Flash loans enable traders to borrow large amounts of cryptocurrency instantly without collateral, executing complex arbitrage opportunities within a single transaction to maximize profits. Basket trading involves simultaneously buying or selling a group of assets to diversify risk and optimize portfolio performance through strategic asset allocation. Explore the intricacies and strategic advantages of flash loans and basket trading to enhance your trading approach.

Why it is important

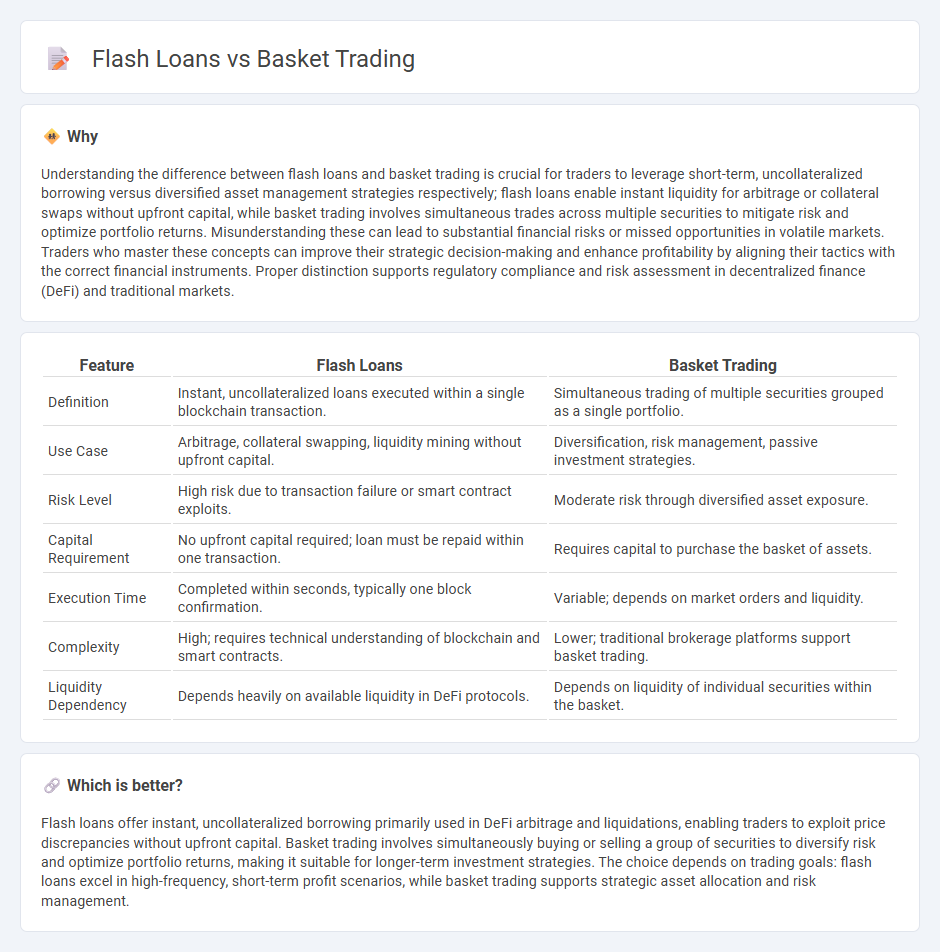

Understanding the difference between flash loans and basket trading is crucial for traders to leverage short-term, uncollateralized borrowing versus diversified asset management strategies respectively; flash loans enable instant liquidity for arbitrage or collateral swaps without upfront capital, while basket trading involves simultaneous trades across multiple securities to mitigate risk and optimize portfolio returns. Misunderstanding these can lead to substantial financial risks or missed opportunities in volatile markets. Traders who master these concepts can improve their strategic decision-making and enhance profitability by aligning their tactics with the correct financial instruments. Proper distinction supports regulatory compliance and risk assessment in decentralized finance (DeFi) and traditional markets.

Comparison Table

| Feature | Flash Loans | Basket Trading |

|---|---|---|

| Definition | Instant, uncollateralized loans executed within a single blockchain transaction. | Simultaneous trading of multiple securities grouped as a single portfolio. |

| Use Case | Arbitrage, collateral swapping, liquidity mining without upfront capital. | Diversification, risk management, passive investment strategies. |

| Risk Level | High risk due to transaction failure or smart contract exploits. | Moderate risk through diversified asset exposure. |

| Capital Requirement | No upfront capital required; loan must be repaid within one transaction. | Requires capital to purchase the basket of assets. |

| Execution Time | Completed within seconds, typically one block confirmation. | Variable; depends on market orders and liquidity. |

| Complexity | High; requires technical understanding of blockchain and smart contracts. | Lower; traditional brokerage platforms support basket trading. |

| Liquidity Dependency | Depends heavily on available liquidity in DeFi protocols. | Depends on liquidity of individual securities within the basket. |

Which is better?

Flash loans offer instant, uncollateralized borrowing primarily used in DeFi arbitrage and liquidations, enabling traders to exploit price discrepancies without upfront capital. Basket trading involves simultaneously buying or selling a group of securities to diversify risk and optimize portfolio returns, making it suitable for longer-term investment strategies. The choice depends on trading goals: flash loans excel in high-frequency, short-term profit scenarios, while basket trading supports strategic asset allocation and risk management.

Connection

Flash loans enable traders to borrow large sums of cryptocurrency instantly without collateral, facilitating complex arbitrage and basket trading strategies. Basket trading involves simultaneously buying or selling multiple assets to optimize portfolio management, often requiring significant liquidity. The instantaneous liquidity provided by flash loans allows traders to execute basket trades efficiently, capitalizing on price discrepancies across different markets without the need for upfront capital.

Key Terms

**Basket Trading:**

Basket trading involves simultaneously buying or selling multiple securities as a single transaction, optimizing portfolio diversification and trade execution efficiency. This method reduces transaction costs and market impact while allowing investors to manage risk across various assets in one order. Explore the advantages of basket trading and how it compares to alternative strategies for enhanced investment outcomes.

Diversification

Basket trading involves purchasing a group of securities simultaneously to achieve diversification and reduce risk exposure across various assets. Flash loans enable borrowing a large sum of capital instantly without collateral, primarily used for arbitrage, refinancing, or collateral swaps, but they do not inherently provide diversification benefits. Explore the differences and strategic uses of basket trading and flash loans to optimize your investment portfolio.

Portfolio Rebalancing

Basket trading allows investors to simultaneously buy or sell multiple assets, facilitating efficient portfolio rebalancing by maintaining target asset allocations with reduced transaction costs. Flash loans offer instant, unsecured borrowing to capitalize on arbitrage opportunities but demand fast execution to avoid liquidation, making them less suited for gradual portfolio adjustments. Discover how these financial tools can optimize your portfolio management strategies.

Source and External Links

Basket Trading: What it is, key aspects & examples. - Equirus Wealth - Basket trading involves buying or selling a group of securities as one unit to diversify portfolios, manage risk, and simplify trading with flexible weighting options among stocks, commodities, currencies, and index funds.

What is Basket Trading? Types, Advantages, and Challenges ... - Motilal Oswal - Basket trading allows for simultaneous trading of many assets, such as equity baskets mimicking an index, helping preserve portfolio integrity and reduce risk through diversification.

Basket Trade - Meaning, Types, Working and Benefits | Bajaj Broking - A basket trade is an order to buy or sell multiple securities at once, used mainly by institutional investors to manage portfolios containing shares, fixed-income securities, or commodities with flexible weighting and diversification benefits.

dowidth.com

dowidth.com