Smart money concepts focus on understanding the actions of institutional investors to anticipate market movements, leveraging volume analysis and price patterns. Trend following strategies capitalize on existing market momentum by identifying and riding sustained price movements across various time frames. Explore these trading methodologies to enhance your market analysis and decision-making skills.

Why it is important

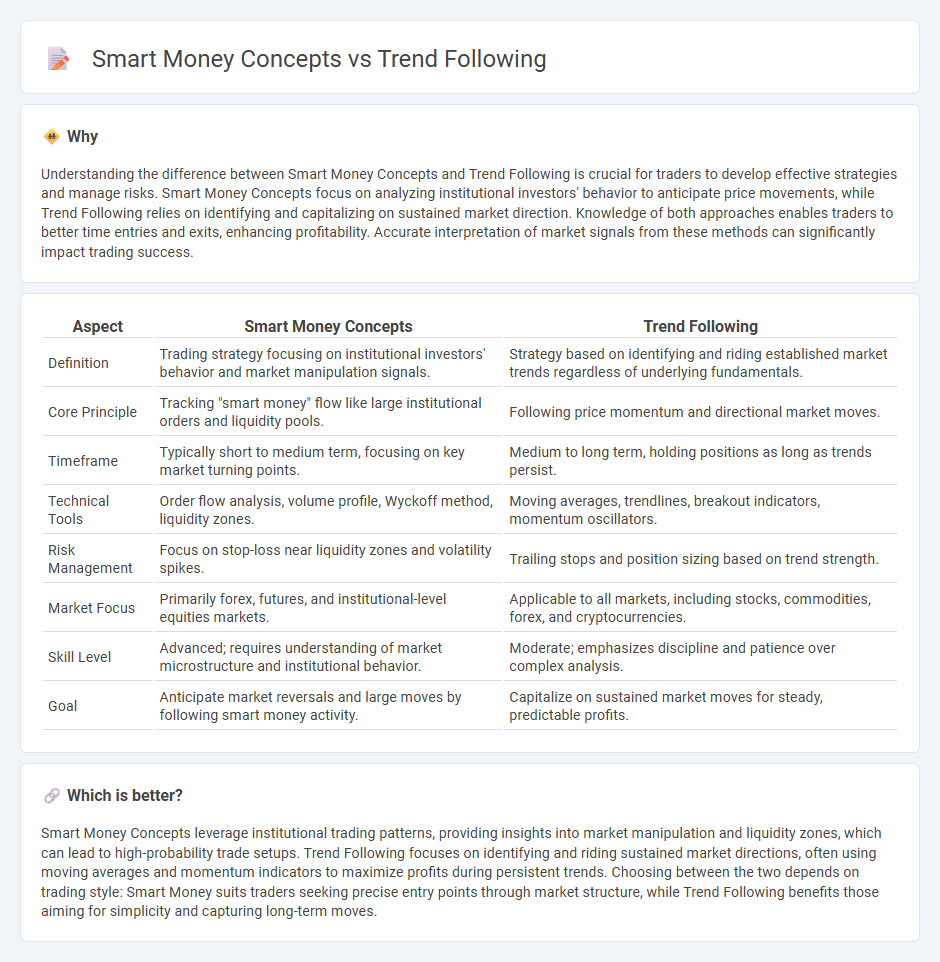

Understanding the difference between Smart Money Concepts and Trend Following is crucial for traders to develop effective strategies and manage risks. Smart Money Concepts focus on analyzing institutional investors' behavior to anticipate price movements, while Trend Following relies on identifying and capitalizing on sustained market direction. Knowledge of both approaches enables traders to better time entries and exits, enhancing profitability. Accurate interpretation of market signals from these methods can significantly impact trading success.

Comparison Table

| Aspect | Smart Money Concepts | Trend Following |

|---|---|---|

| Definition | Trading strategy focusing on institutional investors' behavior and market manipulation signals. | Strategy based on identifying and riding established market trends regardless of underlying fundamentals. |

| Core Principle | Tracking "smart money" flow like large institutional orders and liquidity pools. | Following price momentum and directional market moves. |

| Timeframe | Typically short to medium term, focusing on key market turning points. | Medium to long term, holding positions as long as trends persist. |

| Technical Tools | Order flow analysis, volume profile, Wyckoff method, liquidity zones. | Moving averages, trendlines, breakout indicators, momentum oscillators. |

| Risk Management | Focus on stop-loss near liquidity zones and volatility spikes. | Trailing stops and position sizing based on trend strength. |

| Market Focus | Primarily forex, futures, and institutional-level equities markets. | Applicable to all markets, including stocks, commodities, forex, and cryptocurrencies. |

| Skill Level | Advanced; requires understanding of market microstructure and institutional behavior. | Moderate; emphasizes discipline and patience over complex analysis. |

| Goal | Anticipate market reversals and large moves by following smart money activity. | Capitalize on sustained market moves for steady, predictable profits. |

Which is better?

Smart Money Concepts leverage institutional trading patterns, providing insights into market manipulation and liquidity zones, which can lead to high-probability trade setups. Trend Following focuses on identifying and riding sustained market directions, often using moving averages and momentum indicators to maximize profits during persistent trends. Choosing between the two depends on trading style: Smart Money suits traders seeking precise entry points through market structure, while Trend Following benefits those aiming for simplicity and capturing long-term moves.

Connection

Smart money concepts focus on analyzing the behavior and positions of institutional investors to identify market trends, while trend following strategies capitalize on these established market directions to maximize profits. By interpreting smart money signals such as volume spikes and price accumulation, traders can align their positions with prevailing trends validated by large market participants. This synergy enhances trading decisions by combining insider-informed insights with systematic trend momentum analysis.

Key Terms

Market Structure

Trend following strategies rely on identifying and trading in the direction of prevailing market trends, using tools such as moving averages and breakout patterns to confirm market structure shifts. Smart money concepts emphasize tracking institutional activity by analyzing market structure changes like order blocks, liquidity shifts, and absorption patterns to predict price movements. Explore detailed insights into how market structure analysis differentiates these approaches and enhances trading decisions.

Liquidity

Trend Following strategies capitalize on market momentum by identifying sustained price movements, often driven by retail traders' behavior and broader market sentiment. Smart Money Concepts emphasize liquidity zones where institutional investors accumulate or distribute positions, focusing on price levels with high volume and order flow dynamics. Explore the nuances between these approaches to optimize trading decisions and risk management.

Break of Structure (BOS)

Trend following strategies capitalize on momentum by identifying a Break of Structure (BOS), signaling a potential shift in market direction and confirming trend continuation. Smart Money Concepts (SMC) incorporate BOS as part of broader market manipulation analysis, highlighting institutional order flows and liquidity zones to anticipate reversals or trend exhaustion. Explore deeper into how BOS drives strategic entries in both methodologies for enhanced trading precision.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy where traders buy assets when their price trend moves up and sell when it moves down, using techniques like moving averages and channel breakouts without predicting exact prices.

Trend-Following Primer - Graham Capital Management - Trend following is a systematic investment strategy that uses algorithmic models to identify and trade based on price and volatility trends in multiple markets, aiming for portfolio diversification and risk management.

Trend Following Trading Strategies and Systems (Backtest Results) - Trend following strategies use technical analysis and systematic rules to enter trades in the trend direction and exit on reversals, focusing on momentum and risk control across various asset classes.

dowidth.com

dowidth.com