On-chain analytics offers real-time insights into blockchain transaction data, enabling traders to track asset flows, wallet activities, and network trends with transparency and precision. Algorithmic trading utilizes complex mathematical models and automated systems to execute trades at high speed, optimizing entry and exit points based on market signals. Explore the nuances between these two cutting-edge approaches to enhance your trading strategy and decision-making.

Why it is important

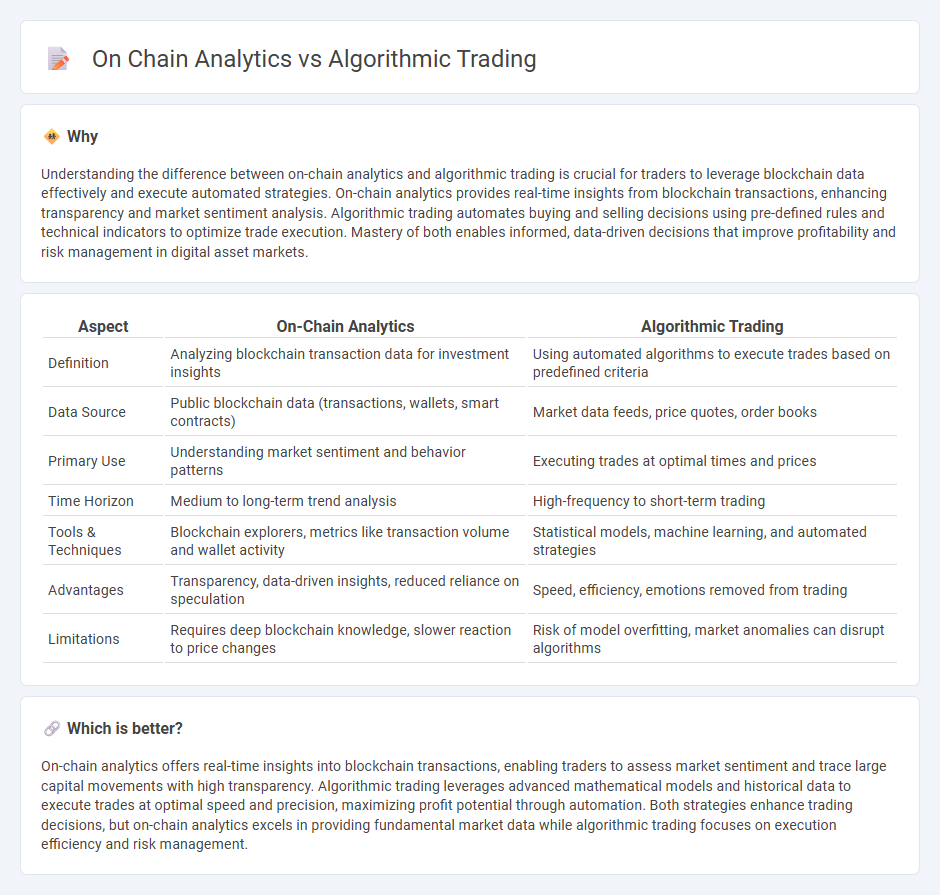

Understanding the difference between on-chain analytics and algorithmic trading is crucial for traders to leverage blockchain data effectively and execute automated strategies. On-chain analytics provides real-time insights from blockchain transactions, enhancing transparency and market sentiment analysis. Algorithmic trading automates buying and selling decisions using pre-defined rules and technical indicators to optimize trade execution. Mastery of both enables informed, data-driven decisions that improve profitability and risk management in digital asset markets.

Comparison Table

| Aspect | On-Chain Analytics | Algorithmic Trading |

|---|---|---|

| Definition | Analyzing blockchain transaction data for investment insights | Using automated algorithms to execute trades based on predefined criteria |

| Data Source | Public blockchain data (transactions, wallets, smart contracts) | Market data feeds, price quotes, order books |

| Primary Use | Understanding market sentiment and behavior patterns | Executing trades at optimal times and prices |

| Time Horizon | Medium to long-term trend analysis | High-frequency to short-term trading |

| Tools & Techniques | Blockchain explorers, metrics like transaction volume and wallet activity | Statistical models, machine learning, and automated strategies |

| Advantages | Transparency, data-driven insights, reduced reliance on speculation | Speed, efficiency, emotions removed from trading |

| Limitations | Requires deep blockchain knowledge, slower reaction to price changes | Risk of model overfitting, market anomalies can disrupt algorithms |

Which is better?

On-chain analytics offers real-time insights into blockchain transactions, enabling traders to assess market sentiment and trace large capital movements with high transparency. Algorithmic trading leverages advanced mathematical models and historical data to execute trades at optimal speed and precision, maximizing profit potential through automation. Both strategies enhance trading decisions, but on-chain analytics excels in providing fundamental market data while algorithmic trading focuses on execution efficiency and risk management.

Connection

On-chain analytics provides real-time blockchain transaction data, enabling algorithmic trading systems to execute trades based on accurate, transparent market activity. By integrating on-chain metrics like transaction volume, wallet addresses, and token flows, algorithmic trading strategies can identify trends and liquidity shifts with precision. This synergy enhances prediction accuracy and risk management in automated digital asset trading.

Key Terms

Algorithmic Trading:

Algorithmic trading leverages complex mathematical models and automated systems to execute trades at speeds and volumes beyond human capability, optimizing market opportunities based on real-time data. It integrates historical price trends, volume patterns, and technical indicators to make predictive decisions that minimize risk and maximize returns. Explore the latest advancements in algorithmic trading strategies and tools to enhance your trading performance.

Backtesting

Algorithmic trading utilizes historical market data to develop and rigorously backtest strategies, optimizing trade execution speed, accuracy, and profitability. On-chain analytics enhances backtesting by incorporating blockchain transaction data, providing deeper insights into asset behavior, liquidity, and market sentiment beyond traditional price action. Explore how integrating algorithmic trading with on-chain analytics can revolutionize your backtesting approach and trading outcomes.

Execution Algorithms

Execution algorithms in algorithmic trading utilize advanced quantitative models to optimize trade orders for best price and minimal market impact. On-chain analytics complement this by providing real-time blockchain transaction data, enhancing decision-making for executing crypto asset trades. Explore how integrating execution algorithms with on-chain analytics can transform trading strategies.

Source and External Links

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves executing trades based on pre-set computer-programmed rules, such as using moving average strategies to buy or sell securities automatically when certain price conditions are met.

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses software to open and close trades according to predefined rules involving price movements or technical indicators, enabling strategies like price action and technical analysis, often used in high-frequency trading.

Does Algorithmic Trading Improve Liquidity? - Research shows algorithmic trading improves market liquidity by narrowing spreads, lowering transaction costs, and enhancing price efficiency, particularly in large stocks.

dowidth.com

dowidth.com