Dark pool prints represent large, private trades executed away from public exchanges, providing insights into institutional activity that might not be reflected immediately in the open market. Order flow involves the analysis of real-time buy and sell orders, offering traders a detailed view of market sentiment and potential price movements. Explore our comprehensive guide to deepen your understanding of dark pool prints versus order flow in trading.

Why it is important

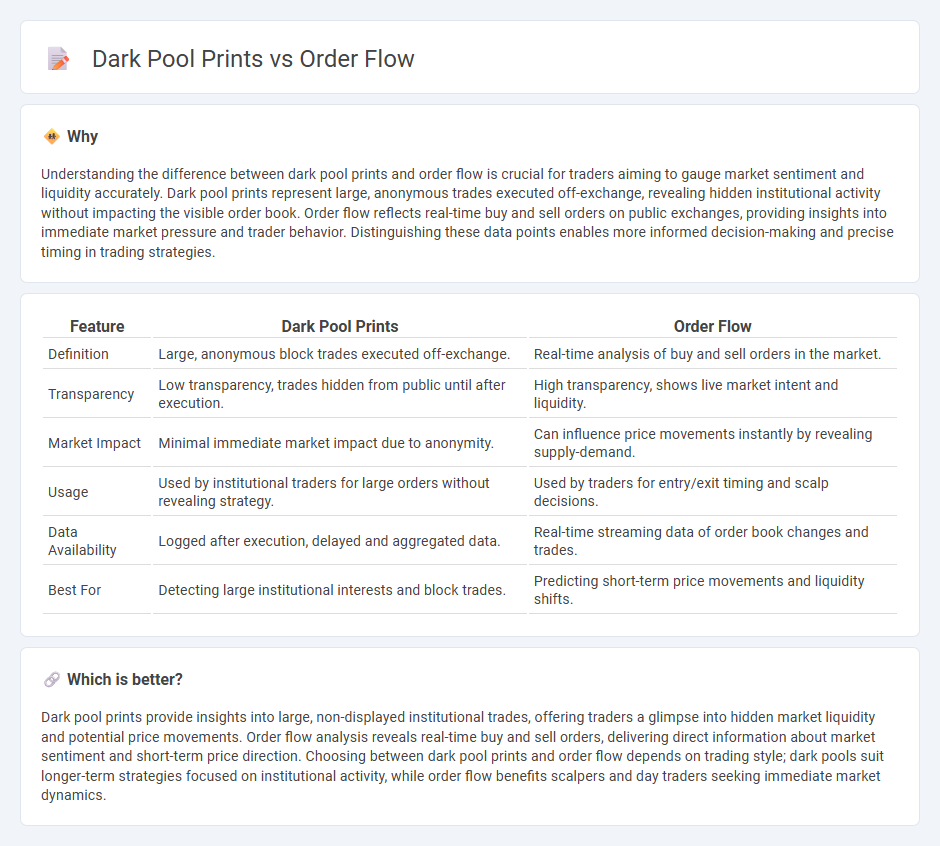

Understanding the difference between dark pool prints and order flow is crucial for traders aiming to gauge market sentiment and liquidity accurately. Dark pool prints represent large, anonymous trades executed off-exchange, revealing hidden institutional activity without impacting the visible order book. Order flow reflects real-time buy and sell orders on public exchanges, providing insights into immediate market pressure and trader behavior. Distinguishing these data points enables more informed decision-making and precise timing in trading strategies.

Comparison Table

| Feature | Dark Pool Prints | Order Flow |

|---|---|---|

| Definition | Large, anonymous block trades executed off-exchange. | Real-time analysis of buy and sell orders in the market. |

| Transparency | Low transparency, trades hidden from public until after execution. | High transparency, shows live market intent and liquidity. |

| Market Impact | Minimal immediate market impact due to anonymity. | Can influence price movements instantly by revealing supply-demand. |

| Usage | Used by institutional traders for large orders without revealing strategy. | Used by traders for entry/exit timing and scalp decisions. |

| Data Availability | Logged after execution, delayed and aggregated data. | Real-time streaming data of order book changes and trades. |

| Best For | Detecting large institutional interests and block trades. | Predicting short-term price movements and liquidity shifts. |

Which is better?

Dark pool prints provide insights into large, non-displayed institutional trades, offering traders a glimpse into hidden market liquidity and potential price movements. Order flow analysis reveals real-time buy and sell orders, delivering direct information about market sentiment and short-term price direction. Choosing between dark pool prints and order flow depends on trading style; dark pools suit longer-term strategies focused on institutional activity, while order flow benefits scalpers and day traders seeking immediate market dynamics.

Connection

Dark pool prints provide concealed trade data that influences order flow by revealing hidden liquidity and large block trades away from public exchanges. This information impacts market participants' decisions, affecting the timing and size of order placements in lit markets. Tracking dark pool activity helps traders anticipate shifts in supply and demand dynamics within the order flow.

Key Terms

Liquidity

Order flow reveals real-time market liquidity by tracking buy and sell orders across public exchanges, offering valuable insights into price movements and volume imbalances. Dark pool prints represent large block trades executed privately, providing a glimpse into institutional liquidity that is not immediately visible on the public order book. Explore the dynamics of liquidity in order flow and dark pool prints to enhance your trading strategy.

Volume

Order flow reveals real-time buying and selling pressure by analyzing the volume of executed trades on public exchanges, providing critical insights into market sentiment and liquidity. Dark pool prints represent large-block trades executed off-exchange, often showing hidden volume that can signal institutional activity without immediate price impact. Explore how volume analysis in order flow and dark pool prints can enhance your trading strategy by decoding market intentions.

Execution

Order flow reflects real-time buy and sell transactions directly from the market, offering transparency and immediate insights into liquidity and market sentiment. Dark pool prints represent large, non-displayed block trades occurring off-exchange, often executed to minimize market impact and avoid price slippage. Explore how mastering the nuances of both order flow and dark pool prints can elevate your execution strategy and optimize trading outcomes.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow analysis involves observing and interpreting real-time buy and sell orders, including their size and aggressiveness, to predict price movements by reading the order book and analyzing volume at specific price levels.

Lesson 1 - The Basics of Order Flow - Jigsaw Trading - Order flow analysis is based on understanding market and limit orders, where aggressive market orders consume standing limit orders and drive price changes, allowing traders to gauge buying and selling pressure at the bid and ask prices.

Order Flow Trading & Volumetric Bars | NinjaTrader - Order flow trading uses tools like volumetric bars, order flow VWAP, and cumulative delta to visualize buying and selling pressure, identify key price levels, and confirm market trends through detailed volume and order flow data.

dowidth.com

dowidth.com