Volatility harvesting focuses on exploiting short-term price fluctuations to generate consistent returns by systematically rebalancing portfolios, while sector rotation targets shifts in economic cycles by reallocating investments among various sectors to capture growth trends. Both strategies aim to enhance portfolio performance but differ in their approach to market dynamics and risk management. Discover how these methods can optimize your trading strategy for improved financial outcomes.

Why it is important

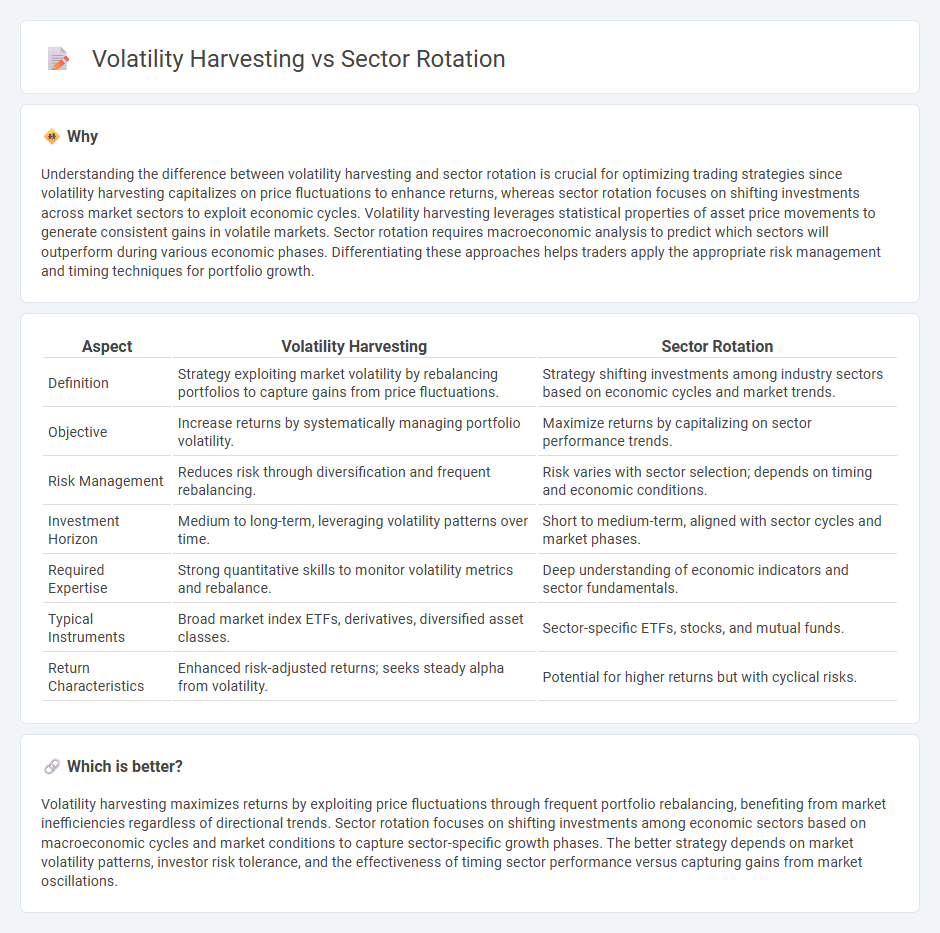

Understanding the difference between volatility harvesting and sector rotation is crucial for optimizing trading strategies since volatility harvesting capitalizes on price fluctuations to enhance returns, whereas sector rotation focuses on shifting investments across market sectors to exploit economic cycles. Volatility harvesting leverages statistical properties of asset price movements to generate consistent gains in volatile markets. Sector rotation requires macroeconomic analysis to predict which sectors will outperform during various economic phases. Differentiating these approaches helps traders apply the appropriate risk management and timing techniques for portfolio growth.

Comparison Table

| Aspect | Volatility Harvesting | Sector Rotation |

|---|---|---|

| Definition | Strategy exploiting market volatility by rebalancing portfolios to capture gains from price fluctuations. | Strategy shifting investments among industry sectors based on economic cycles and market trends. |

| Objective | Increase returns by systematically managing portfolio volatility. | Maximize returns by capitalizing on sector performance trends. |

| Risk Management | Reduces risk through diversification and frequent rebalancing. | Risk varies with sector selection; depends on timing and economic conditions. |

| Investment Horizon | Medium to long-term, leveraging volatility patterns over time. | Short to medium-term, aligned with sector cycles and market phases. |

| Required Expertise | Strong quantitative skills to monitor volatility metrics and rebalance. | Deep understanding of economic indicators and sector fundamentals. |

| Typical Instruments | Broad market index ETFs, derivatives, diversified asset classes. | Sector-specific ETFs, stocks, and mutual funds. |

| Return Characteristics | Enhanced risk-adjusted returns; seeks steady alpha from volatility. | Potential for higher returns but with cyclical risks. |

Which is better?

Volatility harvesting maximizes returns by exploiting price fluctuations through frequent portfolio rebalancing, benefiting from market inefficiencies regardless of directional trends. Sector rotation focuses on shifting investments among economic sectors based on macroeconomic cycles and market conditions to capture sector-specific growth phases. The better strategy depends on market volatility patterns, investor risk tolerance, and the effectiveness of timing sector performance versus capturing gains from market oscillations.

Connection

Volatility harvesting exploits market fluctuations by strategically buying low and selling high, while sector rotation shifts investments among economic sectors to capitalize on their performance cycles. Both strategies aim to enhance portfolio returns by timing market movements and redistributing capital based on sector volatility and cyclical trends. Integrating volatility harvesting with sector rotation enables investors to adapt dynamically to market changes, optimizing gains through disciplined asset reallocation.

Key Terms

**Sector Rotation:**

Sector rotation involves strategically shifting investments across different industry sectors to capitalize on economic cycles and market trends. This approach aims to enhance portfolio returns by investing in sectors expected to outperform during specific phases, such as technology in growth periods or utilities in downturns. Explore how sector rotation can optimize your investment strategy amid changing market conditions.

Economic Cycles

Sector rotation strategies capitalize on shifting economic cycles by reallocating investments into sectors expected to outperform during specific phases, such as favoring technology during expansion and utilities during contraction. Volatility harvesting exploits market fluctuations by systematically rebalancing portfolios to capture gains from asset price volatility, enhancing returns regardless of economic conditions. Explore these distinct approaches to better align your investment strategy with economic cycle insights.

Relative Strength

Sector rotation leverages relative strength by shifting investments to sectors demonstrating superior performance, aiming to capitalize on market trends. Volatility harvesting exploits asset price fluctuations to generate returns through frequent rebalancing but may not prioritize sector momentum. Explore more to understand how integrating relative strength enhances these strategies' effectiveness.

Source and External Links

Sector Rotation Strategies - Fidelity Investments - Sector rotation is an investment strategy that involves shifting portfolio investments among different market sectors based on predictions about the phases of the business cycle, as different sectors tend to perform differently during these phases due to varying economic sensitivities.

Sector Rotation Analysis - ChartSchool - Sector rotation links market sector performance to stages of the business cycle, with sectors like technology and consumer discretionary leading during economic recoveries, and materials and energy sectors gaining strength at economic peaks, helping investors position their portfolios appropriately.

A Stock Market Rotation Is Underway. Will It Last? - Morningstar - Market rotation refers to investors moving investments from sectors that have become expensive after big rallies into undervalued sectors, a process reflecting shifts in market trends and valuations such as the recent rotation away from technology into materials and healthcare sectors.

dowidth.com

dowidth.com