Retail flow chasing involves individual traders attempting to profit by following the buying and selling activities of other retail participants, often leading to reactive and less informed decisions. Institutional order flow, driven by large financial entities such as hedge funds and banks, reflects strategic and high-volume trades that significantly influence market prices. Explore deeper insights into how these distinct types of order flow impact trading strategies and market dynamics.

Why it is important

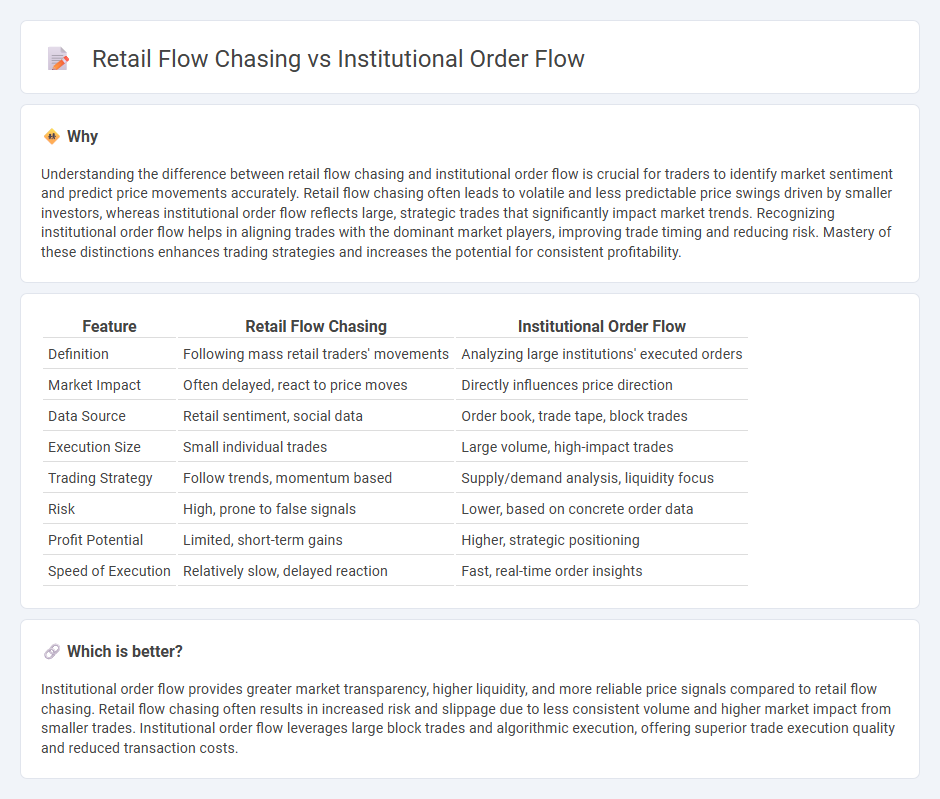

Understanding the difference between retail flow chasing and institutional order flow is crucial for traders to identify market sentiment and predict price movements accurately. Retail flow chasing often leads to volatile and less predictable price swings driven by smaller investors, whereas institutional order flow reflects large, strategic trades that significantly impact market trends. Recognizing institutional order flow helps in aligning trades with the dominant market players, improving trade timing and reducing risk. Mastery of these distinctions enhances trading strategies and increases the potential for consistent profitability.

Comparison Table

| Feature | Retail Flow Chasing | Institutional Order Flow |

|---|---|---|

| Definition | Following mass retail traders' movements | Analyzing large institutions' executed orders |

| Market Impact | Often delayed, react to price moves | Directly influences price direction |

| Data Source | Retail sentiment, social data | Order book, trade tape, block trades |

| Execution Size | Small individual trades | Large volume, high-impact trades |

| Trading Strategy | Follow trends, momentum based | Supply/demand analysis, liquidity focus |

| Risk | High, prone to false signals | Lower, based on concrete order data |

| Profit Potential | Limited, short-term gains | Higher, strategic positioning |

| Speed of Execution | Relatively slow, delayed reaction | Fast, real-time order insights |

Which is better?

Institutional order flow provides greater market transparency, higher liquidity, and more reliable price signals compared to retail flow chasing. Retail flow chasing often results in increased risk and slippage due to less consistent volume and higher market impact from smaller trades. Institutional order flow leverages large block trades and algorithmic execution, offering superior trade execution quality and reduced transaction costs.

Connection

Retail flow chasing often triggers price movements that institutional traders capitalize on by placing strategic orders aligned with these shifts. Institutional order flow provides valuable liquidity and market depth, influencing retail investor behavior and creating a feedback loop between both groups. This dynamic interaction enhances market efficiency and shapes short-term price volatility.

Key Terms

Liquidity

Institutional order flow is characterized by large, strategically executed transactions that target deep liquidity pools, optimizing trade execution and minimizing market impact. Retail flow chasing often reacts to price movements, creating fragmented liquidity and increased volatility as smaller orders cluster around key levels. Explore detailed insights into how liquidity influences these contrasting trading behaviors and market dynamics.

Volume

Institutional order flow represents large block trades executed by professional investors, reflecting significant market volume and providing insights into major market trends. Retail flow chasing, driven by smaller volume trades from individual investors, often reacts to market noise rather than underlying liquidity. Explore how analyzing volume dynamics can improve your trading strategy and market understanding.

Market Impact

Institutional order flow often involves large volume trades executed strategically to minimize market impact, utilizing tactics such as iceberg orders and algorithmic trading to avoid signaling intentions. In contrast, retail flow chasing tends to react to market momentum and news, often causing amplified price movements due to smaller, less coordinated trades. Explore the nuanced differences and their implications on market dynamics to understand how order flow shapes price action more deeply.

Source and External Links

Unlock the Power of Institutional Order Flow - Opofinance Blog - Institutional order flow refers to the large-scale buying and selling activity of major financial institutions that significantly impacts market price movements, liquidity, trends, volatility, and sentiment, and it can be detected through price action rather than volume or market depth data.

Bullish and Bearish Order Flow - SMC & ICT trading - Writo-Finance - Institutional order flow shows "footprints" of large players gradually accumulating or distributing positions through order blocks where big orders shift market momentum and traders can align with smart money moves during retracements.

Institutional Order Flow Trading | PDF - Scribd - Understanding bullish and bearish institutional order flow involves identifying order blocks formed before price reversals, which helps traders construct setups by targeting resting liquidity pools that institutions aim for.

dowidth.com

dowidth.com