Funded account programs provide traders with real capital to trade, offering real profit opportunities and risk management experience, unlike demo accounts that simulate trading with virtual funds to practice strategies without financial risk. These programs often require traders to pass evaluation phases to qualify for funded accounts, ensuring skill and discipline are demonstrated before accessing real money. Explore the differences between funded and demo accounts to enhance your trading journey effectively.

Why it is important

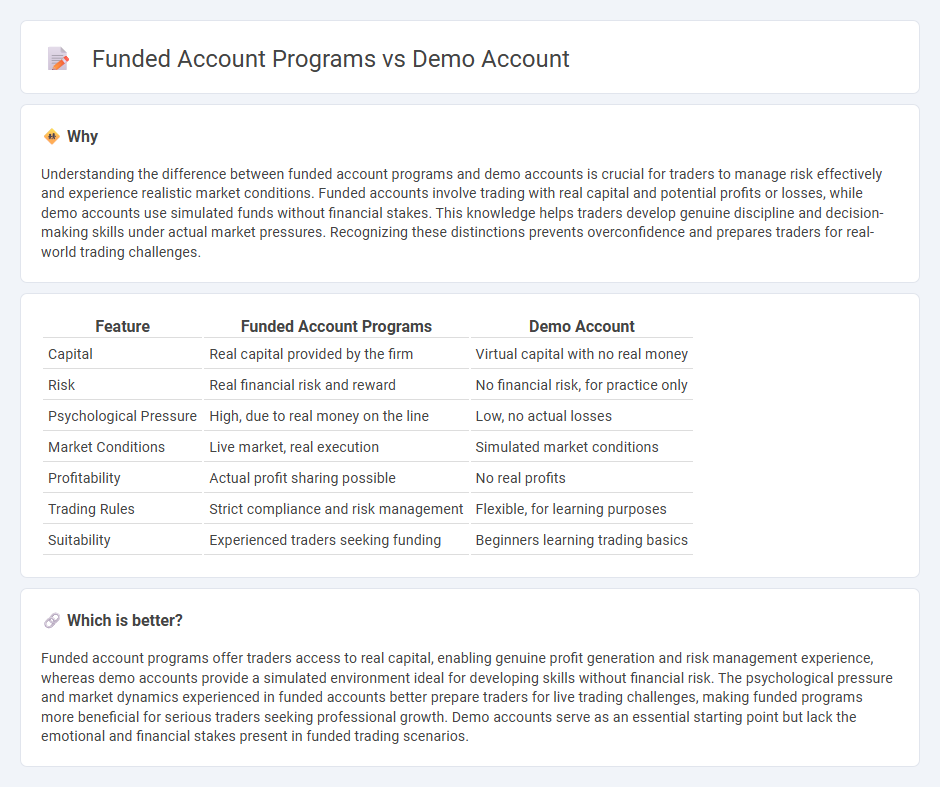

Understanding the difference between funded account programs and demo accounts is crucial for traders to manage risk effectively and experience realistic market conditions. Funded accounts involve trading with real capital and potential profits or losses, while demo accounts use simulated funds without financial stakes. This knowledge helps traders develop genuine discipline and decision-making skills under actual market pressures. Recognizing these distinctions prevents overconfidence and prepares traders for real-world trading challenges.

Comparison Table

| Feature | Funded Account Programs | Demo Account |

|---|---|---|

| Capital | Real capital provided by the firm | Virtual capital with no real money |

| Risk | Real financial risk and reward | No financial risk, for practice only |

| Psychological Pressure | High, due to real money on the line | Low, no actual losses |

| Market Conditions | Live market, real execution | Simulated market conditions |

| Profitability | Actual profit sharing possible | No real profits |

| Trading Rules | Strict compliance and risk management | Flexible, for learning purposes |

| Suitability | Experienced traders seeking funding | Beginners learning trading basics |

Which is better?

Funded account programs offer traders access to real capital, enabling genuine profit generation and risk management experience, whereas demo accounts provide a simulated environment ideal for developing skills without financial risk. The psychological pressure and market dynamics experienced in funded accounts better prepare traders for live trading challenges, making funded programs more beneficial for serious traders seeking professional growth. Demo accounts serve as an essential starting point but lack the emotional and financial stakes present in funded trading scenarios.

Connection

Funded account programs provide traders with real capital based on their demo account performance, allowing them to transition from simulated trading to live markets. Demo accounts enable traders to refine strategies and demonstrate consistent profitability without risking personal funds. This connection ensures that only skilled traders access funded accounts, promoting responsible risk management and increased trading success.

Key Terms

Virtual Capital

Virtual Capital offers demo account programs that allow traders to practice with virtual funds in a risk-free environment, perfect for learning market dynamics and testing strategies. Funded account programs provide real capital to qualified traders, enabling them to trade live markets and share profits with Virtual Capital, which attracts skilled traders seeking genuine earning opportunities. Explore Virtual Capital's detailed program features and requirements to find the best option tailored to your trading goals.

Real Money

Demo accounts simulate real trading environments providing risk-free practice without using actual money, ideal for beginners to build skills and test strategies. Funded account programs allocate real capital to traders after evaluation, allowing them to trade live markets and potentially earn real profits based on performance. Explore the nuances of funded trading programs to unlock real money opportunities tailored to your trading expertise.

Profit Split

Demo accounts allow traders to practice strategies with virtual funds, eliminating financial risk while simulating real market conditions. Funded account programs involve real capital, where traders receive a profit split based on their performance, commonly ranging from 50% to 80% of generated profits. Explore detailed comparisons of profit splits and trading requirements to choose the best program for your trading goals.

Source and External Links

Demo Trading Account - A demo account offers a risk-free trading environment to practice strategies and learn trading platforms with virtual funds, active for 30 days and extendable after funding the real account.

Demo Trading Account | Binary Options Demo - Provides $10,000 in virtual funds to practice trading binary options and other products with real market conditions and multiple trading tools on desktop and mobile.

Trading Demo Account - A forex demo account with $50,000 virtual funds that lets you trade over 80 FX pairs risk-free with live prices and real-time execution to develop skills and test strategies.

dowidth.com

dowidth.com