Flash loan arbitrage exploits temporary, uncollateralized loans to capitalize on price discrepancies across decentralized exchanges, enabling swift, risk-minimized profits often measured in seconds. Order flow analysis examines real-time market orders and trade volumes to predict price movements, providing strategic advantage for traders seeking to anticipate market trends and liquidity shifts. Explore how these trading strategies can enhance your market operations and profitability.

Why it is important

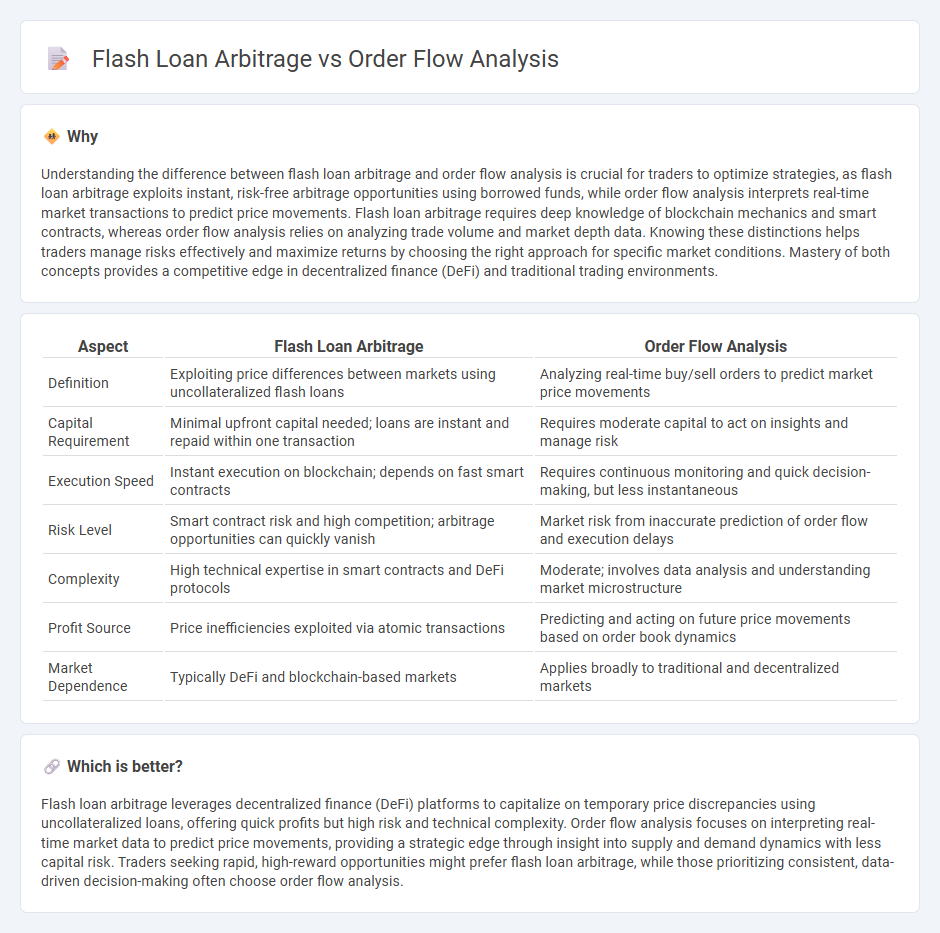

Understanding the difference between flash loan arbitrage and order flow analysis is crucial for traders to optimize strategies, as flash loan arbitrage exploits instant, risk-free arbitrage opportunities using borrowed funds, while order flow analysis interprets real-time market transactions to predict price movements. Flash loan arbitrage requires deep knowledge of blockchain mechanics and smart contracts, whereas order flow analysis relies on analyzing trade volume and market depth data. Knowing these distinctions helps traders manage risks effectively and maximize returns by choosing the right approach for specific market conditions. Mastery of both concepts provides a competitive edge in decentralized finance (DeFi) and traditional trading environments.

Comparison Table

| Aspect | Flash Loan Arbitrage | Order Flow Analysis |

|---|---|---|

| Definition | Exploiting price differences between markets using uncollateralized flash loans | Analyzing real-time buy/sell orders to predict market price movements |

| Capital Requirement | Minimal upfront capital needed; loans are instant and repaid within one transaction | Requires moderate capital to act on insights and manage risk |

| Execution Speed | Instant execution on blockchain; depends on fast smart contracts | Requires continuous monitoring and quick decision-making, but less instantaneous |

| Risk Level | Smart contract risk and high competition; arbitrage opportunities can quickly vanish | Market risk from inaccurate prediction of order flow and execution delays |

| Complexity | High technical expertise in smart contracts and DeFi protocols | Moderate; involves data analysis and understanding market microstructure |

| Profit Source | Price inefficiencies exploited via atomic transactions | Predicting and acting on future price movements based on order book dynamics |

| Market Dependence | Typically DeFi and blockchain-based markets | Applies broadly to traditional and decentralized markets |

Which is better?

Flash loan arbitrage leverages decentralized finance (DeFi) platforms to capitalize on temporary price discrepancies using uncollateralized loans, offering quick profits but high risk and technical complexity. Order flow analysis focuses on interpreting real-time market data to predict price movements, providing a strategic edge through insight into supply and demand dynamics with less capital risk. Traders seeking rapid, high-reward opportunities might prefer flash loan arbitrage, while those prioritizing consistent, data-driven decision-making often choose order flow analysis.

Connection

Flash loan arbitrage leverages instant, uncollateralized loans to exploit price discrepancies across decentralized exchanges, while order flow analysis provides real-time insight into market liquidity and trader behavior. By interpreting order flow data, traders can predict short-term price movements, increasing the efficiency and profitability of flash loan arbitrage strategies. Integrating order flow analysis enhances risk management, ensuring timely execution and maximizing arbitrage gains in volatile cryptocurrency markets.

Key Terms

Order Flow Analysis:

Order flow analysis examines real-time market transactions and liquidity to predict price movements by tracking buy and sell orders, providing traders with insights into market sentiment and potential trends. Flash loan arbitrage exploits temporary price discrepancies across decentralized exchanges using instant, uncollateralized loans, capitalizing on inefficiencies within a single blockchain transaction. Discover how mastering order flow analysis can enhance your trading precision and market timing strategies.

Liquidity

Order flow analysis examines the real-time transaction data to identify liquidity imbalances and anticipate price movements caused by large buy or sell orders, providing traders with insights into market depth and potential slippage. Flash loan arbitrage leverages temporary, uncollateralized loans to exploit price discrepancies across decentralized exchanges by swiftly executing trades within a single blockchain transaction, capitalizing on instantaneous liquidity pools. Explore these strategies further to understand their impact on liquidity optimization and market efficiency.

Market Depth

Order flow analysis leverages real-time transaction data to gauge market depth and trader intentions, providing insights into price movements and liquidity shifts. Flash loan arbitrage exploits temporary price discrepancies across decentralized exchanges, relying heavily on liquidity pools' depth and timing precision within a single transaction block. Explore how mastering market depth can enhance your strategy effectiveness in both techniques.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools - Order flow analysis involves observing and interpreting the real-time flow of buy and sell orders, including their size and aggressiveness, to predict price movements by reading the order book and analyzing volume at specific price levels.

Order Flow Trading Strategy That Pros Are Using In 2024 - Order flow trading uses detailed analysis of executed buy and sell orders at each price level to anticipate future price movements and includes indicators like volume profile, order book imbalance, delta, and cumulative delta to identify support and resistance zones.

Master ORDER FLOW TRADING in Less than ONE HOUR! - Order flow tools, such as footprint charts, volume profiles, and cumulative volume delta, display historical executed orders to quantify buyer and seller activity and aggressiveness for better market timing in futures trading.

dowidth.com

dowidth.com