Pair trading exploits price divergences between correlated assets by buying one and shorting the other to capitalize on mean reversion, often reducing market risk exposure. Scalping focuses on quick, small profits from frequent trades by capturing minor price movements in highly liquid markets. Discover more about how these strategies match different risk profiles and trading styles.

Why it is important

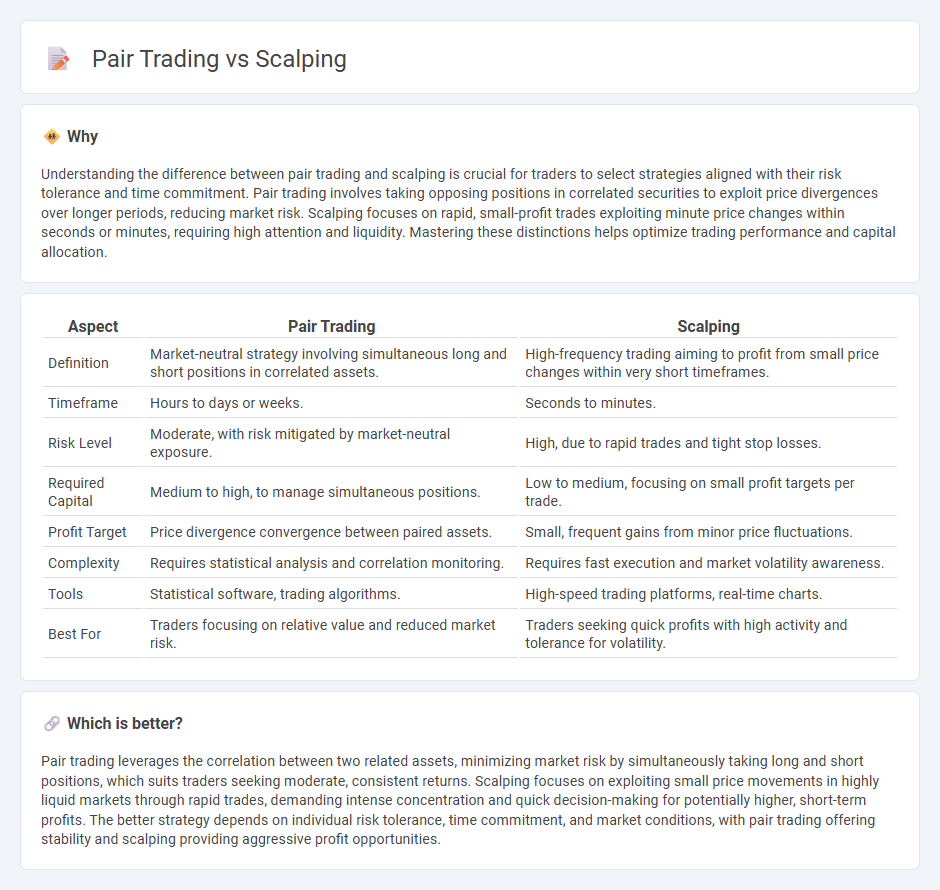

Understanding the difference between pair trading and scalping is crucial for traders to select strategies aligned with their risk tolerance and time commitment. Pair trading involves taking opposing positions in correlated securities to exploit price divergences over longer periods, reducing market risk. Scalping focuses on rapid, small-profit trades exploiting minute price changes within seconds or minutes, requiring high attention and liquidity. Mastering these distinctions helps optimize trading performance and capital allocation.

Comparison Table

| Aspect | Pair Trading | Scalping |

|---|---|---|

| Definition | Market-neutral strategy involving simultaneous long and short positions in correlated assets. | High-frequency trading aiming to profit from small price changes within very short timeframes. |

| Timeframe | Hours to days or weeks. | Seconds to minutes. |

| Risk Level | Moderate, with risk mitigated by market-neutral exposure. | High, due to rapid trades and tight stop losses. |

| Required Capital | Medium to high, to manage simultaneous positions. | Low to medium, focusing on small profit targets per trade. |

| Profit Target | Price divergence convergence between paired assets. | Small, frequent gains from minor price fluctuations. |

| Complexity | Requires statistical analysis and correlation monitoring. | Requires fast execution and market volatility awareness. |

| Tools | Statistical software, trading algorithms. | High-speed trading platforms, real-time charts. |

| Best For | Traders focusing on relative value and reduced market risk. | Traders seeking quick profits with high activity and tolerance for volatility. |

Which is better?

Pair trading leverages the correlation between two related assets, minimizing market risk by simultaneously taking long and short positions, which suits traders seeking moderate, consistent returns. Scalping focuses on exploiting small price movements in highly liquid markets through rapid trades, demanding intense concentration and quick decision-making for potentially higher, short-term profits. The better strategy depends on individual risk tolerance, time commitment, and market conditions, with pair trading offering stability and scalping providing aggressive profit opportunities.

Connection

Pair trading and scalping both rely on exploiting short-term price inefficiencies in correlated assets to generate profits. Pair trading involves taking long and short positions in two historically correlated securities to capitalize on divergence and convergence patterns, while scalping focuses on rapid, small price movements within these positions. The connection lies in their shared emphasis on market neutral strategies and quick trade execution to minimize risk and maximize returns.

Key Terms

Scalping:

Scalping involves executing numerous rapid trades to exploit small price movements, often holding positions for seconds to minutes, making it a high-frequency strategy requiring quick decision-making and low transaction costs. This method contrasts with pair trading, which relies on statistical arbitrage between correlated securities, focusing on mean reversion over longer periods. Discover deeper insights into scalping techniques and risk management to enhance trading performance.

Spread

Scalping targets small price movements within short timeframes, profiting from rapid fluctuations in asset prices and tight bid-ask spreads. Pair trading involves simultaneously buying and selling correlated financial instruments to exploit relative price differences, with the spread being the key metric to gauge trade profitability. Explore the nuanced impact of spread dynamics on these strategies to enhance your trading effectiveness.

Liquidity

Scalping relies heavily on high liquidity to enable rapid entry and exit from positions, allowing traders to capitalize on small price movements with minimal slippage. Pair trading depends on the relative liquidity of both assets in the pair to efficiently execute matched trades and maintain market neutrality. Explore how liquidity dynamics impact strategy performance to optimize your trading approach.

Source and External Links

Scalping (Day Trading Technique) - Scalping is a day trading strategy where traders buy and sell a stock multiple times within the same day to make small profits on each trade by exploiting short-term price movements, often focusing on highly volatile stocks.

Scalping (trading) - Scalping involves making very short-term trades to profit from small price differences such as bid-ask spreads, and can be a legitimate arbitrage method or a fraudulent market manipulation technique; typically trades last minutes or seconds.

What is a scalping strategy in the stock market and how ... - Scalping uses technical indicators like moving averages, RSI, and MACD to quickly identify entry and exit points for buying and selling securities at high speed, appealing to traders who prefer fast, detail-oriented approaches.

dowidth.com

dowidth.com