Market microstructure examines the processes and mechanisms underlying the trading of securities, focusing on how orders are submitted, matched, and executed. Market depth refers to the market's ability to absorb large buy or sell orders without significant price changes, measured by the volume of bids and offers at various price levels. Explore further to understand how these concepts influence trading strategies and market liquidity.

Why it is important

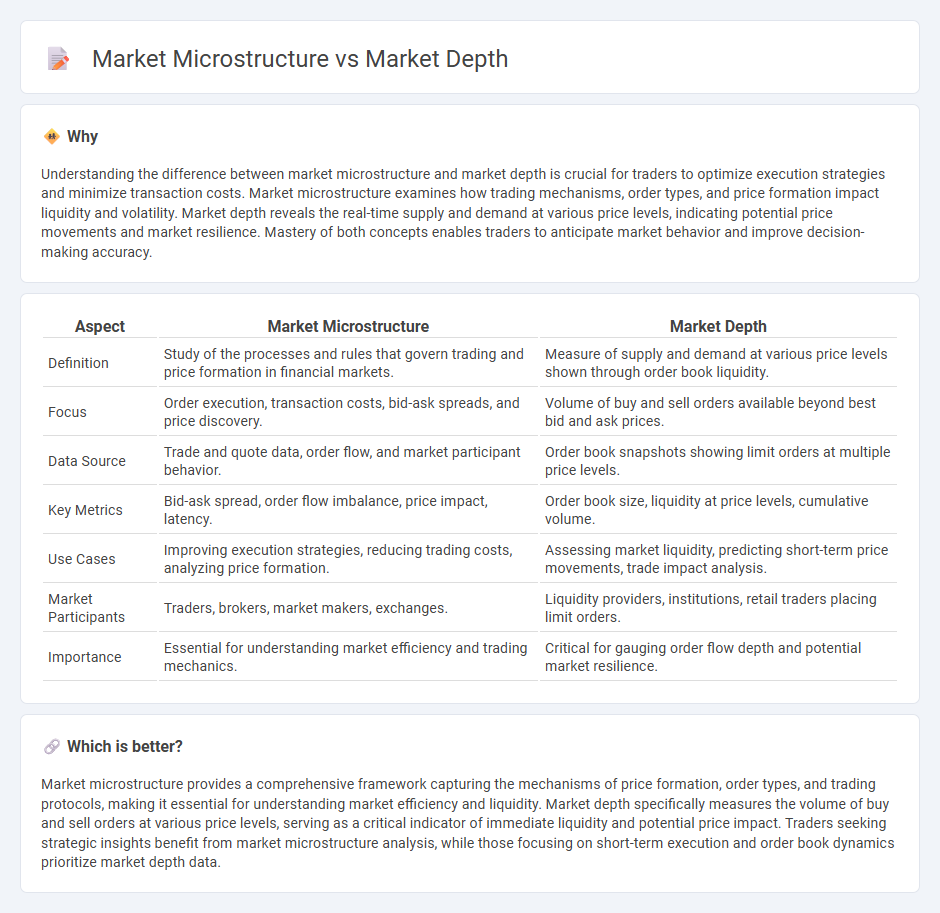

Understanding the difference between market microstructure and market depth is crucial for traders to optimize execution strategies and minimize transaction costs. Market microstructure examines how trading mechanisms, order types, and price formation impact liquidity and volatility. Market depth reveals the real-time supply and demand at various price levels, indicating potential price movements and market resilience. Mastery of both concepts enables traders to anticipate market behavior and improve decision-making accuracy.

Comparison Table

| Aspect | Market Microstructure | Market Depth |

|---|---|---|

| Definition | Study of the processes and rules that govern trading and price formation in financial markets. | Measure of supply and demand at various price levels shown through order book liquidity. |

| Focus | Order execution, transaction costs, bid-ask spreads, and price discovery. | Volume of buy and sell orders available beyond best bid and ask prices. |

| Data Source | Trade and quote data, order flow, and market participant behavior. | Order book snapshots showing limit orders at multiple price levels. |

| Key Metrics | Bid-ask spread, order flow imbalance, price impact, latency. | Order book size, liquidity at price levels, cumulative volume. |

| Use Cases | Improving execution strategies, reducing trading costs, analyzing price formation. | Assessing market liquidity, predicting short-term price movements, trade impact analysis. |

| Market Participants | Traders, brokers, market makers, exchanges. | Liquidity providers, institutions, retail traders placing limit orders. |

| Importance | Essential for understanding market efficiency and trading mechanics. | Critical for gauging order flow depth and potential market resilience. |

Which is better?

Market microstructure provides a comprehensive framework capturing the mechanisms of price formation, order types, and trading protocols, making it essential for understanding market efficiency and liquidity. Market depth specifically measures the volume of buy and sell orders at various price levels, serving as a critical indicator of immediate liquidity and potential price impact. Traders seeking strategic insights benefit from market microstructure analysis, while those focusing on short-term execution and order book dynamics prioritize market depth data.

Connection

Market microstructure examines the processes and mechanisms through which securities are traded, focusing on order flow, bid-ask spreads, and transaction costs. Market depth reflects the liquidity available at various price levels, influencing price stability and execution quality within the microstructure framework. Their connection lies in how microstructure design determines the availability and visibility of market depth, impacting traders' ability to execute large orders without significant price impact.

Key Terms

Order Book

Market depth refers to the volume of buy and sell orders at various price levels in the order book, indicating liquidity and potential price impact of trades. Market microstructure examines the mechanisms and processes, including order book dynamics, trade execution, and price formation within financial markets. Explore detailed insights on how order book data influences trading strategies and market behavior.

Bid-Ask Spread

Market depth represents the volume of buy and sell orders at various price levels, reflecting liquidity, while market microstructure studies the processes and mechanisms governing trading, including the formation of bid-ask spreads. The bid-ask spread, a critical indicator in both concepts, reveals transaction costs and market efficiency by showing the price difference between the highest bid and the lowest ask. Explore further to understand how bid-ask spread dynamics influence trading strategies and market behavior.

Liquidity

Market depth measures the quantity of buy and sell orders at various price levels, directly reflecting liquidity by showing available volume for trading without impacting price significantly. Market microstructure examines the mechanisms and rules that govern trading processes, influencing liquidity through order flow, bid-ask spreads, and information asymmetry. Explore deeper insights into how liquidity dynamics shape trading efficiency and market stability.

Source and External Links

Market Depth - Definition, How It's Used, Examples - Market depth refers to the ability of a market to sustain large orders without impacting the security's price, reflecting liquidity through open limit orders and order book breadth for a given security.

Depth of market (DOM): what it is and how traders can use it - Depth of Market (DOM) is a tool showing buy and sell order volumes at different price levels, helping traders analyze supply, demand, and liquidity for an asset in real time.

Market Depth - The Market Depth gadget outlines best bid and ask quotes from major exchanges, allowing traders to view order sizes and prices, facilitating quick order entries based on current market liquidity.

dowidth.com

dowidth.com