Delta neutral strategy involves creating a portfolio that balances positive and negative deltas to hedge against market movements, minimizing risk and ensuring stability. Growth investing focuses on targeting stocks with high potential for capital appreciation, emphasizing long-term gains over immediate risk mitigation. Explore the key differences and benefits of each approach to determine the best fit for your trading goals.

Why it is important

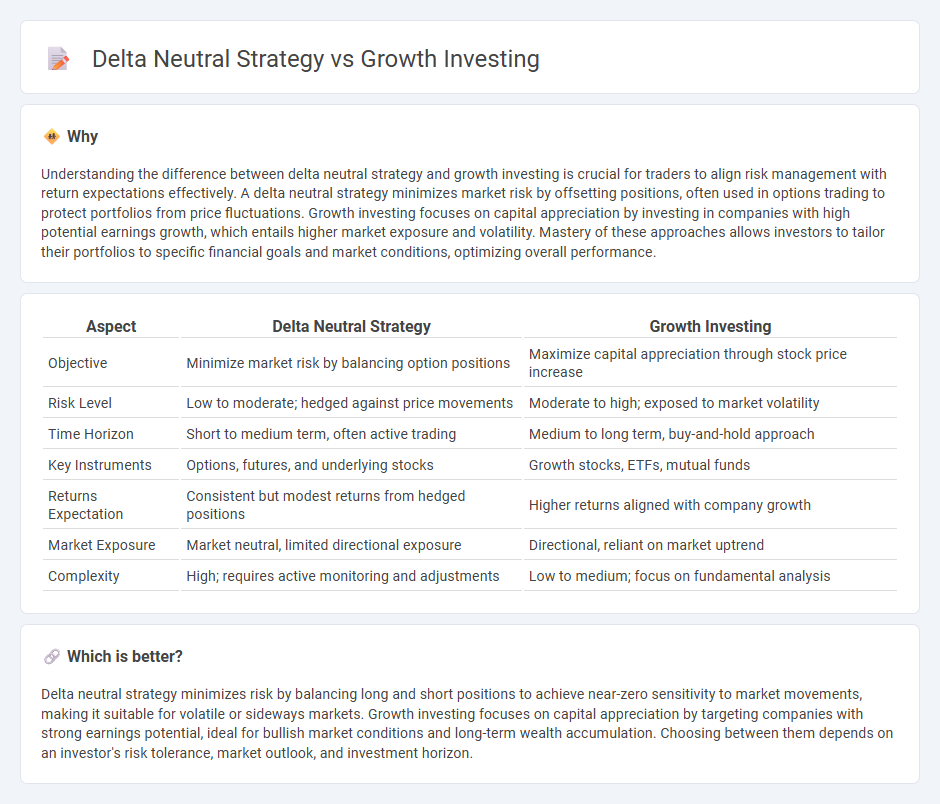

Understanding the difference between delta neutral strategy and growth investing is crucial for traders to align risk management with return expectations effectively. A delta neutral strategy minimizes market risk by offsetting positions, often used in options trading to protect portfolios from price fluctuations. Growth investing focuses on capital appreciation by investing in companies with high potential earnings growth, which entails higher market exposure and volatility. Mastery of these approaches allows investors to tailor their portfolios to specific financial goals and market conditions, optimizing overall performance.

Comparison Table

| Aspect | Delta Neutral Strategy | Growth Investing |

|---|---|---|

| Objective | Minimize market risk by balancing option positions | Maximize capital appreciation through stock price increase |

| Risk Level | Low to moderate; hedged against price movements | Moderate to high; exposed to market volatility |

| Time Horizon | Short to medium term, often active trading | Medium to long term, buy-and-hold approach |

| Key Instruments | Options, futures, and underlying stocks | Growth stocks, ETFs, mutual funds |

| Returns Expectation | Consistent but modest returns from hedged positions | Higher returns aligned with company growth |

| Market Exposure | Market neutral, limited directional exposure | Directional, reliant on market uptrend |

| Complexity | High; requires active monitoring and adjustments | Low to medium; focus on fundamental analysis |

Which is better?

Delta neutral strategy minimizes risk by balancing long and short positions to achieve near-zero sensitivity to market movements, making it suitable for volatile or sideways markets. Growth investing focuses on capital appreciation by targeting companies with strong earnings potential, ideal for bullish market conditions and long-term wealth accumulation. Choosing between them depends on an investor's risk tolerance, market outlook, and investment horizon.

Connection

Delta neutral strategy involves balancing options positions to minimize directional market risk, which aligns with growth investing by protecting portfolio value while seeking capital appreciation through high-potential stocks. By maintaining delta neutrality, investors can hedge against short-term market volatility and focus on long-term growth opportunities. This combination enhances risk management and supports consistent performance in dynamic market conditions.

Key Terms

**Growth Investing:**

Growth investing targets companies with high potential for revenue and earnings expansion, often in sectors like technology, healthcare, and consumer discretionary. Investors prioritize capital appreciation by selecting stocks that are expected to outperform the overall market due to innovation, competitive advantages, or market trends. Explore further to understand how growth investing balances risk and reward for long-term wealth creation.

Earnings Growth

Earnings growth drives the potential returns in growth investing by targeting companies with accelerating income streams and robust profit margins, often leading to stock price appreciation. In contrast, a delta neutral strategy minimizes directional risk by balancing long and short positions, focusing less on earnings growth and more on controlling market exposure and volatility. Explore further insights into how earnings growth influences stock performance and risk management strategies.

Price-to-Earnings Ratio

Growth investing targets companies with high Price-to-Earnings (P/E) ratios, expecting significant future earnings growth that justifies premium valuations. Delta neutral strategy prioritizes minimizing market risk by balancing long and short positions, often disregarding traditional valuation metrics like P/E ratio. Explore deeper insights on optimizing investment strategies based on P/E ratios and risk profiles.

Source and External Links

Growth investing: What it is and how to build a high-growth portfolio - Growth investing focuses on companies expected to grow faster than their industry or the market, benefiting from strong earnings growth, compounding returns, and capitalizing on innovation and market trends.

Growth investing - Wikipedia - Growth investing is a strategy aimed at capital appreciation by investing in companies with above-average growth potential, even if their valuation metrics appear expensive, contrasting with value investing.

Investing for growth opportunities - BlackRock - Growth investing seeks companies with strong potential for rapid revenue and profit increases, aligning investors' goals with long-term wealth accumulation and higher risk tolerance.

dowidth.com

dowidth.com