moving strategies. Retail flow often reacts to short-term trends and news, leading to delayed or less informed decisions that can result in higher risk and lower profitability. Understanding smart money flow through analysis of volume spikes and order imbalances offers traders more reliable signals for market direction and sustainability.

Connection

Retail flow chasing often reacts to market trends based on crowd behavior and technical indicators, while smart money flow represents institutional investors' strategic positioning driven by fundamental analysis and proprietary data. These two flows influence each other, as smart money typically moves ahead of retail traders, causing retail flow chasing to amplify price movements initiated by institutional activity. Understanding the correlation between retail and smart money flow can enhance trade timing and market trend predictions.

Key Terms

Order Flow

Smart money flow represents the activity of institutional investors who analyze order flow data to make informed trading decisions, leveraging large volume trades to influence market direction. Retail flow chasing occurs when individual traders react to market trends without deep order flow insight, often entering positions too late and amplifying volatility. Explore how mastering order flow can distinguish smart money strategies from retail behaviors for improved trading outcomes.

Liquidity

Smart money flow targets high liquidity zones where institutional investors execute large trades, optimizing entry and exit points with minimal market impact. Retail flow chasing often occurs in lower liquidity areas, resulting in greater price slippage and increased exposure to volatility. Discover how focusing on liquidity can improve trading strategies by distinguishing smart money movements from retail behaviors.

Volume

Smart money flow reflects institutional investors' strategic volume movements, often indicating significant market trends before they become evident to the broader public. Retail flow chasing typically involves high trading volumes driven by individual traders reacting to short-term price fluctuations, leading to potentially less stable market outcomes. Explore deeper insights into volume analysis to better understand market dynamics and optimize your trading strategies.

Source and External Links

Smart money index - The Smart Money Index (SMI) and the Smart Money Flow Index (SMFI) are technical analysis indicators that track institutional investors' sentiment based on intra-day price patterns, showing how "smart money" trades relative to market trends.

Smart Money Index (SMI) -- Indicator by HPotter - The SMI is based on the idea that uninformed traders overreact in the morning while smart money trades later, so the index reflects buying and selling by experienced investors usually toward market close, with no fixed signals but interpreted relative to price movements for trend insights.

How Smart Money Moves the Market (And How You Can ... - Trading aligned with smart money (institutional flow) increases success chances, as smart money accumulates quality stocks while many retail traders wrongly buy every dip, often moving against institutional investors' trends.

dowidth.com

dowidth.com