Altcoin sniping targets newly launched cryptocurrencies to capitalize on early price surges, relying on fast executions and precise timing. Scalping involves making numerous small trades throughout the day to profit from minor price fluctuations in established altcoins, emphasizing quick decision-making and tight risk management. Explore detailed strategies and tools to master altcoin sniping and scalping techniques.

Why it is important

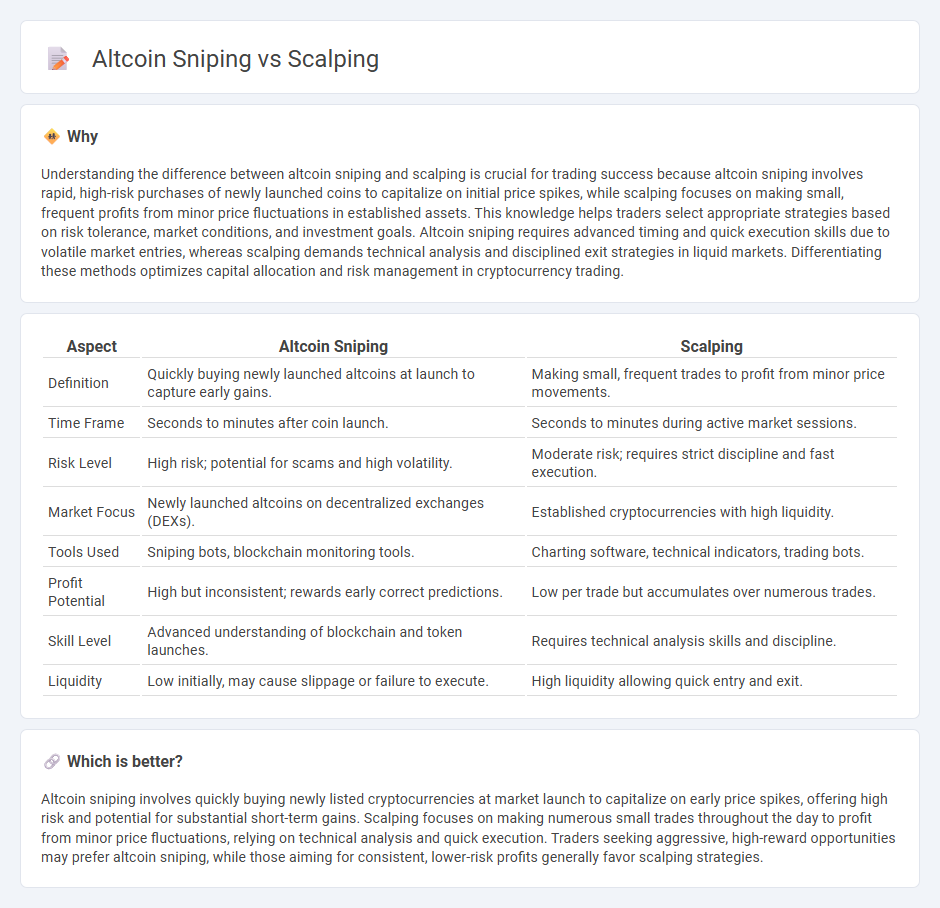

Understanding the difference between altcoin sniping and scalping is crucial for trading success because altcoin sniping involves rapid, high-risk purchases of newly launched coins to capitalize on initial price spikes, while scalping focuses on making small, frequent profits from minor price fluctuations in established assets. This knowledge helps traders select appropriate strategies based on risk tolerance, market conditions, and investment goals. Altcoin sniping requires advanced timing and quick execution skills due to volatile market entries, whereas scalping demands technical analysis and disciplined exit strategies in liquid markets. Differentiating these methods optimizes capital allocation and risk management in cryptocurrency trading.

Comparison Table

| Aspect | Altcoin Sniping | Scalping |

|---|---|---|

| Definition | Quickly buying newly launched altcoins at launch to capture early gains. | Making small, frequent trades to profit from minor price movements. |

| Time Frame | Seconds to minutes after coin launch. | Seconds to minutes during active market sessions. |

| Risk Level | High risk; potential for scams and high volatility. | Moderate risk; requires strict discipline and fast execution. |

| Market Focus | Newly launched altcoins on decentralized exchanges (DEXs). | Established cryptocurrencies with high liquidity. |

| Tools Used | Sniping bots, blockchain monitoring tools. | Charting software, technical indicators, trading bots. |

| Profit Potential | High but inconsistent; rewards early correct predictions. | Low per trade but accumulates over numerous trades. |

| Skill Level | Advanced understanding of blockchain and token launches. | Requires technical analysis skills and discipline. |

| Liquidity | Low initially, may cause slippage or failure to execute. | High liquidity allowing quick entry and exit. |

Which is better?

Altcoin sniping involves quickly buying newly listed cryptocurrencies at market launch to capitalize on early price spikes, offering high risk and potential for substantial short-term gains. Scalping focuses on making numerous small trades throughout the day to profit from minor price fluctuations, relying on technical analysis and quick execution. Traders seeking aggressive, high-reward opportunities may prefer altcoin sniping, while those aiming for consistent, lower-risk profits generally favor scalping strategies.

Connection

Altcoin sniping and scalping both capitalize on rapid price movements within the cryptocurrency market, focusing on executing quick trades to gain small but frequent profits. Sniping involves purchasing newly listed altcoins immediately after launch to exploit initial volatility, while scalping targets minor price fluctuations in highly liquid altcoins throughout the trading day. Their connection lies in the reliance on precise timing, market liquidity, and real-time data analysis to maximize returns in short timeframes.

Key Terms

Timeframe

Scalping involves executing numerous trades within extremely short timeframes, often seconds to minutes, capitalizing on minor price fluctuations for quick profits. Altcoin sniping targets newly listed coins on exchanges, requiring rapid identification and purchase within seconds of the token launch to leverage initial price spikes. Explore detailed strategies and tools to master precise timing in both scalping and altcoin sniping techniques.

Liquidity

Scalping in cryptocurrency trading involves rapidly buying and selling assets to capitalize on small price movements, often relying on high liquidity to execute trades efficiently without significant slippage. Altcoin sniping focuses on instantly purchasing newly listed tokens during initial liquidity pools, aiming to exploit low liquidity scenarios before the market stabilizes. Explore deeper insights into how liquidity impacts these strategies for optimized trading success.

Execution speed

Execution speed is crucial in both scalping and altcoin sniping, where milliseconds can determine profit or loss. Scalping requires rapid order placement and quick market reactions within established liquid markets, while altcoin sniping demands lightning-fast execution to secure initial buy-ins on low-liquidity tokens immediately after launch. Explore the nuances of execution speed strategies to maximize returns in fast-paced crypto trading.

Source and External Links

Scalping (Day Trading Technique) - Corporate Finance Institute - Scalping is a day trading strategy where an investor buys and sells an individual stock multiple times within the same day, aiming to make small profits on many trades by capitalizing on short-term price movements and volatility.

Scalping (trading) - Wikipedia - Scalping in trading refers to either a legitimate arbitrage method exploiting small price gaps from the bid-ask spread to make quick profits in seconds or minutes, or a fraudulent market manipulation tactic, with the legitimate form focused on rapid buying and selling to gain from tiny price changes.

What is a scalping strategy in the stock market and how does it work? - Scalping trading involves fast buying and selling of securities with technical analysis using indicators like Stochastic Oscillator, Moving Averages, RSI, MACD, and Parabolic SAR to identify entry and exit points and make quick profits from small price moves.

dowidth.com

dowidth.com