Liquidity sweeps occur when large orders rapidly execute across multiple price levels to capture available liquidity, often causing short-term price volatility. Flash crashes are sudden, severe price declines triggered by automated trading errors or liquidity imbalances, leading to rapid market disruptions that usually recover quickly. Explore the differences and mechanics of liquidity sweeps and flash crashes to enhance your trading strategies.

Why it is important

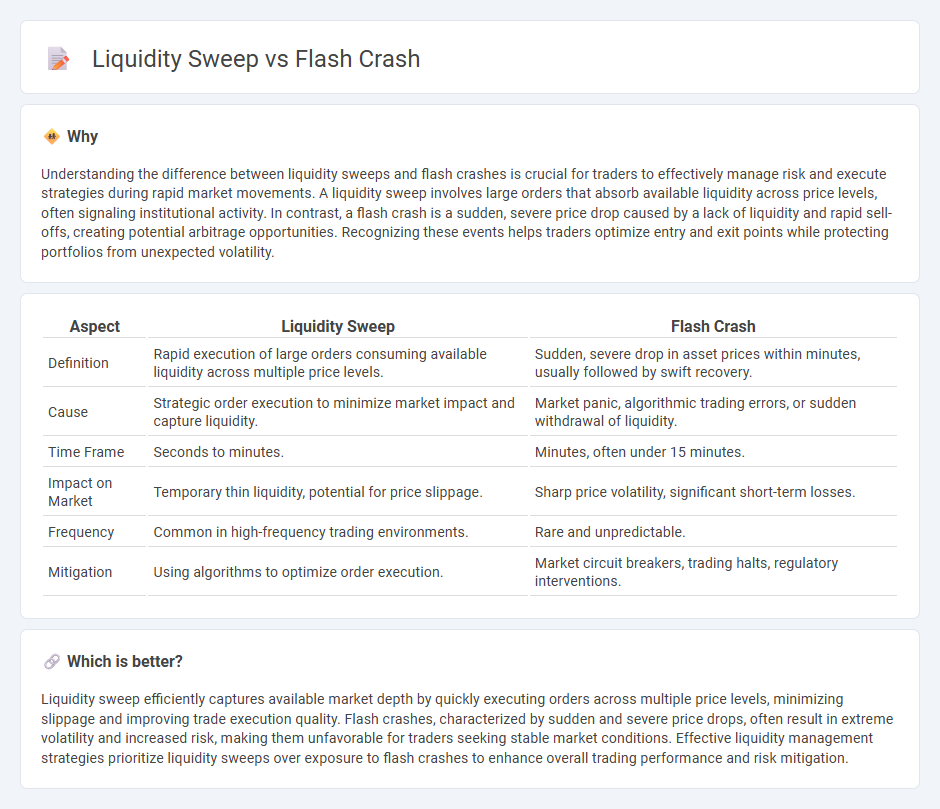

Understanding the difference between liquidity sweeps and flash crashes is crucial for traders to effectively manage risk and execute strategies during rapid market movements. A liquidity sweep involves large orders that absorb available liquidity across price levels, often signaling institutional activity. In contrast, a flash crash is a sudden, severe price drop caused by a lack of liquidity and rapid sell-offs, creating potential arbitrage opportunities. Recognizing these events helps traders optimize entry and exit points while protecting portfolios from unexpected volatility.

Comparison Table

| Aspect | Liquidity Sweep | Flash Crash |

|---|---|---|

| Definition | Rapid execution of large orders consuming available liquidity across multiple price levels. | Sudden, severe drop in asset prices within minutes, usually followed by swift recovery. |

| Cause | Strategic order execution to minimize market impact and capture liquidity. | Market panic, algorithmic trading errors, or sudden withdrawal of liquidity. |

| Time Frame | Seconds to minutes. | Minutes, often under 15 minutes. |

| Impact on Market | Temporary thin liquidity, potential for price slippage. | Sharp price volatility, significant short-term losses. |

| Frequency | Common in high-frequency trading environments. | Rare and unpredictable. |

| Mitigation | Using algorithms to optimize order execution. | Market circuit breakers, trading halts, regulatory interventions. |

Which is better?

Liquidity sweep efficiently captures available market depth by quickly executing orders across multiple price levels, minimizing slippage and improving trade execution quality. Flash crashes, characterized by sudden and severe price drops, often result in extreme volatility and increased risk, making them unfavorable for traders seeking stable market conditions. Effective liquidity management strategies prioritize liquidity sweeps over exposure to flash crashes to enhance overall trading performance and risk mitigation.

Connection

Liquidity sweeps involve rapid removal of available liquidity from markets, which can trigger sudden price movements and contribute to a flash crash--a sharp, deep, and rapid price decline. During a flash crash, automated trading algorithms exacerbate the situation by withdrawing orders, amplifying the liquidity shortage and causing extreme volatility. Understanding the interplay between liquidity sweeps and flash crashes is crucial for developing safeguards against market instability.

Key Terms

**Flash Crash:**

Flash Crash events are characterized by sudden, extreme price drops in financial markets occurring within minutes, driven by high-frequency trading algorithms and liquidity evaporation. These rapid declines create temporary market dislocations, triggering automatic circuit breakers aimed at restoring order. Explore the mechanics and impacts of Flash Crashes to better understand their role in market volatility and risk management strategies.

Market Volatility

Flash crashes represent sudden, severe drops in asset prices caused by rapid, high-volume selling triggered by algorithmic trading or panic. Liquidity sweeps involve the aggressive consumption of available liquidity across multiple price levels, intensifying price volatility and exacerbating market instability. Explore these mechanisms to better understand their impact on market volatility and trading strategies.

Automated Trading (Algorithms)

Flash crash events are sudden, deep price declines triggered by automated trading algorithms rapidly withdrawing liquidity amid market stress. Liquidity sweeps involve algorithms aggressively consuming available orders across multiple price levels to execute large trades quickly, often causing short-term price disruptions. Explore in-depth how these automated trading strategies impact market stability and price discovery.

Source and External Links

Flash Crashes - Overview, Causes, and Past examples - Flash crashes are sudden, deep declines in stock, bond, or commodity prices followed by rapid recoveries, often caused by algorithmic trading creating a snowball effect of sell orders.

Flash crash - Wikipedia - A flash crash is a very rapid, deep, and volatile fall in security prices with a quick rebound, frequently linked to high-frequency and algorithmic trading withdrawing liquidity temporarily.

2010 Flash Crash - Overview, Main Events, Investigation - The 2010 Flash Crash involved a massive sell order in E-Mini S&P contracts that triggered high-frequency traders to aggressively sell, causing extreme volatility and a trillion-dollar market value loss before rapid recovery.

dowidth.com

dowidth.com