Paper trading competitions provide a risk-free environment for traders to test strategies and develop skills using simulated markets without financial loss. Live trading competitions involve real capital, offering authentic market experience but exposing participants to actual financial risks and emotional pressures. Explore the key differences between these competition types to enhance your trading approach.

Why it is important

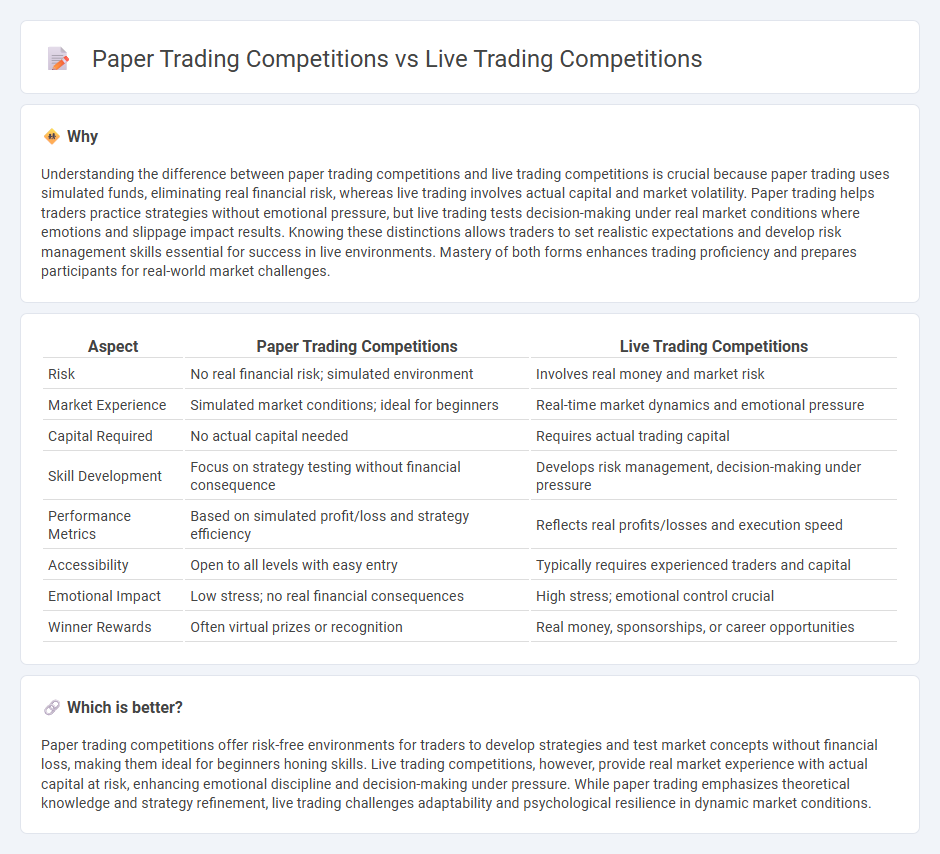

Understanding the difference between paper trading competitions and live trading competitions is crucial because paper trading uses simulated funds, eliminating real financial risk, whereas live trading involves actual capital and market volatility. Paper trading helps traders practice strategies without emotional pressure, but live trading tests decision-making under real market conditions where emotions and slippage impact results. Knowing these distinctions allows traders to set realistic expectations and develop risk management skills essential for success in live environments. Mastery of both forms enhances trading proficiency and prepares participants for real-world market challenges.

Comparison Table

| Aspect | Paper Trading Competitions | Live Trading Competitions |

|---|---|---|

| Risk | No real financial risk; simulated environment | Involves real money and market risk |

| Market Experience | Simulated market conditions; ideal for beginners | Real-time market dynamics and emotional pressure |

| Capital Required | No actual capital needed | Requires actual trading capital |

| Skill Development | Focus on strategy testing without financial consequence | Develops risk management, decision-making under pressure |

| Performance Metrics | Based on simulated profit/loss and strategy efficiency | Reflects real profits/losses and execution speed |

| Accessibility | Open to all levels with easy entry | Typically requires experienced traders and capital |

| Emotional Impact | Low stress; no real financial consequences | High stress; emotional control crucial |

| Winner Rewards | Often virtual prizes or recognition | Real money, sponsorships, or career opportunities |

Which is better?

Paper trading competitions offer risk-free environments for traders to develop strategies and test market concepts without financial loss, making them ideal for beginners honing skills. Live trading competitions, however, provide real market experience with actual capital at risk, enhancing emotional discipline and decision-making under pressure. While paper trading emphasizes theoretical knowledge and strategy refinement, live trading challenges adaptability and psychological resilience in dynamic market conditions.

Connection

Paper trading competitions and live trading competitions are connected through their shared goal of enhancing trading skills and strategies in risk-controlled environments. Paper trading competitions simulate market conditions using virtual funds, allowing participants to practice without financial risk, which builds confidence and refines techniques prior to engaging in live trading competitions involving real capital. Insights gained from high-performance paper trading, such as risk management and decision-making under market volatility, directly inform strategies applied in live trading contests, bridging the gap between theoretical knowledge and practical experience.

Key Terms

**Live Trading Competitions:**

Live trading competitions offer real-time market experience, allowing participants to execute trades with actual capital under authentic market conditions, which enhances decision-making skills and risk management. These competitions often feature real-time volatility and liquidity challenges, providing valuable insights into traders' emotional control and strategy effectiveness. Explore how live trading competitions can accelerate your growth as a trader and provide a competitive edge.

Real Capital

Live trading competitions offer participants the thrill of real-time decision-making with actual capital at risk, providing authentic market dynamics and psychological challenges. Paper trading competitions simulate trading environments using virtual funds, enabling skill development without financial loss but lacking emotional stakes. Explore how Real Capital leverages both formats to enhance traders' performance and market understanding.

Slippage

Live trading competitions often experience slippage due to real market conditions, where order execution prices differ from expected prices, affecting traders' performance and strategy evaluation. Paper trading competitions, in contrast, typically do not account for slippage, providing an idealized environment that can mislead participants about actual market risks and execution realities. Explore how slippage impacts your trading outcomes to choose the competition format that best suits your skill assessment.

Source and External Links

Join the Trading Competition 2025 by RebelsFunding and Win Big! - RebelsFunding hosts a dynamic live trading competition open to traders worldwide with cash prizes and trading account programs for top performers, featuring live tracking of the top 150 traders.

BullRush: Trading Competitions - Free Trading Contests - BullRush offers frequent trading competitions including hourly, daily, weekly, and monthly contests on real markets with real cash prizes, allowing traders to compete, track leaderboard rankings, and win rewards.

Futures Trading Challenges | The Arena - NinjaTrader - NinjaTrader Arena provides risk-free simulated futures trading contests where traders compete for cash prizes in real-time market conditions, with leaderboards and periodic challenges for skill development.

dowidth.com

dowidth.com