Execution algorithms automate trade orders by breaking them into smaller parts to minimize market impact and optimize timing, while Direct Market Access (DMA) allows traders to place orders directly on the exchange order book for faster execution and greater control. Execution algos leverage complex mathematical models and historical data to enhance trade efficiency, whereas DMA provides real-time market visibility and immediate order placement, often favored by high-frequency traders. Explore the nuances between execution algorithms and DMA to enhance your trading strategies.

Why it is important

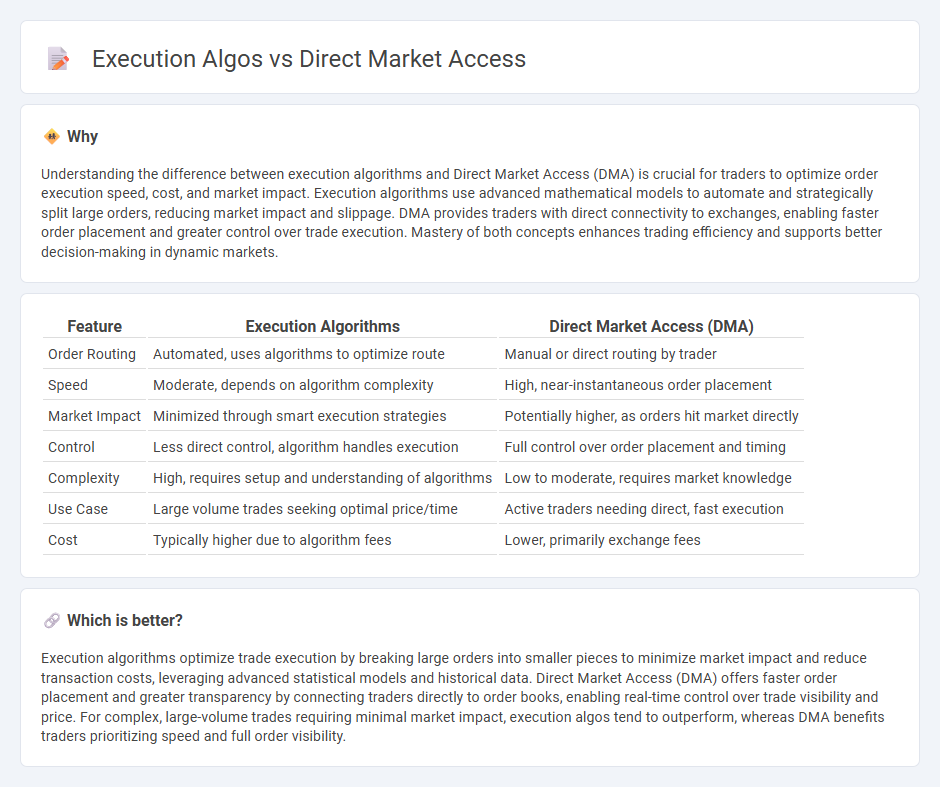

Understanding the difference between execution algorithms and Direct Market Access (DMA) is crucial for traders to optimize order execution speed, cost, and market impact. Execution algorithms use advanced mathematical models to automate and strategically split large orders, reducing market impact and slippage. DMA provides traders with direct connectivity to exchanges, enabling faster order placement and greater control over trade execution. Mastery of both concepts enhances trading efficiency and supports better decision-making in dynamic markets.

Comparison Table

| Feature | Execution Algorithms | Direct Market Access (DMA) |

|---|---|---|

| Order Routing | Automated, uses algorithms to optimize route | Manual or direct routing by trader |

| Speed | Moderate, depends on algorithm complexity | High, near-instantaneous order placement |

| Market Impact | Minimized through smart execution strategies | Potentially higher, as orders hit market directly |

| Control | Less direct control, algorithm handles execution | Full control over order placement and timing |

| Complexity | High, requires setup and understanding of algorithms | Low to moderate, requires market knowledge |

| Use Case | Large volume trades seeking optimal price/time | Active traders needing direct, fast execution |

| Cost | Typically higher due to algorithm fees | Lower, primarily exchange fees |

Which is better?

Execution algorithms optimize trade execution by breaking large orders into smaller pieces to minimize market impact and reduce transaction costs, leveraging advanced statistical models and historical data. Direct Market Access (DMA) offers faster order placement and greater transparency by connecting traders directly to order books, enabling real-time control over trade visibility and price. For complex, large-volume trades requiring minimal market impact, execution algos tend to outperform, whereas DMA benefits traders prioritizing speed and full order visibility.

Connection

Execution algorithms optimize trade orders by automatically splitting large orders into smaller, strategically timed transactions to minimize market impact and achieve favorable prices. Direct Market Access (DMA) provides traders with electronic access to financial markets, enabling these algorithms to place orders directly on the order books of exchanges without intermediary intervention. The integration of execution algos with DMA enhances order execution speed, precision, and transparency, significantly improving trading efficiency and outcomes.

Key Terms

Latency

Direct Market Access (DMA) offers traders ultra-low latency by providing a direct connection to the exchange order book, minimizing intermediaries and accelerating order execution. Execution algorithms, while equipped with sophisticated strategies for order slicing and timing, often introduce additional latency due to their computational complexity and decision-making processes. Explore the technical nuances of DMA and execution algos to optimize trading latency and enhance market responsiveness.

Order Routing

Direct Market Access (DMA) enables traders to place orders directly on exchange order books, offering greater transparency and faster execution speeds. Execution algorithms optimize order routing by dynamically splitting and timing trades across multiple venues to minimize market impact and reduce slippage. Explore how advanced order routing strategies can enhance trading efficiency and execution quality.

Liquidity Access

Direct Market Access (DMA) offers traders immediate, transparent entry to multiple liquidity pools, allowing direct order placement on order books for enhanced price discovery and tighter spreads. Execution algorithms, on the other hand, optimize trade execution by dynamically slicing orders and routing them across various venues to minimize market impact and exploit hidden liquidity. Explore how each approach impacts execution quality and cost efficiency to determine the best liquidity access strategy for your trading needs.

Source and External Links

Direct Market Access (DMA) - Overview, How It Works, Users - Direct market access (DMA) is a method of electronic trading where investors execute trades by directly interacting with the electronic order book of an exchange, bypassing brokers to select their own prices, and is typically suited for advanced traders due to its complexity and capability for algorithmic strategies.

What is Direct Market Access (DMA) Trading Online? - Saxo Bank - DMA trading allows institutional investors and certain high net worth individuals to place orders directly with an exchange via specialized software, enabling them to search and select quotes from the exchange order book without broker intervention.

What is Direct Market Access (DMA) in Trading? - IG - DMA lets traders place trades directly onto exchange order books with greater market visibility and control over pricing, often accessed via platforms offering CFDs, and recommended mainly for experienced traders due to associated risks and complexities.

dowidth.com

dowidth.com