Gamma scalping involves actively managing options positions to capitalize on changes in an asset's price volatility and hedge delta risk, focusing on frequent adjustments as market prices fluctuate. Convexity trading exploits the nonlinear price behavior of options by leveraging the curvature in the payoff profile, aiming for profits from large price movements or volatility shifts. Explore these advanced trading strategies to enhance portfolio risk management and return potential.

Why it is important

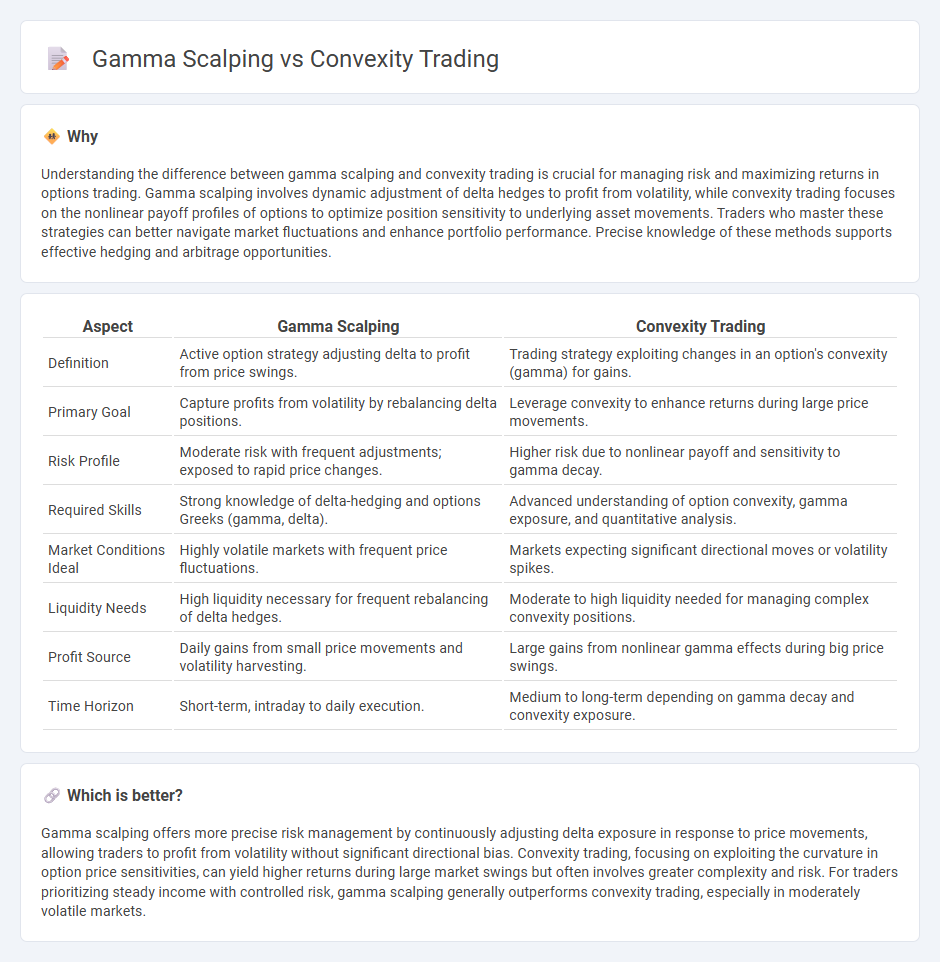

Understanding the difference between gamma scalping and convexity trading is crucial for managing risk and maximizing returns in options trading. Gamma scalping involves dynamic adjustment of delta hedges to profit from volatility, while convexity trading focuses on the nonlinear payoff profiles of options to optimize position sensitivity to underlying asset movements. Traders who master these strategies can better navigate market fluctuations and enhance portfolio performance. Precise knowledge of these methods supports effective hedging and arbitrage opportunities.

Comparison Table

| Aspect | Gamma Scalping | Convexity Trading |

|---|---|---|

| Definition | Active option strategy adjusting delta to profit from price swings. | Trading strategy exploiting changes in an option's convexity (gamma) for gains. |

| Primary Goal | Capture profits from volatility by rebalancing delta positions. | Leverage convexity to enhance returns during large price movements. |

| Risk Profile | Moderate risk with frequent adjustments; exposed to rapid price changes. | Higher risk due to nonlinear payoff and sensitivity to gamma decay. |

| Required Skills | Strong knowledge of delta-hedging and options Greeks (gamma, delta). | Advanced understanding of option convexity, gamma exposure, and quantitative analysis. |

| Market Conditions Ideal | Highly volatile markets with frequent price fluctuations. | Markets expecting significant directional moves or volatility spikes. |

| Liquidity Needs | High liquidity necessary for frequent rebalancing of delta hedges. | Moderate to high liquidity needed for managing complex convexity positions. |

| Profit Source | Daily gains from small price movements and volatility harvesting. | Large gains from nonlinear gamma effects during big price swings. |

| Time Horizon | Short-term, intraday to daily execution. | Medium to long-term depending on gamma decay and convexity exposure. |

Which is better?

Gamma scalping offers more precise risk management by continuously adjusting delta exposure in response to price movements, allowing traders to profit from volatility without significant directional bias. Convexity trading, focusing on exploiting the curvature in option price sensitivities, can yield higher returns during large market swings but often involves greater complexity and risk. For traders prioritizing steady income with controlled risk, gamma scalping generally outperforms convexity trading, especially in moderately volatile markets.

Connection

Gamma scalping and convexity trading both leverage the curvature of an option's price with respect to the underlying asset's price, focusing on managing gamma risk to optimize returns. Gamma scalping exploits fluctuations in the underlying asset's price to adjust delta hedges, capitalizing on convexity by rebalancing positions as volatility unfolds. Convexity trading inherently involves maintaining a portfolio's gamma exposure to benefit from the nonlinear relationship between option price and underlying asset movements, which is the fundamental principle driving gamma scalping strategies.

Key Terms

Vega

Convexity trading and gamma scalping both involve managing options risks, but convexity trading emphasizes the curvature in the price-yield relationship to capture nonlinear benefits, while gamma scalping focuses on maintaining a delta-neutral position by dynamically adjusting hedge ratios. Vega exposure, representing sensitivity to volatility shifts, is critical as convexity trading may take on significant vega risk, whereas gamma scalping often aims to minimize vega net exposure through rapid rebalancing. Explore detailed strategies and risk profiles to understand how vega impacts each approach more comprehensively.

Delta

Convexity trading and gamma scalping both revolve around managing Delta risk in options portfolios to capitalize on price movements. Convexity trading emphasizes the curvature in the option's price relative to underlying asset changes, aiming to profit from large Delta shifts, whereas gamma scalping actively adjusts Delta-neutral positions to capture gains from small, frequent fluctuations. Explore how mastering Delta dynamics through these strategies can enhance options trading performance.

Theta

Convexity trading leverages the geometric profile of an option's price curve to capitalize on changes in volatility, while gamma scalping focuses on adjusting hedge positions to manage delta risk dynamically, both strategies being sensitive to Theta decay--the time decay of options premiums. Theta plays a critical role as it erodes option value over time, making precise management essential to sustain profitability in convexity trading and mitigate losses during aggressive gamma scalping. Explore further insights into how understanding Theta can optimize these sophisticated trading approaches.

Source and External Links

Convexity (finance) - Wikipedia - Convexity trading involves managing the nonlinear relationship between changes in an underlying variable and an output, like options pricing, where long convexity positions benefit from higher volatility but lose over time, typically captured through strategies like straddles to profit from price movement magnitude rather than direction.

Equity convexity and gamma strategies - Macrosynergy - Convexity trading strategies in equities focus on timing exposure to convexity premium, aiming to hedge portfolios by benefiting from strong market movements and volatility spikes, thereby reducing portfolio risk and enhancing risk-adjusted returns, especially in turbulent markets.

What is Convexity? | Simplify - Convexity trading strategies provide protection by increasing support during market downturns (downside convexity) and offer performance benefits by capturing outsized gains in strong market moves (upside convexity), typically manifesting as portfolios that outperform in extreme market conditions while potentially lagging in quiet markets.

dowidth.com

dowidth.com