Order flow analysis examines real-time transaction data to identify buying and selling pressure, offering precise insights into market liquidity and participant behavior. Sentiment analysis assesses market mood by parsing news, social media, and other textual data to gauge trader emotions and potential market direction. Discover how these complementary approaches can enhance your trading strategies and decision-making.

Why it is important

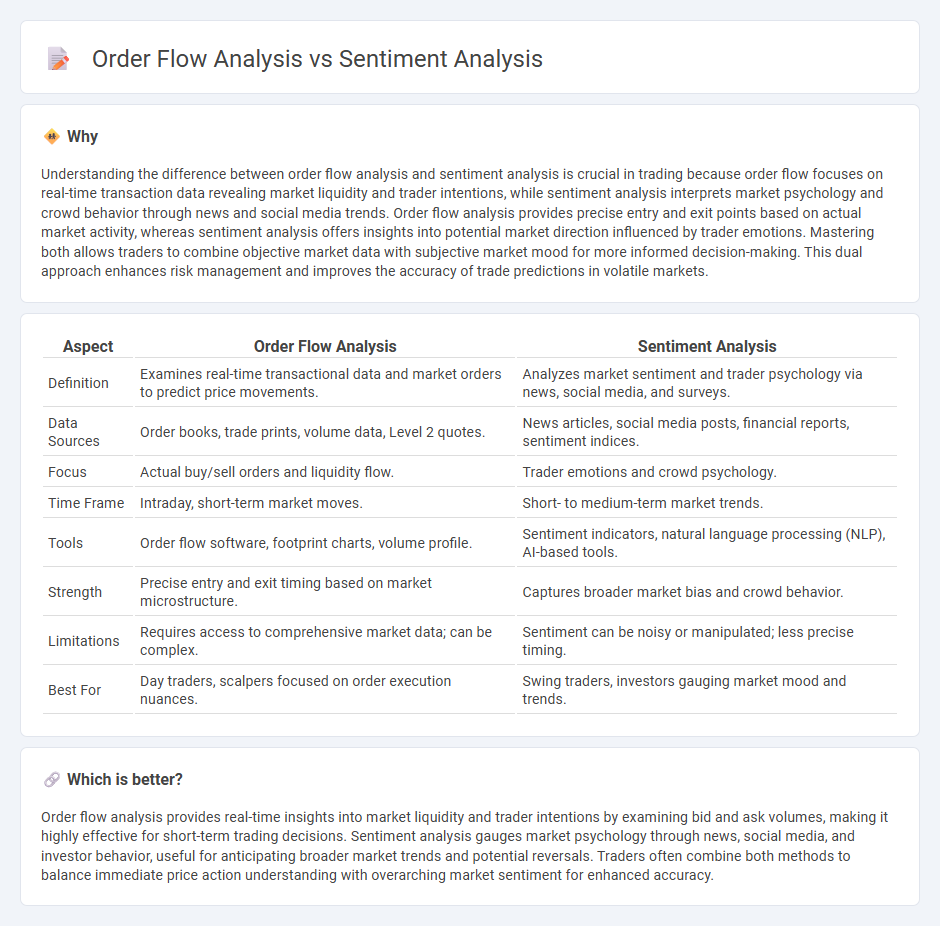

Understanding the difference between order flow analysis and sentiment analysis is crucial in trading because order flow focuses on real-time transaction data revealing market liquidity and trader intentions, while sentiment analysis interprets market psychology and crowd behavior through news and social media trends. Order flow analysis provides precise entry and exit points based on actual market activity, whereas sentiment analysis offers insights into potential market direction influenced by trader emotions. Mastering both allows traders to combine objective market data with subjective market mood for more informed decision-making. This dual approach enhances risk management and improves the accuracy of trade predictions in volatile markets.

Comparison Table

| Aspect | Order Flow Analysis | Sentiment Analysis |

|---|---|---|

| Definition | Examines real-time transactional data and market orders to predict price movements. | Analyzes market sentiment and trader psychology via news, social media, and surveys. |

| Data Sources | Order books, trade prints, volume data, Level 2 quotes. | News articles, social media posts, financial reports, sentiment indices. |

| Focus | Actual buy/sell orders and liquidity flow. | Trader emotions and crowd psychology. |

| Time Frame | Intraday, short-term market moves. | Short- to medium-term market trends. |

| Tools | Order flow software, footprint charts, volume profile. | Sentiment indicators, natural language processing (NLP), AI-based tools. |

| Strength | Precise entry and exit timing based on market microstructure. | Captures broader market bias and crowd behavior. |

| Limitations | Requires access to comprehensive market data; can be complex. | Sentiment can be noisy or manipulated; less precise timing. |

| Best For | Day traders, scalpers focused on order execution nuances. | Swing traders, investors gauging market mood and trends. |

Which is better?

Order flow analysis provides real-time insights into market liquidity and trader intentions by examining bid and ask volumes, making it highly effective for short-term trading decisions. Sentiment analysis gauges market psychology through news, social media, and investor behavior, useful for anticipating broader market trends and potential reversals. Traders often combine both methods to balance immediate price action understanding with overarching market sentiment for enhanced accuracy.

Connection

Order flow analysis reveals the real-time buying and selling pressure in markets by tracking executed trades and volume, while sentiment analysis gauges trader emotions and market psychology through news, social media, and surveys. Combining these methods provides a comprehensive view of market dynamics by linking objective transaction data with the subjective mood driving trader decisions. Traders use this integrated approach to anticipate price movements and improve trade timing in volatile environments.

Key Terms

Sentiment Analysis:

Sentiment analysis evaluates market psychology by extracting emotions and opinions from news, social media, and financial reports to gauge trader behavior. It leverages natural language processing (NLP) and machine learning algorithms to quantify bullish or bearish trends, influencing price movements ahead of traditional indicators. Discover how sentiment analysis can enhance your trading strategy and provide a competitive edge in market forecasting.

News Sentiment

News Sentiment analysis leverages natural language processing to gauge market mood by evaluating news headlines, social media, and financial reports for positive or negative cues, impacting asset price movements. Order Flow analysis, on the other hand, examines real-time buy and sell orders, offering granular insight into market liquidity and trader behavior, crucial for short-term trading strategies. Discover how integrating News Sentiment with Order Flow analysis can enhance predictive accuracy and trading decisions.

Social Media Signals

Sentiment analysis leverages natural language processing to gauge market mood by analyzing social media signals such as Twitter data, Reddit discussions, and news sentiment indices. Order flow analysis examines real-time buy and sell orders and trading volumes to interpret market dynamics and predict price movements. Explore how integrating social media sentiment with order flow data can enhance trading strategies and market forecasting.

Source and External Links

What is Sentiment Analysis? | Definition from TechTarget - Sentiment analysis, or opinion mining, is a natural language processing method that identifies the emotional tone--positive, negative, or neutral--behind text using AI, machine learning, and data mining to help organizations understand customer sentiment and brand reputation.

Sentiment Analysis and How to Leverage It - Qualtrics - Sentiment analysis can be fine-grained to measure emotion intensity, aspect-based to evaluate sentiment on specific features, or intent-based to understand the reasons behind the text, helping businesses interpret customer feedback in detail.

What Is Sentiment Analysis? - IBM - Sentiment analysis processes large volumes of text from sources like emails, reviews, and social media to classify opinions objectively as positive, negative, or neutral, enabling companies to enhance customer experience and brand reputation through AI-driven insights.

dowidth.com

dowidth.com